Nvidia (NVDA +0.03%) has been one of the best-performing stocks over the past few years. If you purchased its shares five years ago, you'd be up by more than 1,500%. However, investors can't go back in time and capture those impressive returns. Instead, they must focus on the future to make their best estimation about whether the stock is worth buying now or not.

Another 1,500% rise over the next five years isn't in the cards, but could Nvidia at least double and crush the market?

Image source: Getty Images.

Nvidia's growth is tied to the AI megatrend

Nvidia has benefited about as much as any other company has from the ever-growing demand for AI. Its graphics processing units (GPUs) provide a large portion of the computational power being used to train and power those systems. While there are now a number of alternatives to Nvidia's GPUs, no rival chipmaker has yet come close to capturing enough market share to threaten Nvidia's leading position.

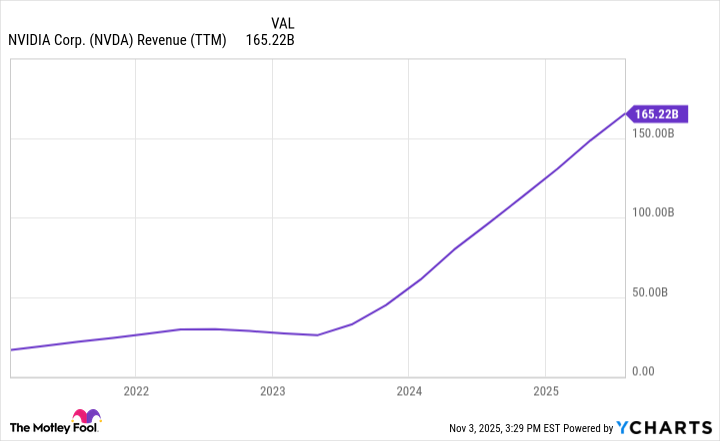

This dominance allows Nvidia to forecast its sales outlook well into the future, as demand for its products easily outpaces supply. During Nvidia's GTC event in Washington D.C., CEO Jensen Huang revealed that Nvidia has $500 billion of orders for cutting-edge data center chips to be filled over the next five quarters. For reference, Nvidia generated $165 billion in revenue over its past four reported quarters.

If all it sold were those chips to data center customers, that would provide it with massive growth in the next year or so alone, but that pales in comparison to where Nvidia could be by 2030. Huang predicts that global data center capital expenditures will reach $3 trillion to $4 trillion by 2030, and Nvidia is positioned to receive a massive chunk of that. Considering that capital expenditures for AI in 2025 are expected to total $600 billion, that would be huge growth. If Nvidia can maintain a market share near its current levels, and if Huang's predictions come to pass, Nvidia stock should be a winning investment from here. The question is, just how much of a winner will it be?

Nvidia will crush the market if its projections pan out

Wall Street analysts expect Nvidia to produce $207 billion in revenue during its fiscal 2026 (which ends in January 2026). If we estimate that Nvidia will capture about a third of all projected AI infrastructure spending over the medium term, in 2030, it could produce annual revenues of $1 trillion -- and that's at the low end of the projected data center spending range.

Nvidia also enjoys stellar profit margins, converting more than 50% of its revenue into net income. If it can keep that margin profile, it would produce profits of at least $500 billion in 2030. If the stock at that point is valued at an earnings multiple of 30, that would give the company a market cap of $15 trillion -- close to triple its current market cap of $5.03 trillion.

Assuming that its outstanding share count remains about the same as it is now, that would price Nvidia at $616 per share, making it a no-brainer buy at today's level. This company has a much better ability to gauge the future of the AI chip market than investors do, and I think it's OK to trust its forecast, though I'd recommend a bit of skepticism. That said, even if its projections don't pan out as optimistically as expected, it could still easily end up being a $10 trillion company. For investors, a position that doubles in size in just five years would be an incredible return that would very likely outperform the S&P 500 (^GSPC +0.13%).

With all this in mind, I'm still bullish on Nvidia. I think the stock should be a core position in every growth investor's portfolio.