Stock splits have made a comeback. Netflix and ServiceNow recently made headlines when both companies announced upcoming stock splits. Netflix is planning a 10-for-1 split, while ServiceNow intends to perform a 5-for-1 split.

The stock split scene had been relatively quiet in the technology space since top artificial intelligence (AI) stocks Nvidia and Broadcom conducted splits last summer.

Could these new blockbuster stock splits ignite more activity in the artificial intelligence (AI) market?

Here are two potential candidates that may be ripe for stock splits.

Image source: Getty Images

First, what stock splits do -- and what they don't do

Investors tend to cheer stock splits. They impact shareholders, but not necessarily in the way you'd expect.

Stock splits are a pretty straightforward concept. Suppose you have a pizza, cut into eight slices. However, you want to feed more people, so you cut each slice in half. Now your pizza consists of 16 smaller slices. That is basically how a 2-for-1 stock split would work. Yes, a stock split lowers the share price on shares you own, but it also proportionately increases the number of outstanding shares you own. To return to the pizza analogy, the pizza didn't get any bigger or smaller, and everyone still got the same amount of pizza; the slices just changed size.

Stock splits don't change a company's fundamentals or its stock's per-share financials. Instead, stock splits mean more shares, but at a lower price, with each share representing a smaller stake in the company.

Then why do stock splits at all? Generally, it's a way for a company's management to make its stock more affordable for individual shareholders to invest in. It also gives existing stakeholders, such as employees with stock-based compensation, greater flexibility in how they cash in their shares.

Additionally, stock splits typically occur when a stock has performed well. A stock split can be a way to acknowledge the company's success to its shareholder base. There are also reverse stock splits, but they aren't as common and usually occur when a stock has performed poorly.

The bottom line? Stock splits can be useful in certain circumstances, but shouldn't be the sole determinant of whether you buy a stock.

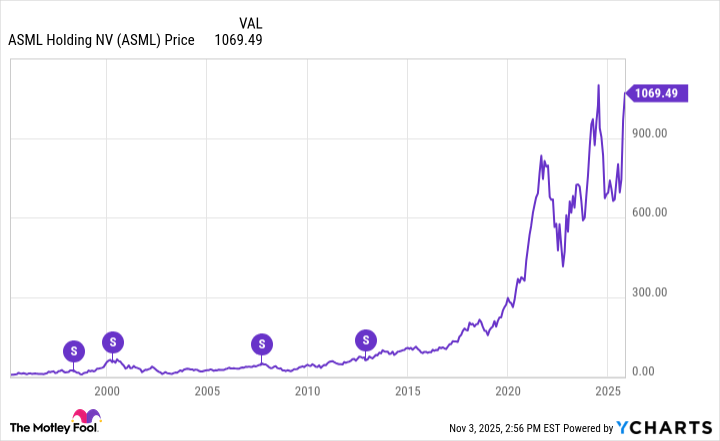

Stock split candidate: ASML Holding

NASDAQ: ASML

Key Data Points

ASML Holding (ASML +4.64%) is a crucial player in the semiconductor industry. It is the only company capable of building machines that use extreme ultraviolet light (EUV) lithography to etch complex designs on silicon wafers. This is critical for manufacturing cutting-edge chips, such as those used in data centers for AI models.

You can see that the company has split its stock before, but it has been over a decade since the last stock split. Today, the stock trades at over $1,000 per share, which is both a round number and a high price that stretches many individual investors' budgets.

Data by YCharts.

Shares have surged back to near all-time highs on a strong quarter that illustrated high demand for its EUV systems. Analysts currently estimate that ASML will grow earnings by an average of almost 21% annually over the next three to five years. The stock's current forward P/E ratio of 36 is reasonable for that growth, so I wouldn't be surprised to see the stock continue to move higher over the next few years. That could crank up the anticipation of a stock split even more.

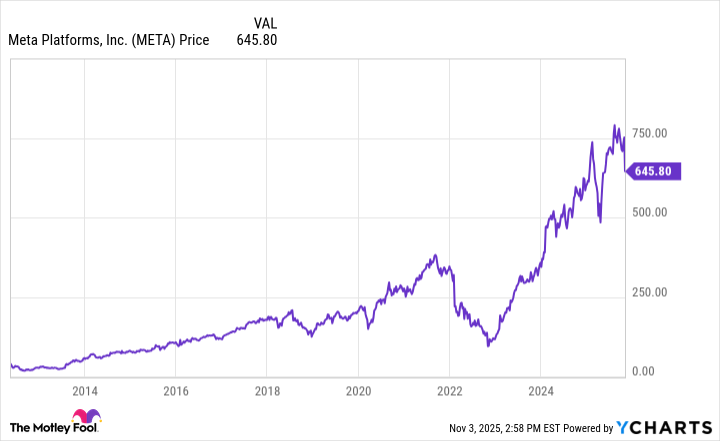

Stock split candidate: Meta Platforms

NASDAQ: META

Key Data Points

Meta Platforms (META 1.24%) has become a prime candidate for a stock split, with its share price surging toward $700. The owner of Facebook, Instagram, WhatsApp, and Threads continues to flex its strength, with a digital advertising business that has churned out over $107 billion in cash flow from operations over the past four quarters.

CEO Mark Zuckerberg has been aggressively investing the proceeds in building out data center infrastructure to position AI as a central part of Meta's business moving forward. The company is automating its digital ads, launching AI-infused personal devices, and developing and open-sourcing its AI model, Llama, to win developer support.

Data by YCharts.

As Meta's stock climbs, a stock split seems increasingly likely. However, it would be the company's first. Meta Platforms went public in 2012 at $38 per share and has never split its stock.

As with ASML, Meta Platforms' valuation is still reasonable enough -- approximately 25 times this year's earnings estimates -- for its anticipated 16% annualized earnings growth to drive the share price higher over the coming years. Therefore, the company's first stock split could be coming sooner than later.