If you've got $1,000 sitting on the sidelines waiting to invest, I think now is an excellent time to deploy the cash. There could be several positive catalysts occurring over the next few weeks: The government shutdown ending, a trade deal with China, a rate cut, and earnings reports. All of these are bullish indicators for the market, and could drive stock prices higher as we finish off 2025.

If you're looking for some stocks to buy, I've got two that look like excellent investments and could have a ton of room to run before 2026 arrives.

Image source: Getty Images.

Nvidia

Nvidia (NVDA +0.47%) has been one of the top stock picks over the past few years, and I haven't seen anything that changes my mind on this topic. Its graphics processing units (GPUs) have been the primary computing devices AI hyperscalers use to train and run AI models. While some of its competitors have been gaining traction recently, there's still a massive computing market out there.

NASDAQ: NVDA

Key Data Points

Nvidia believes that global data center capital expenditures will rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030. That's incredible growth, and if it comes to fruition, any companies involved in the AI computing sector will see massive growth. While some may scoff at this bold prediction, investors must remember that Nvidia has far more information than we do.

Data centers take years to plan and construct. After those processes are done, only then will it be outfitted with computing resources from companies like Nvidia. With Nvidia chips being in tight supply, customers must be in contact with Nvidia years in advance of when they'll actually need them, giving Nvidia superior vision into what the future holds.

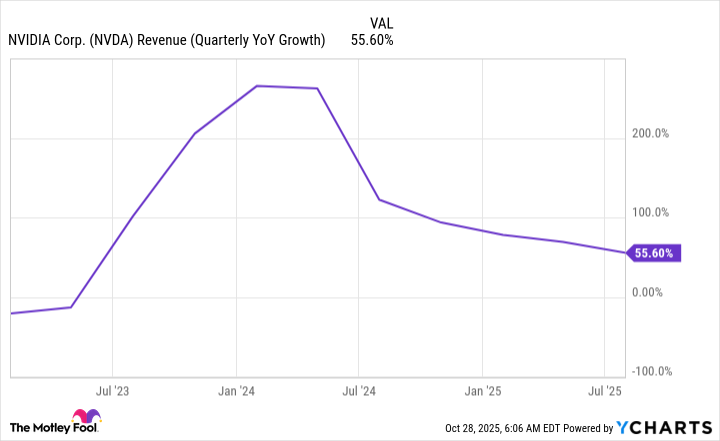

Although Nvidia's growth has slowed in recent quarters, I'd hesitate to call Nvidia's growth slow by any means.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

Revenue growth of 55% is still quite impressive, and with massive artificial intelligence capital expenditures planned for years in advance, I think Nvidia is still a great stock to buy now.

Amazon

Investors may not think of Amazon (AMZN 1.60%) as one of the premier stocks to buy. With e-commerce expansion nearly played out in the U.S., it doesn't seem as if the stock could have more room to run. However, that's missing the big picture. Amazon has two important segments that are driving a huge chunk of its growth, and both of these have much higher margins than its base commerce business.

NASDAQ: AMZN

Key Data Points

The two most important divisions within Amazon right now are its advertising services and Amazon Web Services (AWS), its cloud computing business.

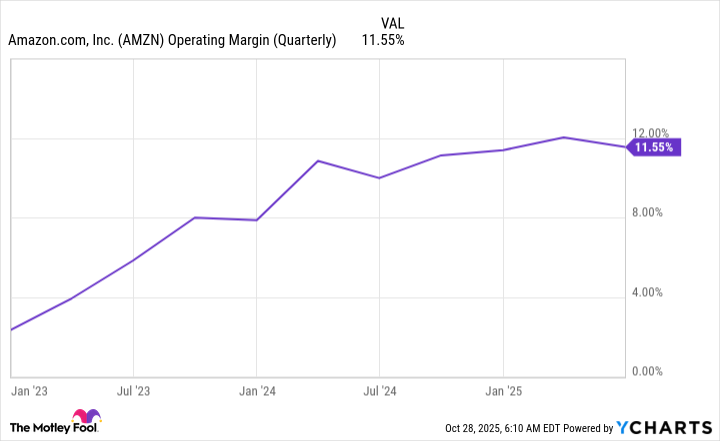

Because consumers go specifically to Amazon's website to buy items, it is sitting on an absolute gold mine of consumer information, which it is starting to leverage in its advertising business. We know from other advertising-focused businesses that this is highly profitable, and it is one of the reasons why Amazon's operating profits soared in the past few years.

AMZN Operating Margin (Quarterly) data by YCharts

Cloud computing is also experiencing major tailwinds, with traditional workloads being migrated to the cloud alongside new AI workloads. AWS is the current market share leader in this sector, and its importance was felt a few days ago when AWS had an outage that crippled parts of the web. While investors may be concerned about another event like this happening, it should also show them that AWS has become integral to today's digital society and that without it, the world wouldn't be the same.

Both advertising and cloud computing have a ton of room for expansion. This bodes well for Amazon, and it will allow it to produce market-beating profit growth for years to come. As a result, I think it's an excellent stock to buy right now.