After a string of high-profile stock splits last year from companies like Nvidia, Broadcom, and Chipotle, the market has been relatively quiet this year. That might change. Speculation is building that artificial intelligence (AI) powerhouse Palantir (PLTR +3.27%) may soon announce a forward split.

Why stock splits matter more than they should

The mechanics of a split are straightforward: A company issues new shares to each shareholder while reducing the price of each share proportionately so that, in the end, no one's portfolio value has changed. In the case of a 10-for-1 forward split, you end up with ten times the shares you started with, but each is worth a tenth of the price.

NASDAQ: PLTR

Key Data Points

In theory, stock splits shouldn't really matter for an investor; in practice, they do. Splits often spark rallies. This could be purely associative -- companies that initiate forward splits usually already have quite a bit of momentum behind them -- but it's possible that the lower price point actually brings new investors into the fold, and the split itself drives growth.

Regardless, it's worth paying attention to. Last year, in the time between announcing a split and actually executing the split, Chipotle, Nvidia, and Broadcom saw their respective stock prices rise by 66%, 121%, and 170%.

The split speculation game

Will Palantir split its stock? The current rumors are being driven by an analyst from RBC Capital who said that retail is "largely focused on the potential for a stock split," though that has been true for some time. There's really no way to know if Palantir will announce a split, much less when. That being said, given the stock's jump to more than 330% in the last year and its popularity with retail investors, it wouldn't be a surprise to see the company do just that. I wouldn't bank on it though.

Besides, splits aren't magical. They are, at best, a short-term catalyst, and investors should focus on the long term and the fundamentals of Palantir's business. Shares of Nvidia and Broadcom have kept soaring over the past year and a half because the companies delivered. Chipotle, on the other hand, has seen growth stagnate, and its stock is down nearly 30% since its split was announced.

Palantir is delivering

On this front, Palantir looks strong. The company is operating in the black -- something not many of its peers can say at this point -- and is continuing to grow sales and earnings by double digits each quarter. Palantir is the poster child for AI's utility and impact in the real world.

The company's success comes from its distinctive approach, which favors the bespoke, tailored-made application of AI. Palantir works intensively to customize its AI systems for each company, sending its "forward-deployed engineers" to work directly alongside the clients they serve.

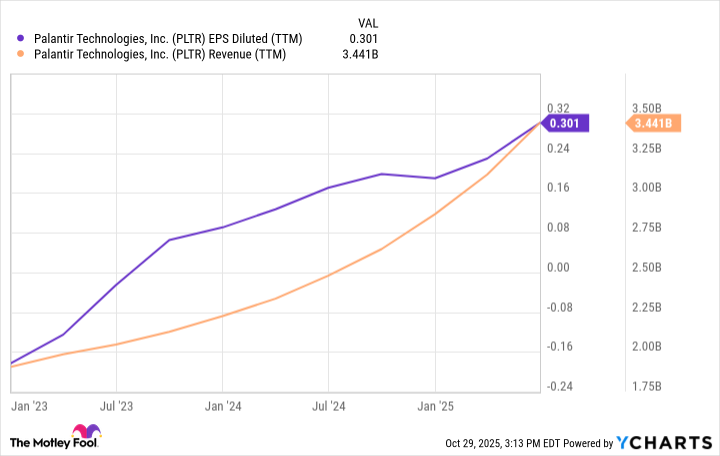

This makes their AI implementation more effective, efficient, and, critical to its long-term success, sticky for the end client. This strategy, along with its cozy relationship with the federal government, has fueled massive growth on its top and bottom lines as you can see on the chart below.

PLTR EPS Diluted (TTM) data by YCharts.

Strong business, stretched valuation

While investors can get carried away waiting for the perfect deal and miss opportunities, the reality is that a great company can be a bad investment. It's hard to look at Palantir's current valuation and see it as anything but stretched -- very, stretched, in fact.

The stock trades at a price-to-earnings ratio (P/E) of more than 620. That's pretty extreme. Palantir would have to grow its earnings 10-fold just to approach reasonable levels. Even then, it would trade at a P/E nearly twice that of Alphabet. I would avoid Palantir stock whether or not a split is announced.