With 79,000 miles of pipeline and 139 terminals, Kinder Morgan (KMI +3.88%) is one of the largest energy infrastructure companies in the country, and by many measures, too big to ignore within the energy patch.

Add in a 4.4% dividend yield -- which has been increased for eight consecutive years and is currently the second-highest of 22 stocks in the Energy Select Sector SPDR (XLE +0.33%) -- and Kinder starts to warrant a closer look.

NYSE: KMI

Key Data Points

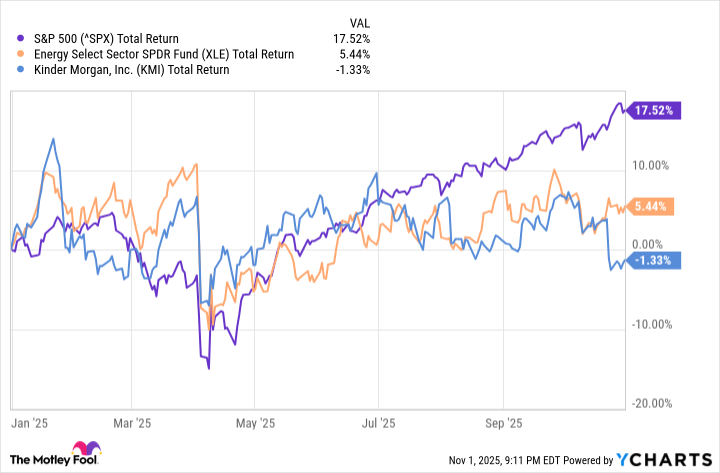

Let's start with the stock. While its $58 billion market cap is the sixth-largest in the energy sector, its 1.3% year-to-date decline ranks it 10th on a total return basis and has it lagging both the energy sector (+5.4%) and the broader S&P 500 index (+17.5%) this year when dividends are included.

As for that dividend, while 4.4% is certainly a very good rate and better than the energy sector and S&P 500, it's only slightly above a 10-year Treasury note (4.11%) and about a half percent behind what investment-grade corporate debt currently pays (5%). In both cases, investors could get a similar -- or higher -- yield with far less risk.

There's also the reality that Kinder Morgan has a 95% dividend payout ratio, which means there's very little room for error if the dividend is to be paid and maintained.

Value investors seeking to buy on weakness will likely find Kinder Morgan to be steady but not cheap, with a forward price-to-earnings ratio of 19, which is the fifth-highest in the energy sector. Twelve of 21 analysts, however, currently rate Kinder Morgan a buy, nine have it at hold, and none as a sell; the average 12-month price target of $31 implies 18% upside.

Add in another 4.4% from dividends, and total return investors looking for capital appreciation as well as income can start getting comfortable with this Houston-based energy play.