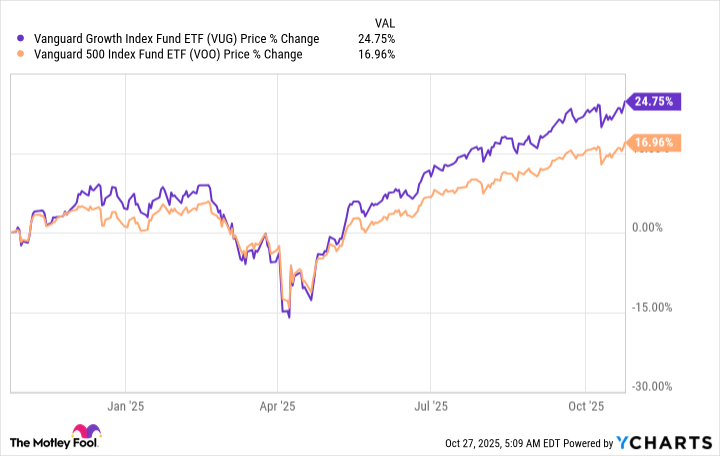

Vanguard Growth ETF (VUG 0.92%) has an incredible track record over the past year. To put a number on that, the exchange-traded fund (ETF) is up nearly 25% over the past 12 months, while the S&P 500 (^GSPC 0.13%) is up roughly 17%. That's eight percentage points of outperformance, with Vanguard Growth ETF up nearly 50% more than the broader market during the past year.

One of the big reasons for the difference comes down to just three stocks: Nvidia (NVDA +0.52%), Apple (AAPL +0.78%), and Microsoft (MSFT 9.99%). Here's what you need to know before you buy this outperforming ETF.

What's the market look like?

The S&P 500 index is what most investors use to represent the market. It's a pretty good proxy, but it isn't actually created to be the market. It is a portfolio of roughly 500 stocks selected by a committee to be representative of the U.S. economy. The stocks are market cap-weighted, which is basically how the economy works, since the largest companies have the most impact on both the economy and the index's performance.

Image source: Getty Images.

The S&P 500 is a strong proxy for the market, but market cap weighting can lead to overweighting in the best-performing sectors.

Today, the heaviest weighting, and the sector driving returns, is technology. That one sector makes up nearly 35% of the index. The three largest tech holdings in the S&P 500 are Nvidia, Apple, and Microsoft, which together account for just over 21% of the index. This trio of stocks has been the driving force behind the index's roughly 17% rise over the past year. Vanguard Growth ETF has done even better, up 25%. The ETF's strong performance is largely thanks to the same three stocks (out of 160 in the ETF), which account for just over 33% of the ETF's assets.

But that's actually just the start of the story, because Vanguard Growth ETF's technology weighting is a massive 62%. Nvidia, Apple, and Microsoft make up just over half of the tech exposure, but there's clearly a very heavy technology bias here beyond just those three stocks.

Data by YCharts.

Low cost, strong performance, but what about the risk?

Clearly, investors looking for strongly performing ETFs will find Vanguard Growth ETF attractive. And the price is right, too, given the ETF's ultra-low 0.04% expense ratio. That's almost as cheap as Vanguard S&P 500 ETF's (VOO 0.21%) 0.03%, though both are pretty darn close to free by Wall Street's standards.

But performance and cost aren't the problem here. The big issue any investor buying Vanguard Growth ETF today needs to think about is diversification. With 62% of assets in one sector and 33% in just three stocks, you are making a big bet if you put your hard-earned savings into Vanguard Growth ETF.

NYSEMKT: VUG

Key Data Points

There's nothing inherently wrong with that. You can lean into technology all you want. But you should do so knowingly. Just because Vanguard Growth ETF is a pooled investment vehicle that tracks an index (CRSP US Large Cap Growth Index, in this case), it clearly doesn't mean that you are buying into a diversified portfolio.

In fairness, given enough time, the index will be reconstituted, and eventually the three technology giants dominating the index today will probably become less important. But that's actually the issue that should worry you. It is far more likely that Nvidia, Apple, and Microsoft fall in value than they continue to dominate as they have, because the markets tend to swing like a pendulum from extreme to extreme.

There could be some pain here

If you believe that technology is going to keep rising, with Nvidia, Apple, and Microsoft leading the way, by all means, feel free to buy the Vanguard Growth ETF. However, you might want to tread with caution. Investors are shockingly enthusiastic about tech in general; Nvidia, Apple, and Microsoft specifically right now. If that ever changes, Vanguard Growth ETF is so heavily concentrated that it would feel the brunt of a swing toward a more pessimistic view.