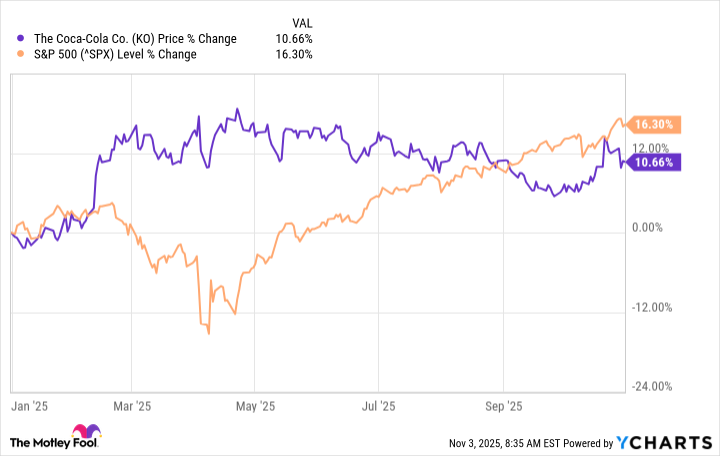

Investors were all fired up about Coca-Cola (KO +0.00%) stock a few months ago when the market was down and growth stocks went tumbling. That's one of the ways the market works. When there's worry, investors run to safe stocks. When they're more confident, safe stocks underperform the market.

Coca-Cola has been underperforming the market for years, outside some of these small blips when its security was prized more than usual. Can investors expect more of the same this year?

More of the same, with some additions

In the spirit of not fixing things that aren't broken, Coca-Cola has a lineup of some of the most popular beverages in the world, and they drive the company's strong sales. It's the Coca-Colas and Sprites that generate the company's gigantic cash flows quarter after quarter, and the company pumps money into advertising to remind drinkers what their favorite drinks are and keep the model flowing.

However, no great company is ever stagnant, and Coca-Cola innovates in a few ways. It's always releasing new flavors for freshness and to discover the next big beverage, and it acquires smaller companies that bring instant revenue growth. These acquisitions are great for Coca-Cola's margins, since the company brings new lines into its global distribution network, and efficiencies make it cheaper for the company to manufacture and distribute them.

Another benefit of this strategy is that it diversifies the company's beverage lines. In the third quarter, a portion of its growth came from some of its premium brands, including Fairlife and Topo Chico. Since these target affluent consumers, they're more resilient than some of the brands that target the mass consumer.

Another way Coca-Cola has managed through higher costs associated with inflation and tariffs is with smaller packaging. It has released many mini beverages, and that's already a $1 billion business.

Over the next year, it isn't likely to change this formula. Expect seasonal flavors, perhaps another large acquisition, and new ways the company will package its favored drinks to save money while offering better pricing options for fans.

Image source: Getty Images.

It's in excellent financial shape

Coke watchers may not realize that the company was struggling for many years before rebounding in a big way a few years ago under new management. It restructured when the pandemic started, and it's been reporting strong performance for several years now, for the most part. Sales growth is robust, profitability is strong, and it's in great shape going into 2026.

In the 2025 third quarter, revenue increased 5% year over year, and organic revenue, which accounts for acquisitions and divestments, was up 6%. Comparable operating margin improved from 30.7% to 31.9%, and comparable earnings per share (EPS) increased 6% to $0.82.

These were excellent results, especially in the tariff-laden operating environment. The market had loved management's update earlier this year that the company is well-shielded from the worst of the tariffs, since production is predominantly local throughout its global empire. That's borne out in the results so far.

Management provided a preliminary 2026 outlook that includes a slight currency tailwind, so at this time next year, the company is likely to be reporting high-single-digit sales growth. It has an advantage against competitors who don't produce locally, which could help it grab greater market share.

NYSE: KO

Key Data Points

Dividends and safety

No discussion of Coca-Cola stock is complete without discussing its dividend. Coca-Cola is a Dividend King, meaning companies that have raised the dividend for 50 years or more. It's raised its dividend annually for the past 63 years. That's as reliable as dividend stocks come, and investors should expect another raise next year.

How the stock performs goes back to what's happening in the markets. Coca-Cola is a safe stock because people always need to drink beverages, and they like their favorite brands. That's not going to change. If the market crashes or corrects, Coca-Cola stock is likely to outperform. Conversely, if the market keeps climbing, Coca-Cola stock is likely to underperform.

This is one reason every investor needs to have some stocks like Coca-Cola in their portfolio. Coca-Cola is an excellent choice because it has a track record over time, and whatever happens in the market, you'll get a great dividend.