On Nov. 4, Super Micro Computer (SMCI +0.87%) reported seemingly disastrous numbers for its fiscal first quarter of 2026. Some of the numbers were already reported two weeks ago. And accordingly, the stock is down about 20% from the October update, as of this writing.

If the first quarter is a precursor, the stock of Supermicro (as the company calls itself for short) could have more downside ahead.

Image source: Super Micro Computer.

Supermicro's first-quarter revenue was down 15% year over year to $5 billion, wildly missing its guidance for $6 billion to $7 billion. CEO Charles Liang says the company has a "commitment to American innovation, job creation, and supply chain resilience." But first-quarter revenue in North America contributed to the decline with a painful 57% drop.

Moving past the top line, Supermicro's first-quarter gross margin was 9.3%, which is roughly what management had expected. But it's a steep drop-off nonetheless. In the same quarter of its fiscal 2025, its gross margin was about 40% higher at 13.1%. In other words, the sales price for its hardware is getting worse compared to what it costs to make the hardware.

NASDAQ: SMCI

Key Data Points

Lastly, on a cash-flow basis, the first-quarter numbers looked particularly bad. As mentioned, revenue was down and gross margin deteriorated. Net income was consequently down 60% year over year and inventory rose by 22%. This resulted in negative cash from operations of $918 million compared to positive operating cash flow of $409 million in the prior-year period -- a $1.3 billion swing.

These financial results aren't what investors want to see from Supermicro. Can anything save the company now?

There is something that can: If Supermicro delivers on its promises for the rest of the year, the first quarter may be just a speed bump receding in the rearview mirror.

Supermicro's lofty promises

According to management, the company had a disaster in the first quarter because the rest of the year is going to be better than what anyone previously imagined. If true, this would almost certainly save the stock.

In the first quarter, Supermicro had record new orders of over $13 billion -- its hardware is popular for data centers build-outs. But these new orders pushed some orders out into the second quarter, hence it missed expectations.

Management now expects to generate second-quarter revenue of $10 billion to $11 billion. For perspective, it had revenue of $5.7 billion in the fiscal second quarter of 2025. Therefore, its guidance for the second quarter implies a stellar growth rate of 75% to 93%.

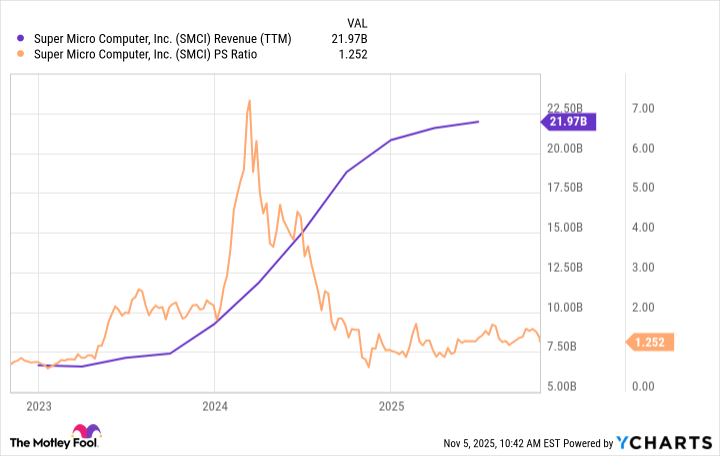

For the year, management expects to generate revenue of "at least" $36 billion, which would represent 64% growth from fiscal 2025 and 140% growth from fiscal 2024. These are stunning growth numbers, particularly for a stock that trades at just 1.2 times its trailing sales.

SMCI Revenue (TTM) data by YCharts; TTM = trailing 12 months.

I believe Super Micro Computer stock could have substantial (and fast) upside if it delivers on its fiscal 2026 guidance. But skeptical investors may have a hard time squaring the 15% drop in first-quarter revenue with the expectation of at least 75% growth in the second quarter. Is there a reasonable explanation for the disparity?

In fact, there is. Supermicro's latest hardware is equipped with the latest products from Nvidia -- specifically Nvidia's Blackwell Ultra chips. Supermicro didn't start shipping these products until Sept. 11. By comparison, its first quarter ended on Sept. 30.

Logically, Supermicro's customers want the latest and greatest from Nvidia. Therefore, it's reasonable that they wanted to wait. Now that the company is shipping these products, it makes sense that growth would take off again.

Its deferred revenue likewise points to an improvement in growth. The company's second-quarter deferred revenue increased by 62% from the previous year. In other words, customers have been charged but products haven't been delivered yet. Again, this indicates an impending jump in growth.

Of course, Supermicro's profit margins have recently declined as it has grown. On one hand, the company understandably must invest to scale up its business. But on the other hand, if margins keep dropping, then the stock might not live up to its potential -- profits are important.

That said, management believes it can improve margins in time. That would provide an extra boost to the stock in addition to what can be achieved with revenue growth.

In closing, Supermicro stock isn't without risk -- management needs to deliver on its promises. But the industry trends are in the company's favor. And I believe the upside will be impressive if things go right.