Real estate is a timeless asset, and investors have been generating passive income from owning real estate for centuries. But most people cannot afford to or have the time to manage a real estate portfolio. Thankfully, there are real estate investment trusts (REITs) like Realty Income (O +0.62%). REITs acquire and lease properties, then distribute most of their income to shareholders as dividend payments.

Realty Income is famous for paying a monthly dividend, and over its decades of existence, it has paid out well for its shareholders. However, the stock hasn't performed well over the past five years.

What do the next five years hold for Realty Income? Here is what you need to know.

Image source: Getty Images.

Acquisitions and high rates have stunted growth

The REIT's juicy 5.4% dividend yield and monthly payment schedule make it a popular dividend stock among income-focused investors. Price performance probably isn't the leading reason to own this stock, but most people typically still want decent total investment returns.

And despite outperforming the broader stock market over its lifetime, Realty Income has woefully lagged it over the past five years. The share price is up only about 3% during that time, and its total returns are about one-quarter of the S&P 500's.

Why? Two reasons stand out. First, the REIT has made two blockbuster acquisitions over the past few years. It bought the Encore Boston Harbor Resort and Casino for $1.7 billion under a long-term net lease agreement with Wynn Resorts in late 2022. Roughly a year later, Realty Income announced a $9.3 billion deal to acquire Spirit Realty Capital in an all-stock transaction.

During these years, interest rates began soaring. Higher rates can affect a REIT's profitability if they narrow the spread between its weighted-average cost of capital and its return on that capital.

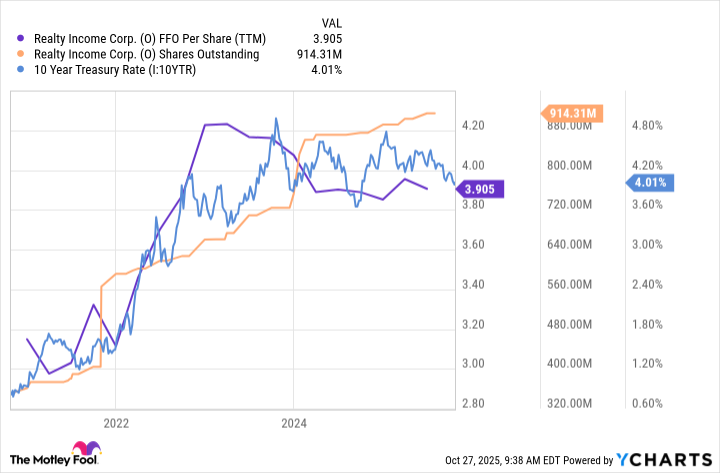

Data by YCharts; TTM = trailing 12 months.

As a result of post-acquisition share dilution and higher interest rates, Realty Income's profit, reported as funds from operations (FFO) per share, has actually declined over the past few years.

Nearing a turnaround?

These issues have played out over a few years, so it helps to zoom out and look at the big picture before assuming that a historically excellent business such as Realty Income has lost its fastball. Upon closer inspection, it seems that these issues will soon subside, paving the way for a long-awaited turnaround for the stock.

NYSE: O

Key Data Points

The 10-year Treasury yield, the baseline for corporate debt, has stabilized after ripping higher from 2022 to 2023, and it could come under downward pressure if the Fed cuts its benchmark interest rate. That would likely help alleviate Realty Income's profitability problems.

Then you have the actual growth benefits of the REIT's acquisitions. These deals are beginning to pay off. Management raised the low end of its 2025 FFO guidance last quarter, and its current range of $4.24 to $4.28 per share would represent a leap in profits from the past few years.

Where will the stock be in five years?

Realty Income stock has grown at an annualized rate of 5.5% over its lifetime. That said, it's now one of the world's largest REITs, so you may not want to assume that rate will continue. Still, the company's struggles have priced the stock at a nice valuation, just over 14 times 2025 guidance.

What if the business grew FFO per share at 4% annually? Add that to the stock's 5.4% dividend yield, and investors could reasonably expect total returns of 9% to 10% annualized.

That growth would mean Realty Income's FFO per share would reach approximately $5.17 five years from now. A return to growth would likely lift the stock's valuation, too. Trading at 17 times its FFO per share at that point would translate to a share price of $88, or a 46% price gain over five years.

The takeaway? Some rough math suggests that Realty Income is likely to perform far better for investors over the next five years than it has over the past five.