The rally in Netflix (NFLX 2.25%) stock finally came to a halt, at least momentarily. After crushing the market for the better part of two years, the streaming specialist's most recent quarterly update gave investors pause. Worse-than-expected bottom-line numbers sent the stock down by about 10% on the heels of its earnings release.

The company recovered after it announced a 10-for-1 stock split, but that's hardly a good reason to invest in a stock, and some might still worry about the long-term implications of the earnings miss. Despite this problem, though, there are still strong reasons to invest in the stock. Here are three.

1. Important growth avenues

Netflix has long said that, despite the streaming industry's significant headway over the past decade, there is still a huge runway for growth. One way to see this is by looking at television viewing time in the U.S., one of the more penetrated streaming markets. Cable and broadcast together still accounted for about 44.6% of TV viewing time in September, much of which should eventually be captured by streaming.

Image source: Getty Images.

Just as important, Netflix's strategy continues to evolve. Two opportunities the company is pursuing are live events and advertising. The former generate significant noise and can attract viewers who might otherwise never have considered a Netflix subscription, while also helping retain others who might have been considering canceling theirs. The result: Live events drive higher subscriptions and recurring revenue.

Advertising represents another exciting avenue for the company, given its deep ecosystem. It launched an ad-supported tier just a few years ago, and it is already seeing results. The company said that its third quarter was the best one yet for ads, while it doubled ad commitments in the U.S. Netflix will also combine these two opportunities: ads during live events.

Companies are willing to pay significant premiums to place ads when they know more eyes are focused on the screen, which should help boost ad sales. The bottom line: Despite the recent setback from the quarterly update, long-term growth prospects remain attractive.

2. A strong economic moat

Netflix isn't the only game in town; the number of streaming platforms has soared over the past 10 years. However, the company has maintained its lead and still captures more television viewing time than comparable peers (YouTube gets even more, but strictly speaking, it's not comparable).

One of the key reasons the company has remained the dominant force in streaming is its competitive advantage, stemming from at least two sources.

NASDAQ: NFLX

Key Data Points

First, there is Netflix's brand name, which is literally synonymous with streaming. It has achieved the difficult task of becoming a verb used in everyday language, which speaks volumes.

Second, it benefits from a strong network effect. The company has access to data on viewers' habits: what they watch, when they watch it, for how long, whether they fast-forward, skip parts, rewatch it, and the like. Netflix uses all that data to carefully select which content to license for its platform or what original movies or TV shows to create (or reboot).

These efforts lead to higher customer satisfaction and more people on the platform, granting it access to even more data to fine-tune its content. Netflix can also use this advantage to make its ad business successful.

Despite the competition, the company should remain a leader in streaming and capitalize on the long-term opportunities in the industry.

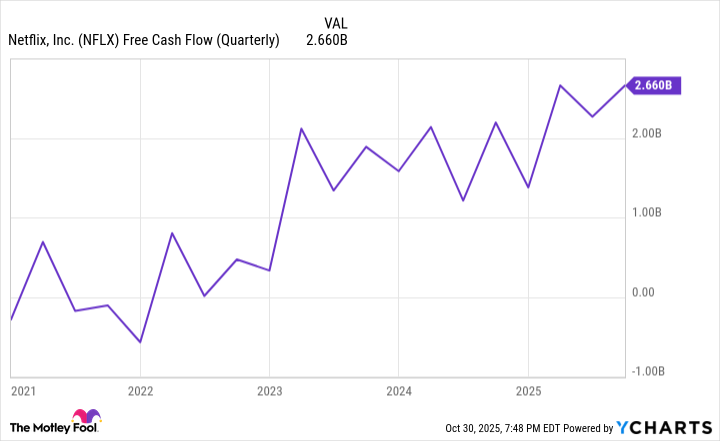

3. Rapidly rising free cash flow

Netflix's subscriber numbers were, for a long time, one of the highlights of its quarterly update. The company stopped reporting this metric in the first quarter of this year, hoping investors would focus on other financial metrics that arguably better reflect its performance.

One of them is free cash flow, and in this department, it continues to perform well. In the third quarter, free cash flow increased by 21.2% to $2.7 billion. And it's not just this quarter.

NFLX Free Cash Flow (Quarterly) data by YCharts.

The company has significantly improved this metric over the past five years, which is a sign of a healthy business that's performing well.

Looking beyond the recent dip

Netflix's worse-than-expected net earnings were due to a large expense stemming from a tax dispute with Brazilian authorities. The company does not expect this issue to affect its financial results in the future. In the grand scheme of things, this problem is likely little more than a hiccup we won't even remember in another five years.

In the meantime, the company could generate consistent financial results and superior stock market performance, given the strength of its underlying business and its growth prospects. That's why Netflix stock is still a buy.