Quantum computing stocks have been hot over the past year. The heat briefly turned up in October after the Trump administration was rumored to be considering equity stakes in quantum companies, but those rumors were debunked by the Commerce Department.

Still, shares of Quantum Computing Inc. (QUBT 14.46%), which also refers to itself as QCi, have done very well. The pure-play quantum company's stock skyrocketed more than 1,000% in the past 12 months through the week ending Oct. 24.

But the quantum computing field is still in its early days, and businesses in the space are jockeying for market share using distinct technologies. Which of these eventually will enjoy widespread adoption is the big question.

Can QCi's tech take off? To assess the company's potential as a quantum computing investment, let's dig into Quantum Computing Inc. in more detail.

Image source: Getty Images.

The technology behind Quantum Computing Inc.

Quantum Computing Inc. chose light particles, called photons, for its quantum machines because they possess many advantages.

Photons can send quantum data over long distances. This is useful for applications such as networking quantum computers. Competitors not using photonic quantum computing can't support the transmission of data without additional equipment and costs.

Photons are also excellent at cybersecurity. Each photon possesses a random quantum state, making it inherently secure. This is a critical capability in the quantum era, since quantum computers are so powerful that they can breach most of today's cyber defenses.

QCi made its first sale of quantum cryptography solutions to a top U.S. bank in July. The company has also sold separate products to NASA, and its EmuCore computer, which can provide the computing power needed for AI and autonomous vehicles, to a major automotive manufacturer.

NASDAQ: QUBT

Key Data Points

Quantum Computing Inc.'s financial situation

Despite these advances, QCi has yet to produce much revenue. In the second quarter, it generated $61,000 in sales, down from $183,000 in 2024 as some of its contracts expired.

However, Q2 operating expenses were $10.2 million, which were nearly double 2024's $5.3 million. The rapidly rising costs compared to its small sales spell financial disaster on the horizon.

That's why QCi took advantage of its soaring stock price to execute an equity offering this fall, which is expected to result in gross proceeds of about $750 million. This would bring the company's cash position to $1.55 billion on a pro forma basis.

According to Quantum Computing Inc.'s CEO, Dr. Yuping Huang, "Total capital raised since November 2024 is now $1.64 billion, positioning QCi with the strongest balance sheet among publicly traded quantum computing companies."

That massive cash balance will be used to make acquisitions, expand QCi's sales force, and increase production capabilities. The sum should sustain the company's operations for a time, giving it breathing room to build up its sales.

To buy or not to buy Quantum Computing Inc.'s stock

Even so, now does not look like a good time to invest in Quantum Computing Inc.'s stock. One reason is its lofty share price valuation.

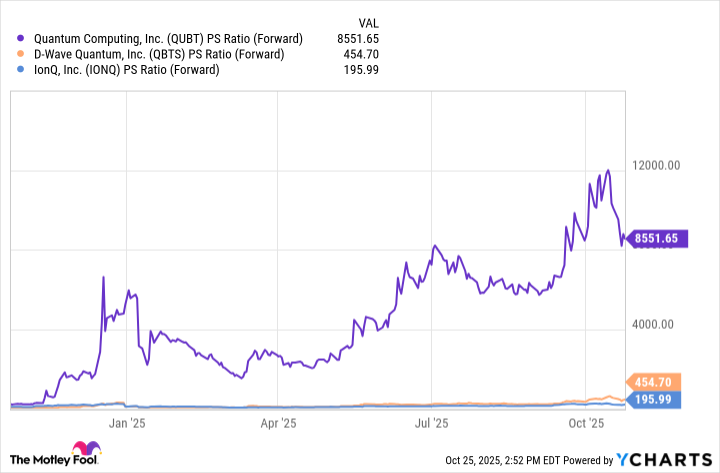

You can see this by comparing its forward price-to-sales (P/S) ratio, which measures how much investors are prepared to pay for every dollar of projected revenue over the next 12 months, to quantum computing competitors IonQ and D-Wave Computing.

Data by YCharts.

The chart shows that QCi's forward P/S ratio is far higher than its rivals, indicating that its stock is more expensive. In fact, the company's October forward sales multiple is higher than it has been for the past year, suggesting shares are significantly overpriced.

Not only is its stock pricey, but the company has yet to prove it can produce a meaningful income stream. While its technology sounds promising, it isn't capturing customers, as QCi's minimal sales to date demonstrate.

The prudent approach is to wait for QCi's next few quarterly earnings reports, looking for signs that the company is gaining greater customer traction in the market, particularly growth in sales.

Although its cash balance will sustain operations for a time, QCi needs to prove its tech can maintain a meaningful revenue stream. Otherwise, investing in its stock is fraught with risk, especially given the high valuation.