Intel (INTC 1.24%) is officially up 100% this year. The forgotten semiconductor giant is regaining its footing after receiving investments from both Nvidia and the United States government, while also splitting off a subsidiary named Altera. With a cleaned-up balance sheet and earnings momentum, Intel's cash burn has begun to stabilize, with plans to increase its manufacturing capacity in the U.S. as a part of its reshoring strategy.

Today, Intel trades at a market cap of just $200 billion, compared to Nvidia approaching $5 trillion. Does that make Intel stock a buy, with good news finally arriving for the computer chip company? Let's take a closer look and find out.

NASDAQ: INTC

Key Data Points

Nvidia and government investments

After a decade of missteps, Intel has officially lost its position as the top manufacturer of advanced semiconductors for computers, smartphones, and data centers. Artificial intelligence (AI) spending has further deepened this divide. Data centers are now being filled with computer chips from Nvidia and other semiconductor companies instead of from Intel, whose designs have fallen behind the pack.

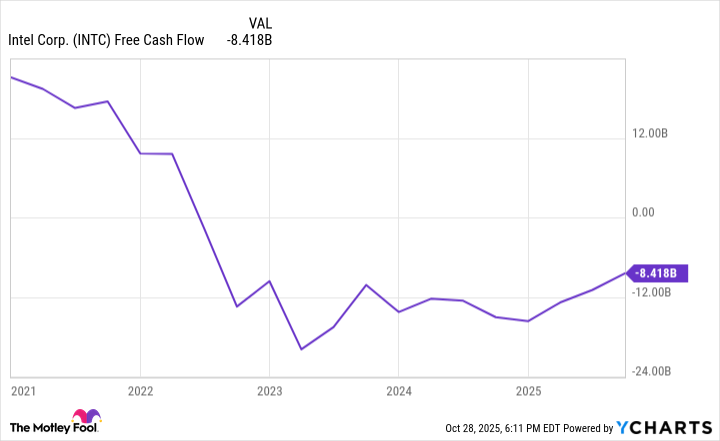

Since the end of 2022, Intel has been burning cash to try to catch up in semiconductor design and to invest in its own semiconductor foundry to compete with Taiwan Semiconductor Manufacturing. A foundry is a manufacturing plant for semiconductors where a company makes third-party designs for customers. Historically, Intel simply manufactured its own chips, but it has since fallen behind in capabilities to its Taiwanese competition.

At the start of this year, investors had counted Intel out, expecting it to keep losing ground to Taiwan Semiconductor and Nvidia. However, Intel's fortunes have begun to change. It brought on new CEO Lip-Bu Tan, a semiconductor design veteran. He then proceeded to sell a stake in Altera, a chip subsidiary for programmable design, for $4.46 billion to raise funds.

Later in the summer, the U.S. government took a strategic stake in Intel as a national champion in semiconductor manufacturing, while Nvidia invested $5 billion into the company. These funds will be used to help Intel invest for the future of AI semiconductor manufacturing in the U.S., giving it a better footing to compete without worrying about its balance sheet. This is why Intel stock is up significantly in recent months, rewarding shareholders who bet on the storied brand in one of its darkest moments.

Image source: Getty Images.

Will it split off the foundry?

We can think of Intel as two businesses. There's the integrated design and manufacturing of its own computer chips, which we can call the legacy business model. Last quarter, Intel's combined segments from this legacy business -- including personal computing and data center sales -- generated $12.6 billion in revenue and $3.7 billion in segment operating income. That's a respectable business, but one still significantly behind Nvidia in terms of scale and profitability.

Then, we have the foundry business. It does a measly $4.2 billion in revenue, and it actually lost $2.3 billion last quarter. Intel needs more scale in manufacturing computer chips for other companies before it can generate a profit, which is the main reason the company has negative free cash flow at the moment. A key issue preventing growing demand for Intel's foundry business is that its potential customers compete with Intel's own computer chips when selling into data center deployments.

With this conflict of interest, analysts have proposed that Intel split up its chip design and manufacturing businesses into two separate companies, using the profits and cash flow generated by the chip design business to capitalize the foundry manufacturing business as it scales up. This would make it more palatable for customers to sign up with the Intel foundry, while giving it a balance sheet capable of surviving years of cash burn as it scales up its factories.

It's unclear whether a plan for this is in the works, but it could help the combined design and foundry businesses grow earnings over the long haul.

INTC Free Cash Flow data by YCharts.

Is Intel stock a buy today?

With a market value of $200 billion, Intel trades at a price-to-earnings multiple of 15 -- if we exclude the money-losing foundry business and simply look at the segment earnings from its personal computer and data center sales. This is a reasonable earnings multiple, especially if you think Intel will start to catch up to competitors like Nvidia over the next decade.

However, that still leaves investors with the foundry business burning a hole in Intel's pocket. Add this subsidiary into the mix, and Intel's stock looks much more expensive on trailing earnings, and risky. If you're a believer in the long-term growth of Intel's foundry and the potential split from its design business, the stock is a buy. But if you think it will stay behind Taiwan Semiconductor forever, then it's best to avoid adding after this massive run-up.