Quantum computing is one of the hottest sectors in the stock market. Several stocks in the industry have produced incredible returns in 2025 but are quite volatile, and it's not uncommon to see them rise or fall by double digits each week. Most investors recognize that quantum computing technology has the potential to transform the computing landscape, but don't want to deal with the massive volatility that comes with investing in pure-play companies like IonQ or Rigetti Computing.

One alternative to investing in quantum computing pure plays is to invest in a company like Nvidia (NVDA 0.32%) that is ancillary to quantum computing. Quantum computing isn't going to exist in a vacuum; it will connect to pre-existing accelerated computing solutions that are currently being built for the artificial intelligence arms race. Nvidia recently announced massive quantum computing news that cements itself as an excellent quantum computing investment, and I think it adds to Nvidia's overall bright investment future.

Image source: Nvidia.

Nvidia has turned from bearish to bullish on the quantum computing space

Earlier this year, CEO Jensen Huang stated that useful quantum computing was 15 to 30 years away. However, after various quantum computing companies demonstrated that it was a lot closer than he thought, he flipped his stance. Nvidia is now embracing quantum computing with open arms and has announced a new system that will connect accelerated computing and quantum computing.

During its GTC event in Washington, D.C., Nvidia announced NVQLink, which allows quantum computing units (QPUs) to connect to accelerated computing devices, like Nvidia's graphics processing units (GPUs). This is a key innovation, and will become a must-have item once quantum computing has progressed to the point where it's useful to be plugged into existing infrastructure. Nvidia collaborated with multiple national research labs, as well as pure plays like IonQ and Rigetti Computing, to develop this device. Noting which companies are compatible with NVQLink is a good way to screen the real quantum computing players from the fakers, as companies that aren't compatible may be locked out of integrating into existing systems.

Right now, this device isn't going to contribute a whole lot to Nvidia's financial results. However, it could become a big deal years down the road when quantum computing becomes more widespread. The NVQLink will ensure that Nvidia is still relevant years from now, an important consideration for long-term investors.

Nvidia is still a compelling investment without quantum computing

Even without quantum computing, Nvidia is still one of the best stocks investors can pick right now. It's posting incredible results and has AI hyperscalers spending every dollar available to build out computing infrastructure, mostly with Nvidia's GPUs. At the GTC event, Huang announced that Nvidia has $500 billion in orders for its advanced data center GPUs over the next five quarters.

For reference, Nvidia generated $165 billion over the past 12 months. There's no guarantee that Nvidia will convert all of these orders into sales due to supply constraints, but if it can, it will unleash a new tranche of growth that investors haven't priced into the stock right now.

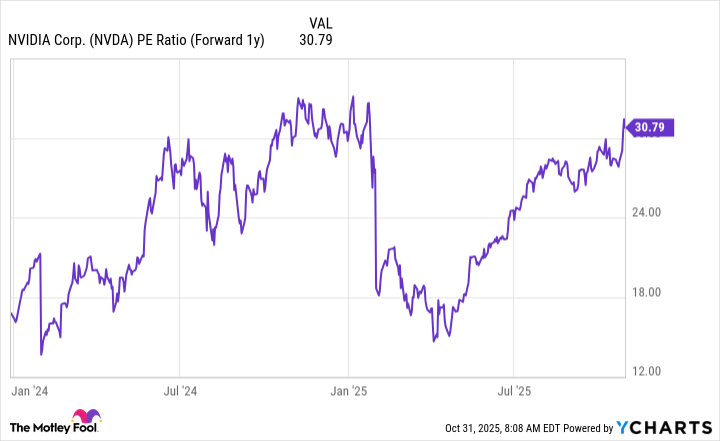

Nvidia's stock isn't as expensive as some investors think, as it trades for 31 times next year's earnings.

NVDA PE Ratio (Forward 1y) data by YCharts

Analysts haven't changed their projections to account for this massive growth that Huang announced, so Nvidia's stock price is actually cheaper than it appears. I think this makes Nvidia a great buy, and it is worth scooping up before it reports Q3 earnings on November 19.

There are still plenty of tailwinds blowing in the AI space, and Nvidia is set to capitalize on them. Until the AI hyperscalers quit spending on AI, Nvidia will remain a must-own stock in my opinion. With massive growth on the horizon, Nvidia looks like a pretty clear no-brainer buy.