As investors focused on artificial intelligence (AI) know, Advanced Micro Devices (AMD 5.28%) stock has been on fire in recent weeks. Deals with companies such as OpenAI and Oracle affirmed its critical role in the AI industry, and if the past gains of Nvidia (NVDA 3.81%) are any indication, AMD may have significantly more room to run.

More importantly to investors, AMD's success also aligns with critical investment advice from one of the more prominent investors of the late 20th century. Not only does that advice apply today, but it could also help make AMD one of the more successful AI stocks in the coming years, and here's why.

Image source: Advanced Micro Devices.

The investment advice

The investment advice that bodes well for AMD's future comes from Jack Welch, the former CEO of what is now GE Aerospace. He led GE in the last two decades of the 20th century, and much of the stock's success came from Welch's investment success rather than directly from the industrial activities one might associate with GE.

At the time, Welch would not invest GE's capital in a company unless it was No. 1 or No. 2 in its industry. If he were alive and running GE today, it is plausible that he would have taken an interest in what is emerging as the No. 2 AI chip company, AMD.

The case for AMD as a No. 2

Admittedly, Nvidia took an early lead in this industry, and it is unlikely any other company, including AMD, will surpass it.

However, Nvidia has had to continue innovating to stay ahead of AMD. While Nvidia's H200 GPU might outperform AMD's MI300X, AMD's GPU sells for half the price, which makes it attractive to some clients.

Also, some industry experts have speculated that AMD's upcoming MI400X GPU, due out in the second half of 2026, might help it make further competitive strides against Nvidia's Vera Rubin processor. Although investors are waiting for more information to confirm that theory, it likely means AMD remains an ongoing threat to the market leader.

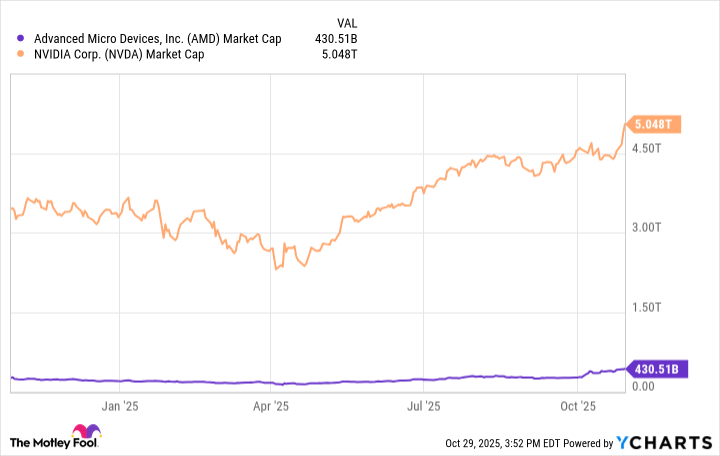

Finally, AMD may offer more stock growth potential as a No. 2. Its market cap of $430 billion is a small fraction of Nvidia's, which topped $5 trillion this week. This means to double in value, Nvidia's market cap will have to reach $10 trillion.

AMD Market Cap data by YCharts

In contrast, doubling AMD's value would take it to $860 billion, a high level but far from a record. Hence, even if AMD never catches up to Nvidia's market cap, its smaller size could still mean higher potential gains for investors.

NASDAQ: AMD

Key Data Points

Areas of caution for AMD

Still, the question for investors is whether such potential for growth means investors should pile into the stock. Fortunately, the long-term answer is likely yes, but admittedly, investors should exercise caution in the near term.

One reason is AMD's AI exposure and the cyclicality of the semiconductor industry. AMD does not explicitly break down "AI revenue." Nonetheless, the data center segment that designs its AI accelerators made up 46% of the company's revenue in the first half of 2025.

The remaining 54% of the revenue sources are split between client, gaming, and embedded segments. These operate under different cycles, meaning a down cycle in one or more of these segments could weigh on AMD stock.

In comparison, Nvidia's data center segment was 88% of total revenue in the first half of fiscal 2026. Thus, one can assume that if AI is succeeding, then so is Nvidia stock, making for a simpler and arguably stronger investment case.

Additionally, Nvidia stock is actually more inexpensive than AMD at the moment. AMD's 152 P/E ratio is well above Nvidia's earnings multiple of 58. While the forward P/E picture is more favorable, AMD's forward multiple of 67 is above Nvidia's at 45, a factor that could deter more conservative investors from buying AMD.

Buying AMD as a No. 2 company

Ultimately, applying Jack Welch's investment advice could bode well for AMD's shareholders.

A No. 1 position in the AI chip market is likely out of reach in a general sense. Nonetheless, at No. 2, AMD is establishing a significant following in the fast-growing AI chip market, and its smaller size could mean potentially higher stock returns than Nvidia over time.

Admittedly, investors might feel better about AMD if the data center segment becomes more dominant and its valuation falls. However, between its improving technology and smaller size, following Welch's 20th-century advice should serve AMD investors well in the 21st century.