Apple (AAPL 0.19%) has been one of Berkshire Hathaway's (BRK.A 0.56%) (BRK.B 0.61%) best investments. The conglomerate first bought shares of the iPhone maker in 2016, increased its stake thereafter, and made it its biggest holding by 2017. Apple's shares have produced incredible returns since, and even though the Buffett-led holding company has trimmed its stake in recent years, it remains Berkshire Hathaway's largest holding.

However, some investors have been concerned about Apple's long-term prospects following recent developments. Can the company still deliver solid returns? Let's look deeper into Apple's business and decide.

Image source: Getty Images.

Looking at Apple's challenges

Apple is one of the largest corporations in the world by market cap, but even well-established businesses face headwinds. The tech giant has encountered several challenges over the past few years. First, the buzz surrounding new iPhone releases has died down significantly since the early days of the device. The iPhone still makes up the lion's share of Apple's sales, so slowing revenue in that department substantially impacts the company.

Second, Apple is once again facing the threat of tariffs from the Donald Trump administration. The U.S. president has pursued an aggressive agenda in that department, sparking trade wars with some countries, especially China, where Apple has significant manufacturing operations. Apple could see margins and profits squeezed as a result. Third, some investors worry that the company's long-term growth opportunities no longer look attractive.

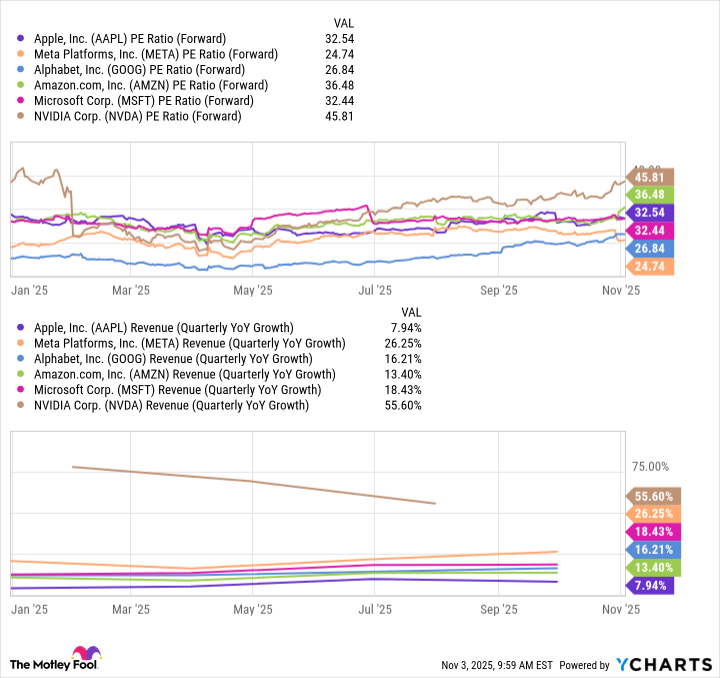

While its similarly sized tech peers are taking full advantage of the ongoing artificial intelligence (AI) revolution, Apple has lagged most of them in that area. And on top of all that, the company's shares aren't particularly cheap by traditional valuation metrics compared to its similarly sized peers, despite lagging all of them in revenue growth.

AAPL PE Ratio (Forward) data by YCharts

These challenges make the stock fairly risky and unattractive, or at least, so the argument goes. Is Apple still a buy?

Don't count this tech giant out yet

It's worth noting that Apple continues to deliver financial results that, although not exceptional, often come in ahead of analyst estimates. In the fourth quarter of its fiscal year 2025, ending Sept. 27, Apple's revenue increased by about 8% year over year to $102.5 billion. The company's earnings per share climbed 13% year over year to $1.85. Apple credited strong demand for some of its latest models, including the iPhone 17, for the results. The company set a September quarterly record for iPhone sales.

In other words, even if the iPhone no longer generates significant buzz on Wall Street, it is still a sales powerhouse. Think of it as a subscription that people upgrade every few years. From that angle, we can reasonably expect that, at least for the foreseeable future, the iPhone will continue to help Apple post solid earnings. One important reason is that the company has an installed base of more than two billion devices. Apple's iPhone installed base did, in fact, hit an all-time high during the period.

NASDAQ: AAPL

Key Data Points

So, the company is growing its ecosystem. And on top of that, Apple benefits from high switching costs. Once consumers are locked into its ecosystem, it's hard to leave, as that requires transferring data and giving up the many ways Apple devices work together to make people's lives much easier.

On top of its subscription-like iPhone business, Apple's long-term prospects look better than the bears imagine, in my view. First, the company has more than a billion paid memberships within its services segment, a unit that carries far higher margins, grows its sales faster than the rest of the business, and should eventually make up a larger portion of total revenue.And as that happens, Apple's overall profits and margins will increase.

Second, Apple is quietly working on an AI strategy behind the scenes. It could boost AI innovation through acquisitions, as it has been looking to do, and eventually make a splash in the field. Third, thanks to its large installed base and incredible brand power, Apple doesn't have to hit it out of the park with every initiative. The company can make a significant dent in its financial results by launching one or two highly successful devices. With almost $100 billion in free cash flow generated over the trailing-12-month period, it has the funds to pour into R&D.

Lastly, Apple is navigating tariffs by negotiating with the administration and increasing its domestic manufacturing footprint. All these moves should provide Apple with ample long-term growth fuel while mitigating threats. That's why, in my view, the stock remains a terrific long-term bet.