Stock splits are exciting events that can drum up a ton of investor excitement. While they are mostly cosmetic in nature, they can have huge implications for options strategies, employee compensation, and index fund inclusion. Currently, Nvidia (NVDA 0.29%) has a stock price of about $200.

Is that pricey enough for Nvidia to announce a stock split? Or will investors have to wait before another one of these exciting events is announced?

Image source: Nvidia.

An Nvidia stock split announcement is unlikely

Over Nvidia's history, it has undergone six total stock splits. The most recent ones occurred in 2021 and 2024, and each was announced following the first-quarter earnings report. The 2024 split was a 10-for-1 split, and Nvidia's share price was a split-adjusted $1,220 at that level. In 2021, Nvidia's stock split at $744.

NASDAQ: NVDA

Key Data Points

Both of those prices are far above where Nvidia currently is, but that's not the only factor to consider. Nvidia is a member of the Dow Jones Industrial Average (^DJI 0.17%), which is a price-weighted index. This means that the companies must stay at about an equal dollar-per-share level. Otherwise, they could throw the whole index out of whack.

Nvidia's inclusion in this index occurred in November 2024, after its last stock split, so we have no history surrounding what Nvidia's stock split level will be with its inclusion in the Dow Jones index. However, Nvidia is currently the 17th largest component in the 30-stock index, indicating that its share price is lower than that of the average stock in the index.

Nvidia is unlikely to announce a stock split on Nov. 19. However, there are plenty of other reasons to be excited about Nvidia's prospects, and it's worth considering buying now as a result.

Nvidia has a ton of growth in store for the next few years

Nvidia's graphics processing units (GPUs) are the computing backbone behind the artificial intelligence race. AI hyperscalers are spending hundreds of billions of dollars on data center buildouts this year, and that number is expected to rise meaningfully again in 2026. Nvidia is one of the largest beneficiaries of this AI race, and is slated to cash in on a massive amount of this spending.

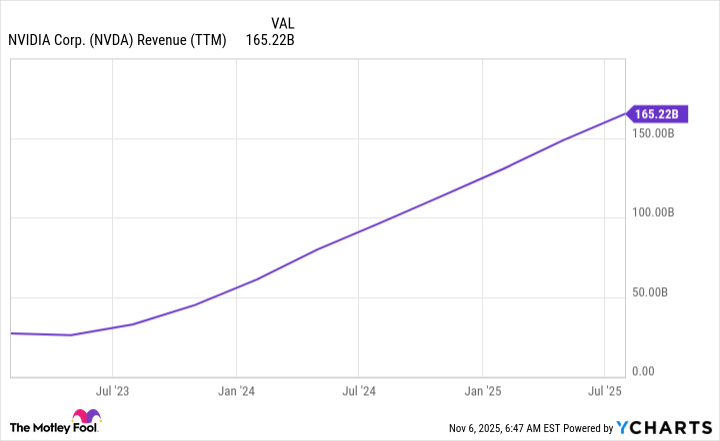

One recent revelation CEO Jensen Huang unveiled is the order log for its most cutting-edge computing chips. They have around $300 billion in orders for these chips already on the books for the next five quarters, indicating that Nvidia could deliver incredible growth over the next year. Time will tell if Nvidia can actually convert these sales, as supply may outpace demand for its GPUs. However, it's still noteworthy, especially considering that Nvidia generated $165 billion over the past 12 months.

NVDA Revenue (TTM) data by YCharts.

Nvidia is a key player in the AI race, and its success will be tied to how much the AI hyperscalers are willing to spend. As of now, their pocketbooks are quite deep, and their checkbooks are open, which makes Nvidia an excellent place to invest. We're still years away from building out the AI computing capacity necessary to run an AI-first society, which will benefit Nvidia over the long run.

Furthermore, Nvidia may be allowed to sell some of its products in China again. This would open up a massive computing market that Nvidia hasn't been able to sell in since the start of 2025.

There are a ton of tailwinds blowing in Nvidia's favor, and investors would be wise to invest in the stock now, regardless of whether a stock split is coming. If Nvidia continues enjoying success like it has, another stock split will eventually come, although it could be a few years down the road.