Tesla (TSLA 0.99%) has outperformed the market indexes in recent months, now trading at a market cap of $1.5 trillion. It is the 10th most valuable company in the world by market capitalization. What if I told you that the electric vehicle company is vastly overvalued?

With a price-to-earnings ratio (P/E) in the stratosphere heading into a declining electric vehicle market, Tesla stock is bound to disappoint investors over the next five years unless Elon Musk can pull a rabbit out of his hat.

Instead of betting on Tesla and its nosebleed earnings multiple, investors should consider buying reasonably valued stocks like Netflix (NFLX 0.15%) and Visa (V 1.03%) instead.

Here's why the numbers prove that both of these stocks should be larger than Tesla five years from now.

Image source: Tesla.

Tesla's tough path

The next few years may prove to be tough for Tesla. It keeps losing market share of electric vehicle sales in the United States, China, and Europe, which are its core demand markets.

Compared to 75% of all new electric car sales at the beginning of 2022, Tesla's market share in the United States has fallen to around 45% in recent quarters. What's more, the company has lost market share while drastically cutting its selling prices, which, combined with inflationary input costs, has greatly reduced the company's gross margin.

NASDAQ: TSLA

Key Data Points

Gross profit margin has gone from close to 28% at its peak to 17% over the last 12 months. Further pain may be ahead because of expiring tax credits in the United States on electric car sales, a $7,500 discount on purchases that completely went away at the end of September.

In China and Europe, competitors are taking a huge share from Tesla, which is why the company's annual unit volumes have barely budged and are now lower than BYD, the largest player in China.

Steady growth for Visa and Netflix

Cyclicality and competition are threatening Tesla's business. If you look at the likes of Netflix and Visa, it is steady growth each and every quarter.

In Q3, Netflix's revenue grew 17% year over year with an EBIT (earnings before interest and taxes) margin of 29%. Riding the growth of streaming TV around the globe, Netflix keeps expanding its presence in all sorts of markets like East Asia, the United States, Europe, and Latin America. It is now expanding into more talk shows, live TV, and sports to increase the value of a Netflix subscription.

With the tailwind of streaming TV adoption still well at its back, Netflix can keep growing revenue over the next five years with strong profit margins.

Visa is perhaps an even more consistent grower. Its business model relies on taking a small sliver of the trillions of dollars that flow through its credit cards, debit cards, and digital wallets every year. That means it grows along with global consumer spending, while also being protected by inflationary headwinds.

In its latest second-quarter results, Visa's payment volume grew 8% year over year, and its revenue grew 14%. It has an impressive EBIT margin of 67%, making it one of the most profitable businesses in the world. As the global economy grows over the long term, Visa's earnings will keep compounding higher and higher over the next five years.

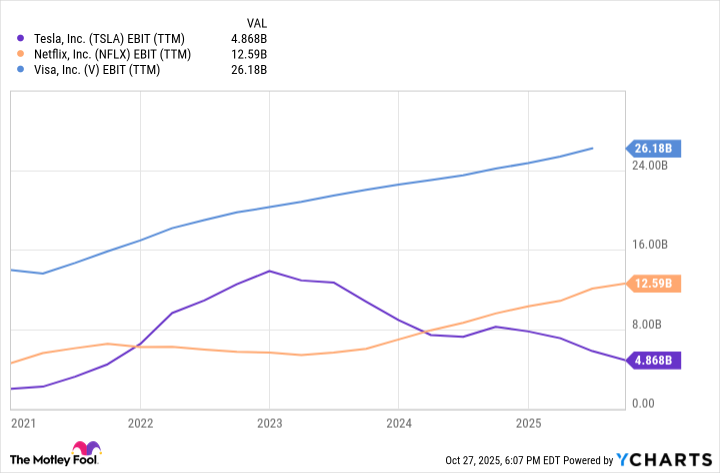

TSLA EBIT (TTM) data by YCharts

The answer is in the numbers

As of this writing, Tesla has a market cap of $1.5 trillion compared to $675 billion at Visa and $464 billion at Netflix. While it may seem daunting for Netflix or Visa to surpass Tesla's market cap within five years, the profit figures bear this out.

Tesla's EBIT over the last 12 months was less than $5 billion. Netflix generated $12.6 billion. Visa generated $26 billion. Over the next five years, I think it is unlikely that Tesla will grow its earnings much, if at all, due to the headwinds talked about above, while both Netflix and Visa have put up consistent growth and should continue to deliver consistent growth for shareholders in the years to come.

At the end of the day, a stock is only worth the profit it generates for shareholders. With this as an anchor, I think it is likely that Netflix and Visa surpass Tesla in market cap at some point over the next five years, making them a buy and Tesla a sell at current prices.