Netflix (NFLX +0.96%) announced some exciting news recently: It's enacting a 10-for-1 forward stock split, effective on Nov. 17. Stock splits can be exciting for investors for multiple reasons, including because they open up access for new investors who don't use brokerages that allow fractional share purchases. Investment strategies involving options are also easier when the share price is smaller.

This is Netflix's first stock split in over a decade (it last split its stock in 2015). Companies often see their stock's price point rise around a split due to factors like those mentioned above. Some investors like to capture those short-term gains by buying shares. However, that's not a great reason to buy the stock. Instead, investors should focus on long-term metrics to guide whether the stock is a buy or not. If that guidance suggests a buy is a good idea, though, buying around the time of a forward split can sometimes be beneficial.

Here are three reasons why Netflix is a great long-term investment that might warrant a buy before the stock splits.

Image source: Getty Images.

1. Netflix's revenue growth is accelerating

In the streaming race, Netflix was one of the first movers. Its early success in streaming disrupted the linear TV world and forced many media businesses to offer their own streaming platform. While many have tried and some have failed, Netflix's offering is one that viewers tend to come back to or never cancel in the first place. This has helped Netflix enjoy relatively consistent growth even as it develops into a fairly mature business.

During the third quarter, revenue rose 17.2% year over year -- its best growth rate since the same quarter in 2023. Management guided for fourth-quarter year-over-year growth of 16.7%, which is also one of the highest rates in the past few years. This shows management's monetization strategy and push to reach a wider audience is working.

2. Netflix's regional performance is impressive across the board

It's just not one market region that Netflix serves showing strength; all of them are doing well. A look at the breakdown of performance by region -- the U.S. and Canada; Europe, the Middle East, and Africa (EMEA); Latin America, and Asia-Pacific -- shows strength across the board. (Note that these rates use currency-neutral figures since each of these regions has widely varying currency fluctuations against the U.S. dollar):

| Region | YOY Growth | Q3 Revenue Total |

|---|---|---|

| U.S. and Canada | 17% | $5.1 Billion |

| EMEA | 18% | $3.7 Billion |

| Latin America | 20% | $1.4 Billion |

| Asia-Pacific | 20% | $1.4 Billion |

Data source: Netflix; YOY = year over year.

The U.S. and Canada have the largest share of revenue, and as long as this segment is doing well, the company should see success. But the other regions combine to make up over half of the rest of the total revenue, so management also needs to have a strong international strategy.

Netflix is doing a great job with its worldwide strategy, and it must continue to do so to deliver long-term success.

3. Netflix's valuation isn't overly expensive

Some stocks are outrageously valued due to the hype around artificial intelligence (AI), but Netflix isn't in the same ballpark. While its stock is far from what most investors would consider cheap, it isn't so bad compared to other big-tech stocks.

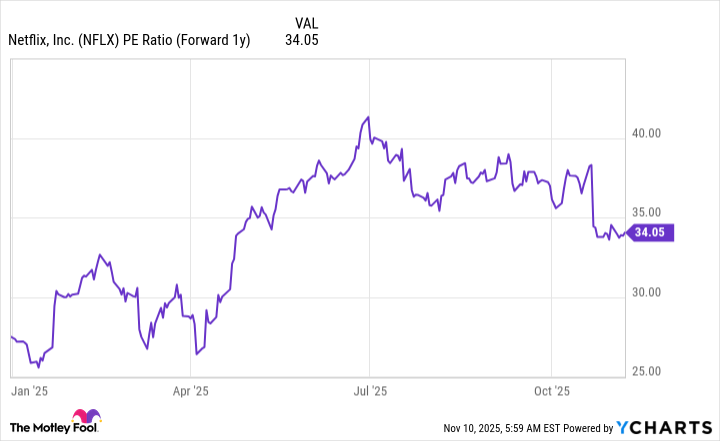

Data by YCharts; PE = price to earnings.

At 34 times next year's earnings, the stock is still cheaper than some Consumer Staples stocks like Costco Wholesale, which has a high valuation of 42 times forward earnings. One could argue that Netflix's product line is almost becoming a consumer staple, and it's a service that subscribers might not cut back on during a recession, since it gives them entertainment for a relatively cheap monthly price.

Why buy before Nov. 17?

As already noted, these are all good reasons to buy Netflix stock as a long-term investment. Although it has been an excellent investment so far, there are still plenty of customers to capture domestically and worldwide. Buying it before its Nov. 17 stock split is just a way to take advantage of the investor enthusiasm that sometimes comes along with splits. But don't have the split action be the prevailing reason you buy this stock. It is likely to gain in value regardless of the split.