You may recall that 2020 and 2021 were some epically unusual times in the capital markets. As people adopted remote work environments around the world, attention collectively turned to a new form of entertainment -- and I'm not talking about streaming or online shopping.

Of all things, the stock market became a vessel of amusement for veteran and first-time investors alike. What followed was a period of casino-like gamification as retail investors fueled pronounced volatility in the most unsuspecting stocks.

While history may not repeat exactly how things played out in the past, its patterns tend to rhyme. Right now, one of the hottest stocks in the market is Beyond Meat (BYND +0.30%), a plant-based food company that has seen its shares go parabolic over the last few weeks.

Beyond Meat's rally looks suspicious. Using GameStop and AMC Entertainment as case studies, let's break down what's influencing the stock -- and, more importantly, explore how investors can navigate these uncharted waters.

NASDAQ: BYND

Key Data Points

Why did GameStop and AMC stocks go "to the moon" in 2021?

In retail investing lexicon, the phrase "to the moon" simply means an asset's price is rising sharply. In 2021, shares of GameStop and AMC rose significantly -- seemingly completely out of nowhere.

The biggest force behind this movement was traced to a forum on Reddit called r/wallstreetbets. Within this community, an investor named Keith Gill -- who uses the pseudonym Roaring Kitty -- identified an interesting pattern with GameStop stock.

Specifically, he noticed that short interest in GameStop's public float was well above 100%. This means that some of GameStop's shares that were sold short were borrowed and shorted again.

Gill recognized this and identified an opportunity: If he could draw enough buzz to this structure and convince people to buy GameStop stock, it could trigger a massive short squeeze. Spoiler alert: That's exactly what happened, and institutional investors -- primarily hedge funds shorting GameStop -- were forced to cover their positions.

GameStop is one of the founding members of the meme stock movement. These are stocks that exhibit pronounced increases for reasons independent of sound fundamentals, but rather driven by hype narratives native to online communities.

Another company that experienced similar levels of outsized buying during 2021 was AMC, whose stock was also heavily shorted due to the theater chain's vulnerabilities to the COVID-19 lockdown protocols.

Beyond Meat: A rallying stock, but a slumping business

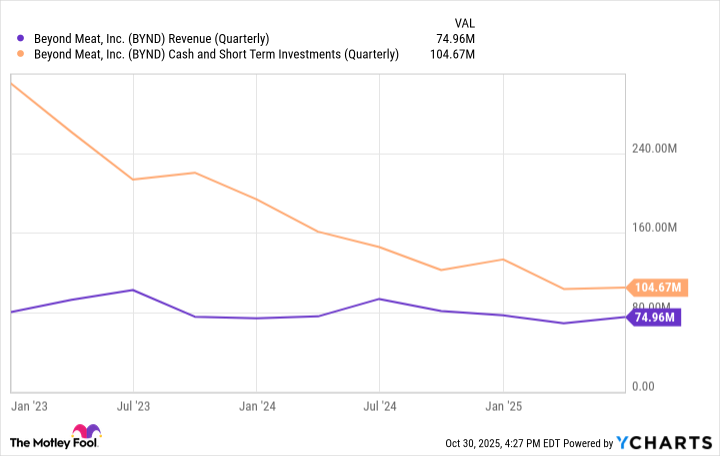

In early October, filings revealed that Beyond Meat was gearing up for a convertible bond deal. A move like this could indicate that the company was under liquidity pressures and needed to raise cash quickly.

Given the company's lumpy revenue profile and the pace at which cash is going out the door, I think it's fair to say that Beyond Meat's business is in trouble, and financing options were likely limited.

Similar to GameStop and AMC, however, Beyond Meat's stress levels became a hotbed for day traders. A cauldron of rumors, narratives, and ambiguities about the convertible note and the overall health of the company fueled an acute rise in Beyond Meat's stock price.

Perhaps ironically, around the same time the stock started to rally, Beyond Meat announced a new distribution partnership with Walmart. This only further influenced the retail community to double down on its position.

Should you invest in Beyond Meat right now?

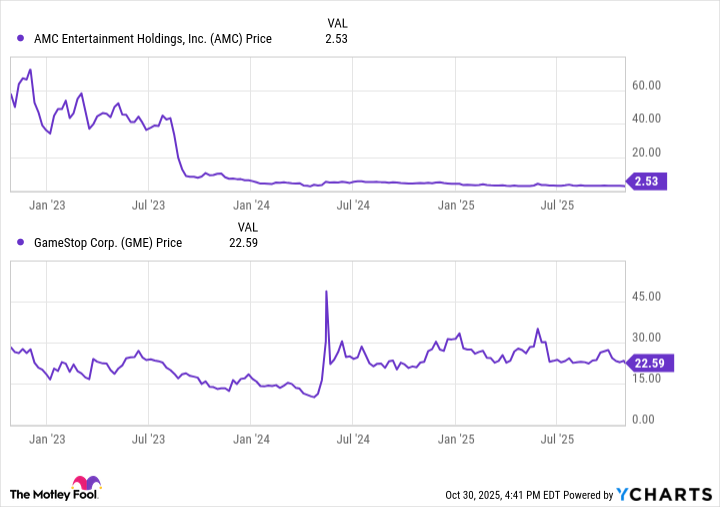

While GameStop and AMC experienced meaningful run-ups in their respective share prices, the graphs included below also show what eventually happened: The rally faded, each stock crashed, and activity remained sideways -- never recovering from prior highs.

Whether Beyond Meat becomes the next AMC or GameStop remains to be seen. But right now, I think the parallels with each of these companies are quite clear. As I write this (Oct. 30), Beyond Meat stock has already fallen from an intra-month high of $3.62 to $1.66.

Beyond Meat is not operating from a position of strength. While a turnaround could be in store by way of the Walmart deal, I think such a thesis is rooted more in hope than realism. My suspicion is that the company's products -- plant-based alternatives to meat -- largely remain a niche category and therefore have a limited serviceable market.

One of the biggest mistakes an investor can make is to simply follow a crowd. While Beyond Meat stock could bounce back, my hunch is that any upside swings will be fleeting. Until the company can demonstrate measurable improvements and sustained progress, I see little reason to own the stock.