It's rare enough to find a company that has a high dividend yield and a multidecade-long track record for dividend raises. But it's even more unique to check those two boxes and generate so much free cash flow (FCF) that a company can afford a $10 billion annual dividend expense.

Enter household and personal care products company Procter & Gamble (PG 0.64%) -- which has a 2.8% dividend yield, 69 consecutive years of dividend increases, and is forecasting $10 billion in dividends in fiscal 2026 (which began Oct. 1).

Here's why P&G is as safe as it gets when it comes to collecting passive income from dividend stocks, and why the Dividend King is worth buying now.

Image source: Getty Images.

Rewarding shareholders through thick and thin

P&G isn't at the top of its game. And yet, it expects to pay $10 billion in dividends in fiscal 2026 and repurchase $5 billion in stock. The sheer size of its capital return program showcases how much of a steady cash cow P&G is, even during industrywide slowdowns.

P&G and the consumer staples sector in general are facing slowing sales growth, an inability to pass along cost pressures to consumers, supply chain challenges, and unpredictable trade policy. Many of P&G's peers are experiencing negative sales growth and declining margins. But P&G is holding up relatively well, forecasting 3% to 9% diluted earnings per share growth in fiscal 2026 and 1% to 5% organic sales growth.

NYSE: PG

Key Data Points

P&G's competitive advantages stand out in a downturn

P&G can deliver solid results even in a challenging operating environment thanks to its highly efficient supply chain and diversified brand portfolio. P&G doesn't need every product category or geographic region to be firing on all cylinders at all times. Rather, it can pivot and tap into what the market gives it.

Right now, regions outside of North America, particularly Greater China and Latin America, are driving the best results at P&G. More specifically, its skin and personal care segment is thriving while the rest of the business is either barely growing or experiencing negative organic growth.

Even with a value-driven consumer base, P&G is seeing growth in premium skin and personal care products through a shift from bars to liquids. The trend is a testament to P&G's position in skin care and the ongoing beauty trend that focuses on proactive and preventive rather than just covering up with quick fixes.

Olay was a standout brand for P&G in its recent quarter. And although it represents one of P&G's premium skin care brands, it's relatively cheaper than luxury alternatives. In this vein, it's important to recognize the nuances in P&G's business.

Within a segment like detergent, consumers may be shifting from premium-priced Tide to Gain. With both brands owned by P&G, the company is retaining customers but is likely losing some organic growth due to an unfavorable category mix. But in beauty, consumers seem to be shifting their buying behavior from specialty products to mass-market options like Olay, which offers quality at a more affordable price.

P&G's latest quarter is a testament to the company's versatility and how certain brands can shine depending on the operating environment. Companies that operate in fewer brand categories or are more dependent on a handful of geographic regions don't have P&G's versatility.

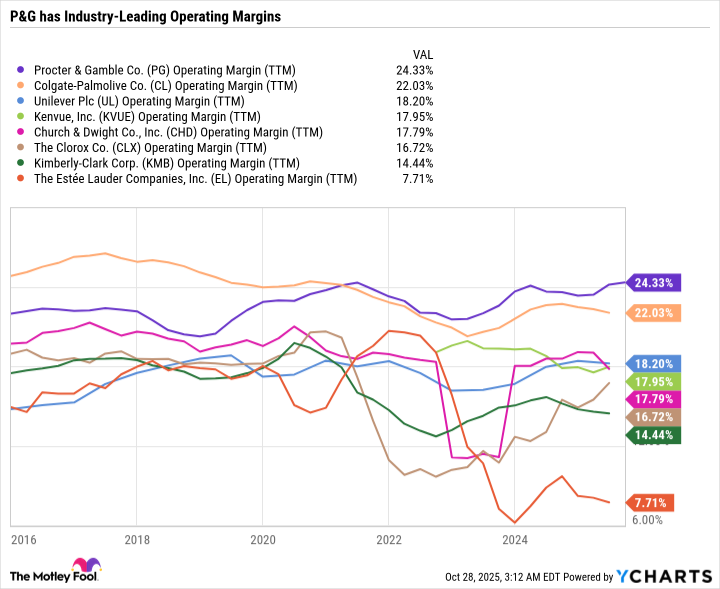

As you can see in the following chart, P&G's operating margins are industry-leading -- a testament to its efficiency and ability to leverage its size and scale to drive profitability.

PG Operating Margin (TTM) data by YCharts

A great company at a compelling valuation

P&G isn't growing earnings at the rate it was in years past. But it is still delivering good results, given the challenging operating environment. The company is on track to generate tons of FCF, which supports dividend raises and stock buybacks.

To top it all off, P&G is a great value, trading at 23.3 times fiscal 2025 diluted earnings per share. That may not seem dirt cheap for a stodgy consumer staples stock, but consider that P&G sports a five-year median price-to-earnings ratio of 25.9.

Add it all up, and P&G is an excellent buy for risk-averse investors looking for a dividend stock to build their passive income portfolio around.