A few months ago, semiconductor powerhouse Broadcom (AVGO 3.21%) shocked investors when management revealed that the company had secured a $10 billion chip order from a new customer.

Given the pace at which OpenAI CEO Sam Altman is striking deals, it was natural for investors to think the ChatGPT developer was Broadcom's unnamed customer. However, Broadcom's leadership later debunked those rumors.

Equity research analyst Vijay Rakesh of Mizuho thinks the mystery customer is Anthropic, a top rival of OpenAI. I agree with this prediction, and below I'll break down why a tie-up between Anthropic and Broadcom could make strategic sense right now.

Image source: Getty Images.

What hyperscalers does Broadcom work with?

Broadcom has more than two dozen business segments. But when it comes to artificial intelligence (AI), one of the company's largest sources of revenue stems from rising demand for custom application-specific integrated circuits (ASICs).

Some of Broadcom's notable custom silicon customers include hyperscalers like Meta Platforms, Alphabet, and ByteDance, the parent company of social media platform TikTok.

Why Anthropic could be Broadcom's mystery customer

Anthropic burst onto the AI scene shortly after ChatGPT made its commercial debut in November 2022. While Microsoft was first to capture OpenAI's attention, Amazon and Alphabet swiftly followed suit -- pouring significant capital into Anthropic during its early days.

NASDAQ: AVGO

Key Data Points

Throughout the AI revolution, Anthropic has been heavily tied to Amazon Web Services (AWS) -- training its generative AI models on Amazon's custom Trainium and Inferentia chips. This alliance echoes the early dynamics between OpenAI and Microsoft, as ChatGPT relied heavily on Microsoft Azure for compute capacity during its initial scaling.

However, OpenAI has started to distance itself from Microsoft over the last several months. One of the most notable signs of OpenAI's new independence featured a cloud infrastructure deal with Google over the summer.

In my eyes, Anthropic is beginning to employ a similar playbook. After closing a $13 billion funding round back in September, Anthropic struck a partnership of its own with Google Cloud Platform (GCP).

Specifically, Anthropic plans to use up to 1 million of Alphabet's custom tensor processing units (TPUs). In the press release announcing this collaboration, Anthropic noted that the company is focusing on a "diversified approach" to its chip platforms -- leveraging Nvidia GPUs, Google's TPUs, and of course, Amazon's Trainium and Inferentia hardware.

Given that Broadcom is already a supplier for Alphabet's custom silicon needs, and considering Anthropic's recent capital raise and multivendor approach for chip deployment, I think it is quite possible that Anthropic could turn to Broadcom for additional compute resources to drive future product development as new AI workloads become increasingly complex and demand for sophisticated solutions increases.

Is Broadcom stock a buy right now?

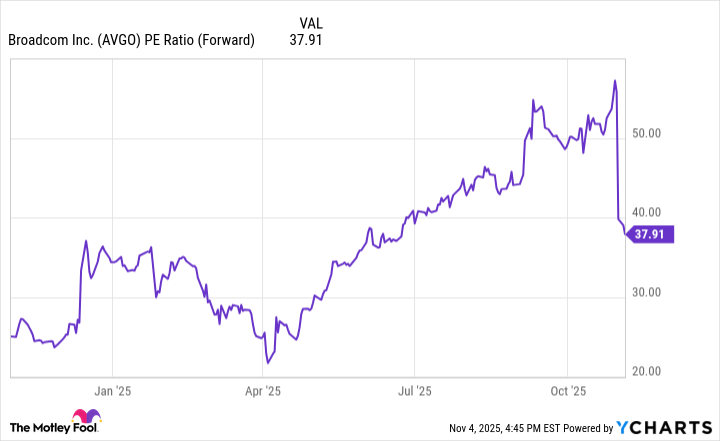

The chart below illustrates movements in Broadcom's forward price-to-earnings (P/E) ratio over the last year. Throughout 2025, Broadcom has been experiencing outsized momentum -- leading to meaningful valuation expansion.

AVGO PE Ratio (Forward) data by YCharts

Nevertheless, the company appears to be experiencing a bit of a contraction -- a rarity in what has otherwise been a scorching hot AI trade. While a forward earnings multiple of 38 isn't dirt cheap, it's the most discounted level investors interested in Broadcom have seen in about six months.

While the prospects of a new $10 billion customer are exciting, I'd encourage investors to zoom out and think about the bigger picture. From a macro standpoint, McKinsey & Company is estimating that investment in AI infrastructure is a $7 trillion opportunity through the rest of the decade.

Powerful secular tailwinds like this bode well for many of Broadcom's businesses -- including its custom silicon solutions as well as its critical networking equipment needed to power AI data centers.

The idea here is that no matter who Broadcom's new customer is, the company appears well positioned to not only continue onboarding hyperscalers but also expand relationships with these AI developers over time.

For this reason, I think Broadcom is a compelling buy-and-hold opportunity as the AI infrastructure era continues to accelerate.