Rigetti Computing (RGTI 8.55%) is one of the leading quantum computing pure-play companies to invest in. Pure plays are exciting investment opportunities, as they're slated to soar if their version of quantum computing becomes the industry standard. On the flip side, these companies have an incredible amount of risk baked into them because there is no backup business; it's quantum computing supremacy or bust.

Rigetti Computing is one of the more popular investment opportunities in this field, but where will it be one year from now? Let's take a look.

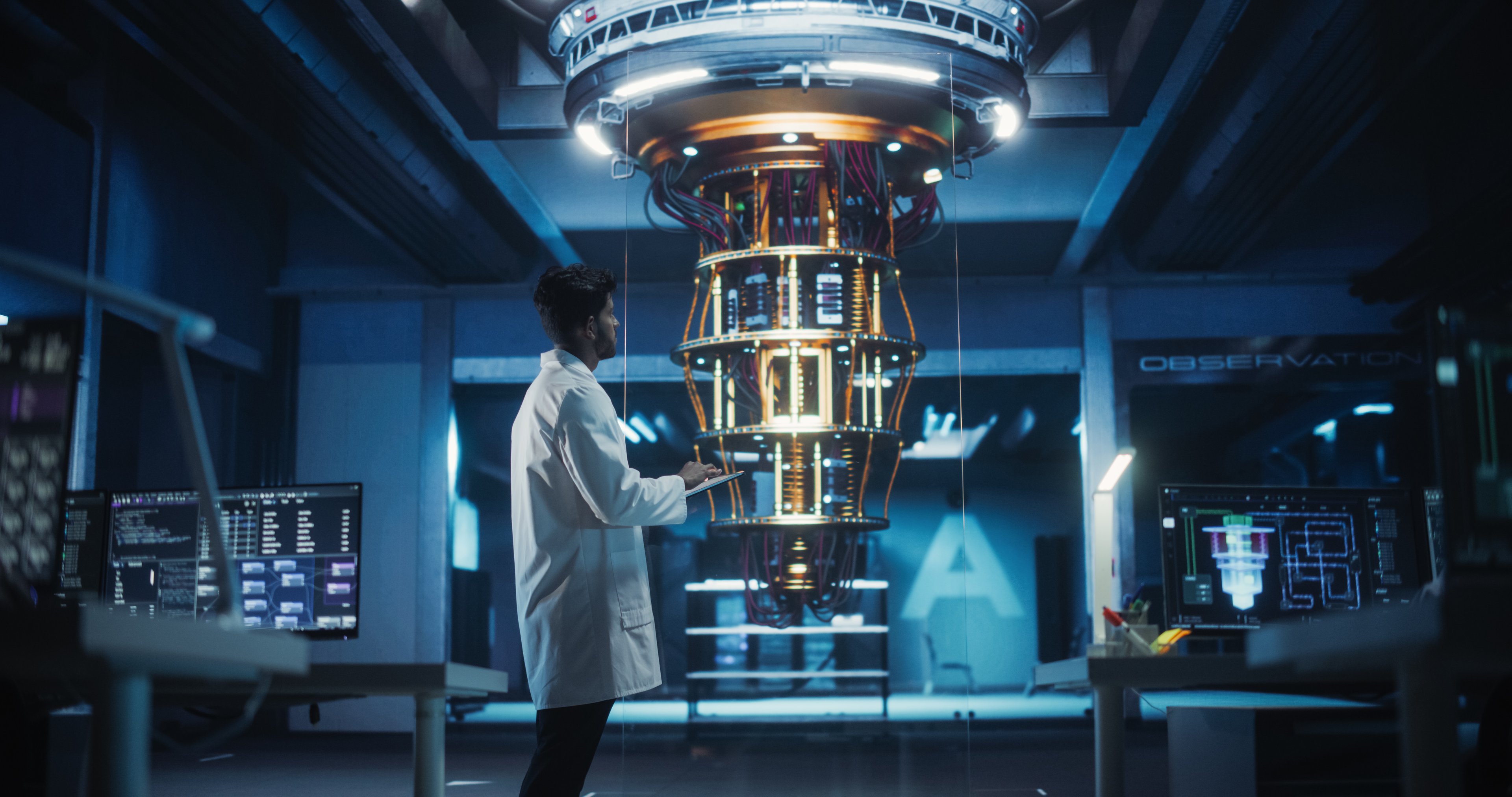

Image source: Getty Images.

Rigetti Computing is already selling some of its quantum computers

Rigetti Computing made some waves a few weeks ago when it announced that it sold two of its Novera quantum computing systems for a total of $5.7 million to two separate companies. While this is a far cry from where investors expect Rigetti's revenue to be years from now, it shows they have a viable quantum computing product available for purchase. This is a big deal because it indicates that Rigetti is a leader among the competition right now. These two unnamed clients likely vetted all available quantum computing options before settling on Rigetti's product, which lends credence to Rigetti's leadership position.

NASDAQ: RGTI

Key Data Points

Additionally, Nvidia also announced some exciting news regarding quantum computing. During its GTC event in Washington, D.C., Nvidia unveiled the NVQLink, which allows quantum computing units (like what Rigetti makes) to plug into existing computing infrastructure filled with Nvidia graphics processing units (GPUs). Not every quantum computing competitor was listed as compatible with Nvidia's product, and being one of the companies that is compatible with this product is a huge deal for Rigetti.

With Nvidia launching a product that allows quantum computing companies to connect to existing infrastructure networks readily, it informs investors that quantum computing could be here before we know it, making Rigetti an excellent stock to buy. However, there's a lot that can occur between now and true quantum computing integration.

Useful quantum computing is still a few years out

While investors may be concerned with where Rigetti Computing will be next year, I think that's the wrong way of assessing the stock. Furthermore, Rigetti Computing also urges investors to take a long-term outlook, invalidating where the stock may go in a one-year time frame.

Rigetti Computing believes that the annual demand for quantum computing hardware will be about $1 billion to $2 billion before 2030. That's slated to grow to $15 billion to $30 billion between 2030 and 2040, so if you have a one-year mindset when investing in Rigetti Computing, you're going to be disappointed.

Over the next few years, Rigetti Computing's stock will rise and fall based on how much risk tolerance the market is willing to accept. Furthermore, it will dramatically react to any news announcements surrounding the quantum computing industry. This will make Rigetti's stock highly volatile, so investors must check themselves before investing in a quantum computing business like Rigetti to ensure they have the appetite for the massive volatility.

Additionally, there's no guarantee that Rigetti Computing will produce a viable quantum computing option for industry. Several well-funded competitors could easily outspend Rigetti and its pure-play peers, which could cause it to lose in the race. On the flip side, if Rigetti's solution is the go-to option, its stock could soar. This makes Rigetti Computing a high-risk, high-reward stock. As a result, investors need to limit their overall exposure in their portfolio, say no more than 1% total allocation. That way, if it fails, it doesn't hurt overall returns too much. But if it succeeds, it will have a meaningful impact.

Where Rigetti Computing is a year from now is irrelevant, and will likely be directly correlated to the market's appetite for risk. What matters is where Rigetti is five to 10 years from now, as that will determine how successful an investment it ends up being.