It's been a tough year for DexCom (DXCM +0.22%), whose stock price is down 25% since the start of 2025. It's a surprising performance, given that the overall stock market has been doing well; you might not expect to a see a promising growth stock like DexCom do so poorly amid fairly bullish conditions.

The company recently reported earnings, which led to a further decline in its share price. Now, the stock is trading at around five-year lows. Could this be a good buying opportunity for investors, or could there be more of a decline coming for the stock?

Image source: Getty Images.

Why have investors been so bearish on DexCom?

DexCom makes continuous glucose monitoring (CGM) devices, which are crucial for people with diabetes who have high glucose levels. There are also CGMs now available for people who don't have health conditions, but who nonetheless want to track their glucose to ensure it's at healthy levels.

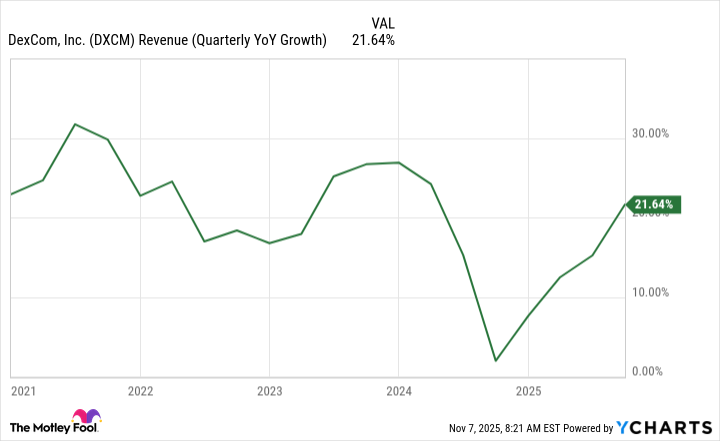

The healthcare company reported its third-quarter earnings on Oct. 30, and the results looked good; revenue came in at $1.2 billion, a year-over-year increase of 22%. But while its growth rate looks strong, DexCom is also coming off some slow growth last year and thus is going up against light comparables. That's why the result may not have been strong enough to convince investors it's a good buy, especially given future growth concerns.

DXCM Revenue (Quarterly YoY Growth) data by YCharts.

Prospective shareholders are likely concerned with the emergence of GLP-1 weight loss drugs, which have helped people with diabetes reduce their glucose levels, and thus may impact future demand for CGMs.

The growing prominence of GLP-1 weight loss drugs in recent years has made investors generally bearish on DexCom. While there's hope that the drugs may lead to healthier outcomes for the general population and bring down obesity rates, that also means that need for DexCom's devices may diminish. Arguably, CGMs can still play a vital role in helping manage a healthy lifestyle, but the market doesn't appear to be sold on that yet.

DexCom's stock hasn't been this cheap since 2020

The last time you could have bought DexCom's stock at these levels was during the brief COVID-19 crash of 2020. Its shares would go on to surge in the following couple of years, before falling due to worsening economic conditions (including inflation) and the rise of GLP-1 drugs. As a result of that decline, the stock is now trading at a forward price-to-earnings (P/E) multiple of 26, which is lower than it has averaged in the past.

While there may be some hesitancy to buy the stock based on what may lie ahead for the business in terms of growth, analysts still believe that it's a cheap buy given its potential. DexCom's stock trades at a price-to-earnings-to-growth (PEG) multiple of around 0.85. This valuation metric considers longer-term expected growth for a business (often over a five-year period); when the multiple is 1.0 or less, that indicates a good buy in relation to future growth.

Analysts could, of course, be wrong about their projections for DexCom. But the low multiple does seem to suggest that the stock offers a good margin of safety at current levels.

NASDAQ: DXCM

Key Data Points

Why DexCom continues to look like a great long-term buy

The past few years haven't been great for DexCom. But I don't believe that GLP-1 drugs are the magic solution to the obesity epidemic, or that diabetes will stop being a problem. Many people can't stay on GLP-1 drugs long-term due to cost and side effects. And when they stop taking them, they often regain much or even all of the weight they lost.

I believe investors have been too bullish on the GLP-1 trend and too bearish on DexCom. If I'm correct, that unlocks a great opportunity to buy low, as is the case with DexCom's stock today. For long-term investors, this can be a no-brainer buy right now.