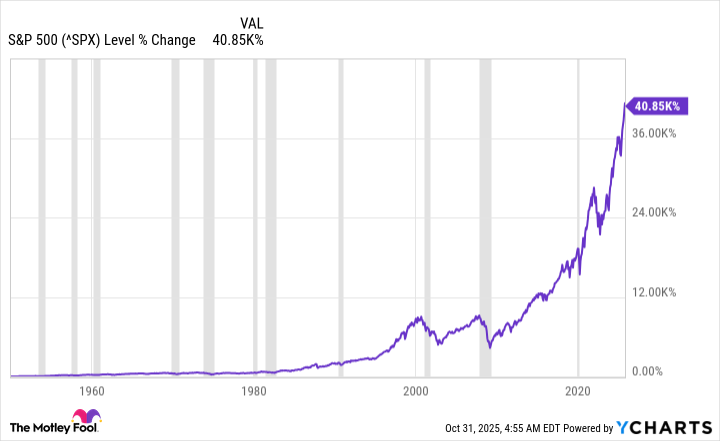

Warren Buffett, the famous investor and CEO of Berkshire Hathaway, has long suggested that most investors would be better off just buying the S&P 500 (^GSPC +0.54%) index fund rather than picking individual stocks. Given the long-term rise in the index, that sounds like great advice, and historically, it has even worked out well if you bought when the market was near all-time highs, as it is today.

There are three broad ways, and very different, to buy the S&P 500 index. Here are the options, and the one that is probably the smartest choice if you are looking to buy the index this November.

Image source: Getty Images.

What is the S&P 500 index?

Before looking at how to buy the S&P 500 index, it is important to understand what the index does. It is a committee-selected list of roughly 500 U.S. stocks that the committee thinks are representative of the U.S. economy. The holdings are market-cap weighted, so the largest businesses have the biggest impact on the index's performance, which is basically how the economy works.

So, in a nutshell, the S&P 500 is meant to track the U.S. economy. That's why Warren Buffett suggests that most investors go with the index over trying to cherry-pick individual stocks. The U.S. economy has grown materially over the long term. Although there's no way to know what the future holds, given the history, buying the S&P 500 seems like a decent call for people who know they need to invest in stocks but don't have the time or desire to dive in too deep.

Data by YCharts. Note: Grey lines indicate recessionary periods.

Three big-picture ways to buy the S&P 500 index

The first way to buy the S&P 500 index is a path that no small investor should go down. It is to open a brokerage account and buy each individual stock in the exact proportion needed to reconstruct the index. The time and energy needed to do this would be shocking. You would also need a fairly large amount of money, given that 500 stocks is a rather large portfolio to build. Luckily, this isn't something you need to do.

The second way to buy the S&P 500 index is to buy a mutual fund like Vanguard 500 Index Fund (VFIAX). The benefits are that it is easy, since you only have to buy one investment, and it is cheap, noting the expense ratio of just 0.04%. That said, there are some potential limitations. For example, mutual funds can only be bought and sold at the end of a trading day. In other words, you can't act as quickly as you might like if the markets are moving. And there is a minimum initial investment of $3,000 before you can buy the shares. That's not a huge hurdle, but for new investors, it may be a deterrent.

NYSEMKT: VOO

Key Data Points

The negatives are why the third option, buying an S&P 500 exchange-traded fund (ETF), will most likely be the best choice for most investors. Without getting into the complicated details, an ETF is a pooled investment vehicle like a mutual fund, but it trades all day long like a stock. And ETFs tend to have even lower expenses than mutual funds.

The best choice for an S&P 500 ETF is probably Vanguard S&P 500 ETF (VOO +0.54%). The key is the ETF's 0.03% expense ratio. Basically, it does the same thing as the mutual fund version, but it costs less, allows you to trade all day long, and you can buy a single share (or even fractional shares at some brokers) if you want. The only negative is that you may have to pay broker commissions when you trade, but a large number of brokerages waive commissions on ETFs.

Simple and cheap makes Vanguard S&P 500 ETF a winner

If you know that investing in stocks is a good idea but you just don't have the desire to do it, then buying the Vanguard S&P 500 ETF is likely to be the best place for your cash. While just getting started is super important, there's another piece of Buffett advice that you should keep in mind: Hold for the long term.

The S&P 500 will go through bull and bear markets, but you'll make out best if you buy and keep buying year after year (also known as dollar-cost averaging). History suggests that if you do that, buying more in down periods and less in up periods, you'll slowly build your wealth. Do this long enough and you could even create meaningful generational wealth to pass on to your kin.