Warren Buffett, the world-famous investor and CEO of Berkshire Hathaway, has explained that you don't need to be a genius to invest. What you need is the right temperament. I've learned that the hard way, but you don't have to. Here's my simple investment blueprint and what I needed to learn before I finally landed on it.

What I do as an investor

Buffett's investment approach, simplified dramatically, is to buy good companies when they are attractively priced and then hold for the long term. That is, basically, what I do now. The way I do this is by focusing on buying companies that have long histories of paying dividends, preferably dividends that grow annually. I only dig more deeply into businesses that I understand and like.

Image source: The Motley Fool.

I then examine the stocks that have historically high dividend yields, which I believe is an indication of a cheap price. I confirm that view with traditional valuation metrics like price-to-sales and price-to-book value ratios. And once I buy a stock I hold on to it until there's a very good reason to sell it, which will hopefully be never. (A good reason to sell might be a material change in the business approach, a dividend cut, or some catastrophic business development like a massive class-action lawsuit.)

This is, essentially, my dividend-focused investing take on the Buffett style of investing. I actually used this approach and then abandoned it for a little while, which was a huge mistake. Here's what I wish I had known during my years in the investment wilderness.

Managing your emotions is the key to being successful

Buffett had explained what I needed to know years ago, but I just didn't listen. I was young and I had to learn for myself. Put simply, I let greed drive my decisions. I wanted to get rich quickly when, in truth, most investors get rich slowly and over time.

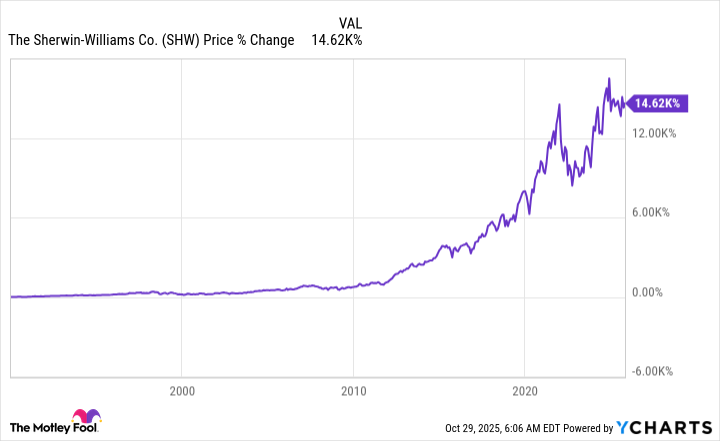

As an example, I bought Sherwin-Williams (SHW 0.46%) around the turn of the century. And I sold it to buy penny stocks, one of the highest-risk investment approaches you can take. The chart below shows you the gains I missed out on. What I was left with were a few bankrupt companies that lingered on my brokerage statement for years, reminding me of my poor decisions.

Sherwin-Williams, sadly, isn't the only stock I bought and then sold because I wasn't emotionally ready to hold for the long term. Most of them have gone on to be big winners and I missed out on them all.

Greed isn't the only emotional issue I had trouble with, though. I got into penny stocks by listening to so-called "experts" that were really just out to make a buck. And I let my emotions get swayed by current events, by constantly watching the markets and business news.

I could keep going, but the real takeaway here is that I wish I had known just how important controlling my emotions was when it came to investing.

Protect yourself the easy way

There's a body of literature around what is today called behavioral investing. Every single year I read a book that summarizes the main points to remind myself just how fallible and susceptible I really am to my own emotions. The Little Book of Behavioral Investing is short and easy to read, and it would be a good idea for you to read it at least once (if not annually).

If you don't read this book, at least read another one on the topic. It will help save you a lot of time and effort learning the hard way, like I did, that your emotions are what you need to control most of all. And maybe you won't have to look back on the big winners you let slip away.