On Nov. 3, IREN electrified the investment community by announcing a $9.7 billion deal to provide added cloud capacity to hyperscaler Microsoft. But several investors failed to read past the headline.

Microsoft has a cloud-computing business called Azure, and it needs graphics processing units (GPUs) to handle increased workloads from artificial intelligence (AI). And under its agreement with IREN, Microsoft will use its AI cloud services.

As big as this deal could be for IREN, which is based in Australia, it's also a big deal for Dell Technologies (DELL 1.66%). The press release stated that IREN will buy $5.8 billion of Dell's equipment to support its services to Microsoft.

NYSE: DELL

Key Data Points

This deal with IREN is just the latest example of how Dell's AI server business is absolutely booming, leading to strong gains for Dell Technologies stock in recent years.

Dell's booming AI business

During its fiscal 2024 (which ended in February 2024), Dell began talking about its AI-optimized servers. Many of the company's customers began ordering these products as the AI infrastructure trend picked up speed.

From the fiscal third quarter of 2024 to the fiscal fourth quarter of 2024, the company's backlog for AI-optimized servers doubled to $2.9 billion, catching investors' eyes. By the end of fiscal 2025, the backlog had increased to $4.1 billion.

As of the most recent quarter, the fiscal second quarter of 2026, Dell has a backlog of $11.7 billion. But keep in mind, the backlog continues to grow at this breakneck pace even though it's shipping plenty of AI-optimized servers. In fact, it shipped more in the first half of its fiscal 2026 than it shipped in all of its fiscal 2025.

In short, the demand for the company's AI hardware products far exceeds its supply. So not only is it growing its AI-based revenue, but its future opportunity also continues to improve. The deal to sell hardware to IREN is just the latest example of the surge in demand for its AI products.

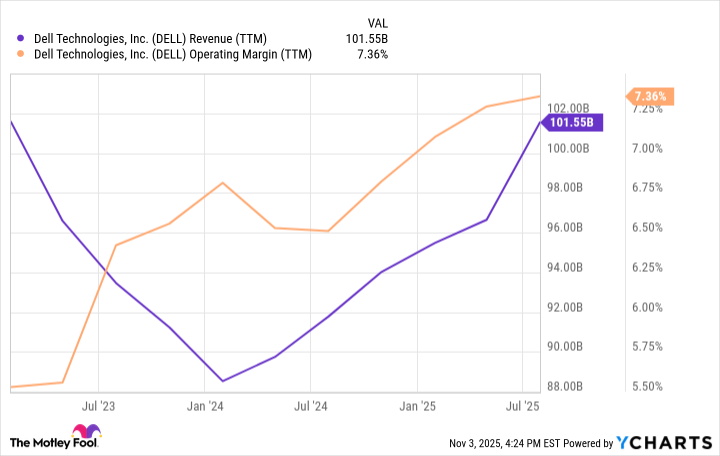

With surging demand, Dell's operating profit margin has increased as well, and it's now at its highest level since it went public again in 2018.

DELL Revenue (TTM) data by YCharts; TTM = trailing 12 months.

What it means for Dell stock from here

Demand for AI-optimized servers is contributing to Dell's stellar growth rate -- second-quarter revenue was up 19% year over year. This helps the stock price, and the high demand boosts margins, which also helps the stock price.

The question for Dell's investors is: How long can the AI trend keep the company's growth rate up and its margins high? If it can continue for years to come, then the stock likely has strong long-term upside.

I'm personally inclined to think that the AI infrastructure trend still has plenty of life. The hyperscalers -- including the aforementioned Microsoft -- want to win when it comes to AI cloud computing, and they have a lot of money to spend to make it happen.

Some argue that the clock is about to strike midnight for AI infrastructure spending because many businesses are spending money with little return on investment. But even if the return isn't quite there, I believe that these hyperscalers could keep justifying their expenditures with the sunk cost fallacy: They've spent billions of dollars already, and nobody wants to be the first hyperscaler to tap out.

Given all of the incentives to win and the ongoing commitments to spend, I believe that hyperscalers will continue to scale up AI cloud operations, to the benefit of many hardware providers, including Dell Technologies.

Its stock is up nearly 40% in 2025, which is a lot for this tech pioneer. That said, it still trades at only 17 times its forward earnings, which is cheaper than many other stocks benefiting from the AI trend. Considering there seems to be no end in sight for its AI hardware products, this could keep the wind in Dell's sails for some time yet.