Nuclear energy had a huge moment in 2025. Novel reactor designs and excitement around new enrichment capacity have helped nuclear energy undergo a resurgence this year. That resurgence helped spark a 480% year-to-date stock price gain of Oklo and a 360% gain for Centrus Energy.

Add to that list a company that's designing microreactors -- Nano Nuclear Energy (NNE +4.54%). The stock's price is up about 90% on the year, and its portable microreactor concept could make it one to watch before it reports earnings in December.

Image source: Getty Images.

Why you should consider Nano Nuclear before its next earnings report

Think of a small power plant that can fit into a shipping container and can be transported by truck. That, in a nutshell, is one design that Nano Nuclear is trying to build. Big nuclear plants can take years -- decades even -- to construct, as well as cost billions of dollars. Nano's power plants, in contrast, are smaller, portable, and much lower in upfront costs.

The compactness of these reactors is a huge selling point. But so is its portability. Our world is already using more and more electricity, and huge data centers that run artificial intelligence (AI) are poised to demand truly astronomic loads. Since these data centers are often in remote areas -- places that may not have reliable power -- Nano Nuclear's reactors could bring a mini-grid where the power is needed.

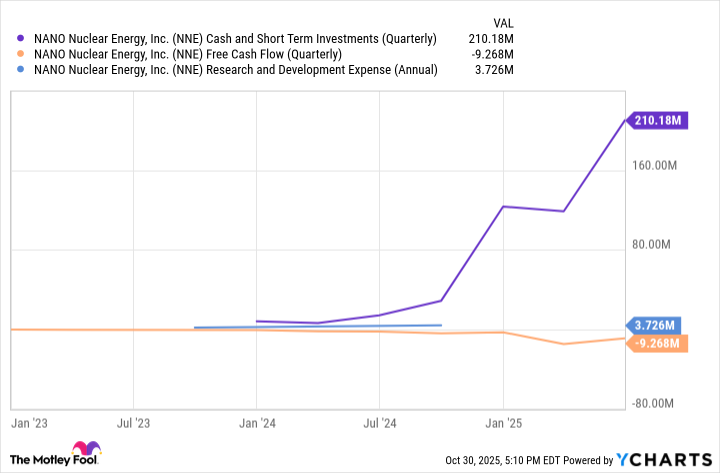

Notice, however, that I'm writing in hypotheticals. That's because Nano Nuclear, for all its good ideas, is still in its R&D phase. It doesn't have regulatory approval from the Nuclear Regulatory Commission (NRC) for its designs, nor has it made a single sale. It has sufficient cash to keep its research humming apace, but until it builds a prototype, the stock is soaring almost entirely on promise.

Data by YCharts.

If Nano Nuclear can succeed in commercializing its mini-reactors, the pay-off could be huge. As such, I'd open a small position on this one, especially if it makes concrete progress toward getting a license.