The big draw for most investors when they look at Annaly Capital Management (NLY +1.29%) is going to be the gigantic 12.9% dividend yield. Don't get blinded by the yield, you need to do a deep dive to really understand what this real estate investment trust (REIT) is doing, or you could end up sorry you bought it. Here are the three most important things you need to know about Annaly Capital.

1. Annaly is a complicated REIT

A traditional real estate investment trust buys a physical property and then leases it out. That's easy to understand because it's exactly the same thing you would do if you bought a rental property. Annaly doesn't do that; it buys mortgages that have been pooled together into bond-like securities. That's not good or bad, but mortgage REITs are a different animal from property-owning REITs.

Image source: Getty Images.

For starters, you probably couldn't do what Annaly does. Second, the business is best viewed as something similar to a mutual fund, since the value of the company is basically the value of the mortgage securities it owns. Note, however, that Annaly makes use of leverage, which most mutual funds don't do. That debt is generally backed by the REIT's portfolio of mortgage securities. Leverage can improve performance during the good times, but it can also exacerbate the problems during hard times.

It is perfectly fine to buy Annaly, but you need to do more homework here to ensure you truly understand what you are buying. If you don't, you may end up surprised by this investment in a not-so-desirable way.

2. Annaly's dividend isn't reliable

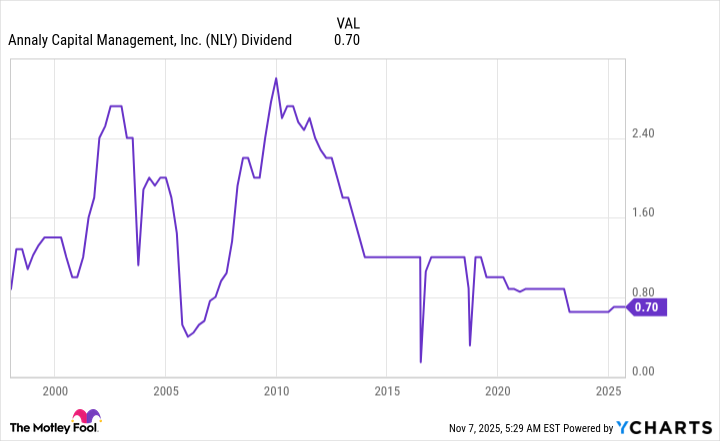

If you buy for the dividend yield and don't understand the mortgage REIT business well enough, the big surprise you are likely to get is from the dividend. Simply put, if you need the income your portfolio generates to pay your living expenses, you probably won't want to buy Annaly. As the chart below highlights, the dividend has been volatile over time.

NLY Dividend data by YCharts

The dividend swings have been pretty dramatic, too. The largest quarterly dividend was a huge $3.00 per share, while the lowest was a tiny $0.14. There have been long periods in which the dividend trended lower, too, which would mean a steadily decreasing income stream for dividend investors. And while the most recent change in the dividend was an increase, the history here is very clear: Annaly's dividend is variable, and you need to be ready for that or you will be disappointed with your investment decision.

3. Annaly does a good job at achieving its goal

This is where things get interesting for Annaly. The company's investor website is fairly clear that management's goal is to provide "stockholders with superior risk-adjusted returns". In fact, when it provides a performance graph, the highlight is total return. It is important for investors to understand that total return, not dividends, is the big goal.

NYSE: NLY

Key Data Points

This matters because total return assumes that dividends are reinvested. If you don't reinvest your dividends, what you'll end up with is very different from what you may expect, looking at the strong total returns the stock has achieved over time. That's because the stock price tends to rise and fall along with the dividend. During a period of falling dividends, the total return might look great, but if you spend the dividends, you'll just end up with less income and less capital.

You need to know what you are buying with Annaly

Annaly Capital is a perfectly fine mREIT. But dividend investors need to fully understand what it means to buy an mREIT before buying Annaly Capital. Annaly is a complicated business; its dividend has been highly variable over time, and the company's goal is really total return, not dividends. All in, most dividend investors will probably be better off avoiding Annaly. But it could be a great fit for investors who are focused on total return and who use an asset allocation approach.