Warren Buffett is one of the most recognized and celebrated personalities in modern finance. During the past 60 years, he has helped build Berkshire Hathaway (BRK.A +0.09%) (BRK.B +0.17%) into a investment conglomerate spanning various industries -- consumer goods, financial services, infrastructure, energy, and much more.

Despite a long-term track record of success, one analyst on Wall Street sees trouble ahead for Berkshire. Last week, Meyer Shields of Keefe, Bruyette & Woods, part of Stifel Financial, downgraded Berkshire stock to underperform (the equivalent of a sell rating).

Let's break down what has Shields so concerned and assess whether now is a good time to trim a position in Berkshire stock.

Why did Meyer Shields downgrade Berkshire Hathaway stock?

During a recent interview with Yahoo! Finance, Shields broke down the rationale behind his Berkshire downgrade in great detail. And honestly? A lot of what he explained makes fundamental sense.

Shields astutely points out that a good deal of Berkshire's portfolio is concentrated around insurance businesses. One of the company's most iconic assets is the insurer GEICO, a wholly owned subsidiary. Broadly speaking, one of its specialties, auto insurance, is a relatively commoditized business.

What I mean by that is most consumers don't notice much of a difference in quality among insurers. Rather, they are simply looking to get the best deal -- paying the lowest premium. In an effort to stay competitive, GEICO has been slowing down the pace at which it raises rates across its customer base. Shields contends that a move like this could put downward pressure on Berkshire's profitability margins.

NYSE: BRK.B

Key Data Points

In addition, many economists think the Federal Reserve will continue loosening its monetary policy during the coming months. Considering Berkshire's balance sheet currently holds $382 billion in cash and short-term U.S. Treasury bills, lower interest rates will tighten yields on these investments.

The other headwinds that Shields called out relate to the Trump administration's policies.

For example, some of the companies under Berkshire's energy division benefit from green energy tax credits. However, President Donald Trump's Big, Beautiful Bill phases out many of these incentives, which could damp the profitability of Berkshire's energy subsidiaries.

Lastly, Shields also notes that railroad activity is below historical volumes, suggesting the trade tensions with China are weighing on freight volumes. Berkshire is vulnerable to these dynamics given its heavy exposure to rail and infrastructure.

Berkshire Hathaway CEO Warren Buffett at a financial conference. Image source: The Motley Fool.

Valid concerns do not always mean that it's time to sell

On the surface, I agree with much of what Shields outlined in his report. But I see many of his concerns as relatively short-term issues.

Bear in mind that Buffett has been at the helm of Berkshire for 60 years. Between 1965 and 2024, its stock returned 5,502,284%. During this same period, the S&P 500 (^GSPC +0.32%) rose by 39,054% with dividends reinvested.

I bring these statistics into the equation for one reason above all else: Buffett has proved to be a master at navigating the stock market across various economic cycles, different interest rate environments, and numerous administrations in Washington. No matter the conditions, Berkshire has been a resilient investment overall. And even though Buffett is stepping down as chief executive officer at year-end, his successor is steeped in Berkshire's investing philosophy, so I don't expect much to change in that respect.

Image source: Getty Images.

Is Berkshire Hathaway stock a buy right now?

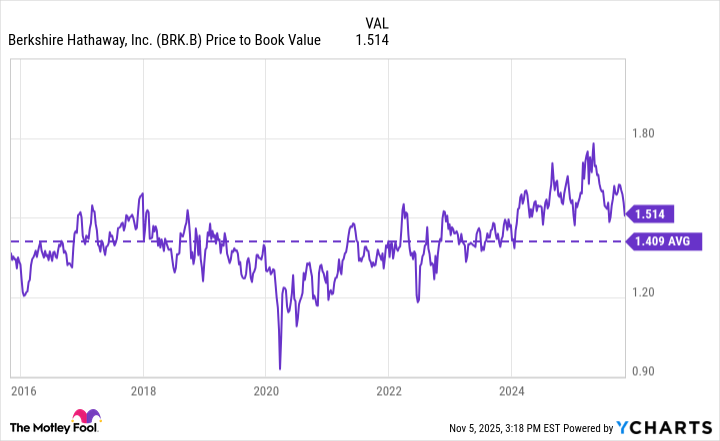

Looking at the price-to-book ratio (P/B) is an appropriate valuation measure to benchmark Berkshire given the company's asset-heavy structure spanning railroads, infrastructure, energy, retail, and of course its equity portfolio.

BRK.B Price to Book Value data by YCharts.

Right now, Berkshire's P/B multiple of 1.5 is only nominally above its 10-year average. In my eyes, this suggests the stock is reasonably valued.

However, looking through a more macro lens provides some nuance to this analysis.

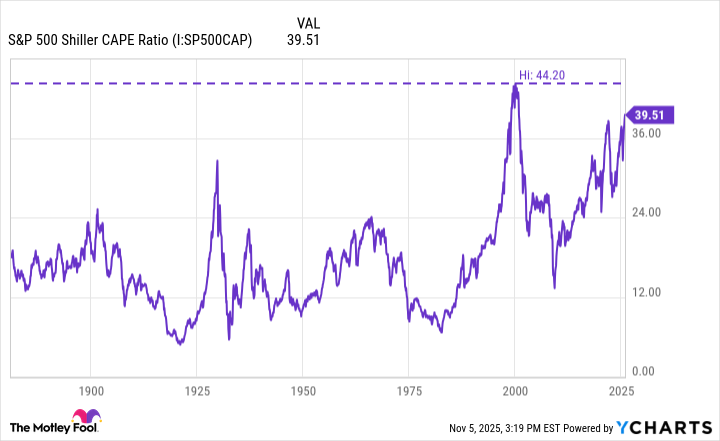

S&P 500 Shiller CAPE Ratio data by YCharts.

Currently, the S&P 500 Shiller CAPE ratio is hovering around 40. As the trends above indicate, this is within shouting distance of peaks seen during the dot-com bubble.

Against this backdrop, valuations across the overall stock market look stretched. Moreover, investors can see from the chart above that higher CAPE readings often precede periods of sharp corrections.

In my eyes, Berkshire's decision to pad its balance sheet with cash and Treasuries appears very much strategic and calculated. While Berkshire stock may not be a deep value play at the moment, its balanced valuation relative to the broader market and its cash-rich liquidity profile make it a rational defensive opportunity in an otherwise frothy market with elevated macroeconomic uncertainty.