Investors have been very interested in quantum computing stocks since last December, when Alphabet's Google unit announced breakthroughs in the field.

Indeed, Alphabet, IBM, and Microsoft are widely considered leaders in the field, and artificial intelligence (AI) tech leader Nvidia is also emerging as a significant player in the hybrid classical computing-quantum computing space.

However, these huge companies are far from being pure plays on quantum computing and that will likely remain the case, at least for quite some time. So, investors have been more drawn to quantum pure-play stocks such as IonQ (IONQ 3.55%), Rigetti Computing (RGTI 2.53%), D-Wave Quantum (QBTS 1.44%), and Quantum Computing Inc. (QUBT +0.76%)

Soon, investors will have another quantum technology pure play to invest in: Infleqtion. The Colorado-based company announced in September that it plans to go public via a reverse merger with special purpose acquisition company (SPAC) Churchill Capital Corp X (CCCX +3.70%). Going public via this method is often speedier and less costly than going the traditional initial public offering (IPO) route.

Image source: Getty Images.

What is quantum computing?

Quantum computing refers to using the properties of quantum mechanics for computing purposes. It is still nearly entirely in the research and development phase, but it has massive potential.

Quantum computing uses quantum bits, or qubits, to store and process data rather than the binary bits (zeros and ones) used by classical computers. Qubits can encode much more data because they can exist in superposition, rather than in just zeros and ones. This gives quantum computers the potential to solve problems that classical computers either can't solve or would take an extremely long time to solve.

Infleqtion's technology

Infleqtion bills itself as a "global leader in neutral atom-based quantum technology." None of the publicly traded quantum companies mentioned above use this technology. The company has over 230 issued and pending patents.

Neutral atom-based quantum technology uses neutral atoms trapped and arranged by laser beams to act as qubits. This contrasts with technologies that use charged ions, which are reportedly more prone to environmental noise. Another reported main advantage of the neutral atom-based technology is the potential for operation at room temperature without cryogenics.

Infleqtion's plans to go public

Infleqtion expects to go public in late 2025 or early 2026, subject to shareholder and regulatory approvals.

The company's current valuation is $1.8 billion, and it expects to receive over $540 million in gross proceeds from the transaction.

Upon the deal's closing, Infleqtion is expected to be listed on a leading North American stock exchange under the ticker "INFQ."

Infleqtion's founders and top management

Infleqtion was founded in 2007 as ColdQuanta by Dana Anderson and several other individuals. Anderson is the company's Chief Science Officer. He's also a fellow at the JILA Institute and a physics and electrical engineering professor at the University of Colorado Boulder. (JILA is a joint research institute of the University of Colorado Boulder and the National Institute of Standards and Technology.)

Matthew Kinsella, who has a venture capital background, is the founding investor and CEO. He led the founding investment in Infleqtion from Maverick Capital and joined the board of directors in 2018. Anderson was the first CEO, with Kinsella becoming CEO in mid-2024 to lead Infleqtion's next phase of growth.

Infleqtion's business

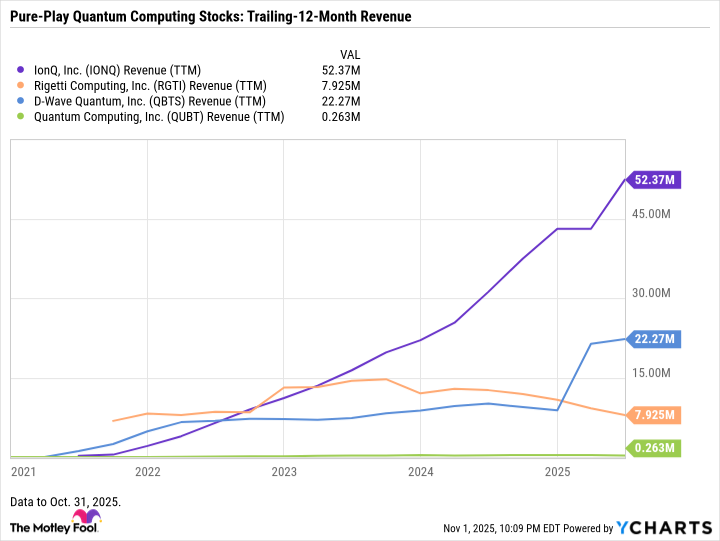

What most caught my eye about Infleqtion is that the company isn't just in the research and development stage -- it has commercial sales. Moreover, its 12-month sales through the first half of 2025 were higher than those of D-Wave Quantum, Rigetti Computing, and Quantum Computing Inc. None of these pure plays (or IonQ) are profitable, nor is Infleqtion.

The second thing that caught my eye is that Infleqtion is a Nvidia strategic partner -- and, in fact, Nvidia is a customer of Infleqtion's, although the company didn't expound on what Nvidia has bought from it. Along with Nvidia, the U.S. Department of Defense (DOD), NASA, and the U.K. government are using Infleqtion's products.

To the date of the announcement about going public (Sept. 9), Infleqtion has sold three quantum computers and hundreds of quantum sensors.

The company's product portfolio includes quantum computers and three types of quantum sensors (quantum clocks, quantum radio frequency RF systems, and inertial navigation solutions), all optimized with Infleqtion's proprietary software. Quantum sensors use the properties of quantum mechanics to measure quantities like time, position, radiofrequency signals, and gravity more precisely than classical sensors.

Infleqtion said it will use the proceeds from going public to accelerate its "technology and product roadmap and expand applications to new end markets, unlocking additional use cases in artificial intelligence, national security, space, and beyond."

Data by YCharts.

Infleqtion's finances

The company generated approximately $29 million in trailing-12-month revenue as of June 30. Moreover, it has about $50 million in booked and awarded business, which it expects to realize as revenue over time. In addition, it touts a $300 million-plus identified pipeline of potential customers.

Infleqtion had $88 million in cash on hand as of the end of the first half of 2025. Its cash burn was $33 million for the trailing 12 months ended June 30. So, it's in decent shape from a liquidity standpoint for a startup in the quantum space. And again, it expects to receive over $540 million in gross proceeds when it goes public.

The company's sales of quantum sensing products are "anticipated to generate cash to grow our quantum platform and reduce the need for new segment investments as computing scales," it said in a September investor presentation.

The fact that Infleqtion has the revenue stream from quantum sensing products is an advantage over companies solely involved in quantum computing, as liquidity is a major concern in this space. Unlike quantum computers, quantum sensing products have had real-world applications for some time, though they are still being improved.

If you're interested in quantum computing stocks or emerging technology stocks, Infleqtion looks worth putting on your watch list.