Several millionaire-maker tech megatrends have been roaring ahead in recent years, from cryptocurrency to generative artificial intelligence (AI). But over the last few months, quantum computing has arguably been the most explosive in terms of the stock price performances of the central players. For example, if you bought $10,000 worth of D-Wave Quantum (QBTS +0.38%) stock 12 months ago, your position would have grown in value to a potentially life-changing $183,700 today. That's a return of over 1,700% compared to the S&P 500's gain of just 12% over the same period.

That said, we all know that past performance doesn't guarantee future results. Furthermore, buying a stock that has already experienced such an explosive rally increases your risk of being left holding the bag if momentum shifts.

The real question for investors now is, do the fundamentals of D-Wave's business indicate that the stock still has millionaire-maker potential from here, or would this be a good time for current shareholders to take their profits and head for the hills?

NYSE: QBTS

Key Data Points

When will quantum computing actually be viable?

Quantum computing is an emerging technology that has the ability to rapidly solve certain unusual types of calculations that would take today's best supercomputers years -- or centuries -- to handle. If quantum computing can be made reliable and cost-effective at scale, it could transform the global economy in a host of ways -- helping scientists discover new materials and medicines; enabling logistics companies to find the most efficient routes to deliver packages; and helping optimize smart cities, power grids, and financial markets, among other uses. While this technology has felt "just around the corner" for years, there are some signs that progress might be heating up.

In October, technology giant Alphabet debuted Willow, a state-of-the-art quantum computing chip. Willow has particularly impressed the tech world with its error-reduction capabilities. By nature, quantum computers are extremely delicate and millions of times more prone to error than conventional computers. If Willow's approach to solving that problem pans out, it could pave the way for building useful, large-scale quantum computers in the future. Alphabet believes commercially viable quantum computing systems could be available within five years -- a sentiment echoed by its rival IBM, which says it aims to develop a usable quantum machine by 2029.

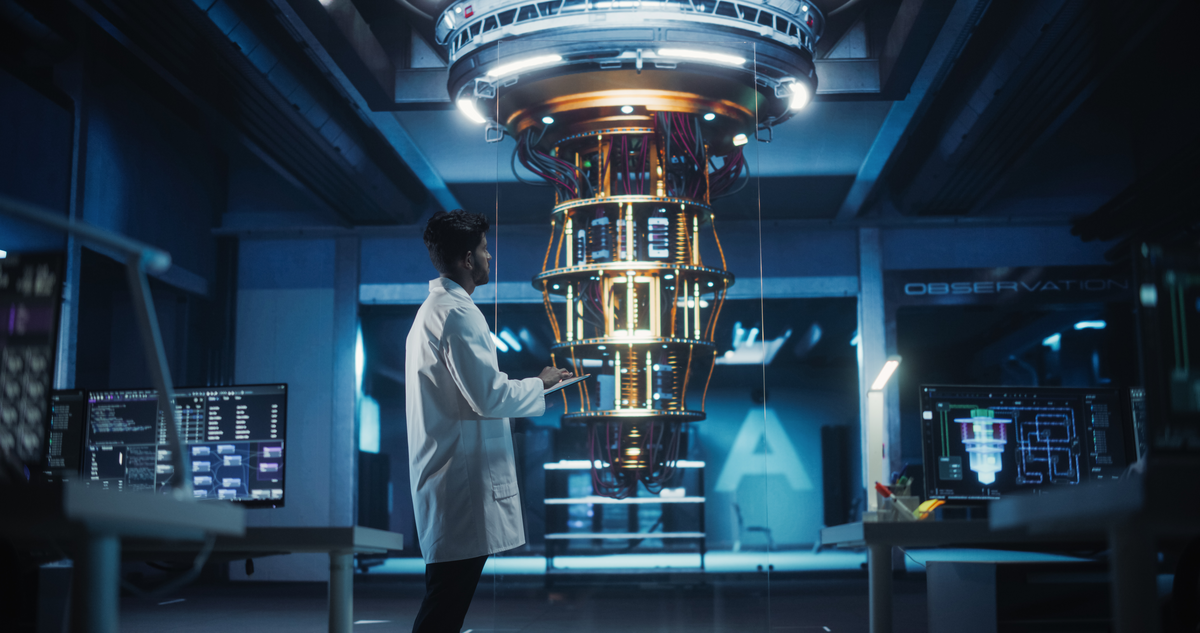

There are several different foundational technologies that can be used to build a quantum computer. Both Google and IBM are pursuing general-purpose gate-based quantum computers. By contrast, D-Wave Quantum is using a niche technology called quantum annealing that is designed to find the lowest-energy solutions to complex calculations -- which are, by extension, the optimal solutions. The company already offers systems like Advantage2 -- a quantum computer the size of a walk-in refrigerator, which the company claims is built to address real-world use cases like materials simulation and AI.

Advantage2's computing power can also be accessed remotely by clients through a cloud service called D-Wave Leap. For most potential customers, this "quantum computing as a service" option will likely be more convenient than installing a machine on-site.

Results are good, but investors should be cautious

In D-Wave's third quarter, revenue jumped by 100% to $3.7 million as the company attracted interest from research institutions and commercial clients like the semiconductor company Skywater, Japan Tobacco's pharma division, and Turkish bank Yapi Kredi. While these aren't the biggest international names, they do suggest D-Wave's products and services are enjoying some level of real-world traction.

Image source: Getty Images.

On the surface, everything looks promising. But there are a few caveats investors should be aware of. D-Wave suggests its annealing quantum computers are ready for real-world, practical use. If this is true, it would put the company roughly half a decade ahead of tech giants like Alphabet and IBM, which seems like a bold assertion. Furthermore, analysts at McKinsey & Company think it might take until 2040 before reliable, commercially viable quantum computers are functioning at scale.

While D-Wave's business grew at an impressive clip in the third quarter, its top line remains tiny. It's also unclear if demand is still being driven by one-off corporate and academic experimentation, or whether the company is beginning to experience sustainable enterprise demand for quantum computing to solve real-world, commercially relevant problems.

Also, D-Wave's operating losses jumped 34% year over year to $27.7 million in Q3, and investors should expect the company to eventually make further use of equity dilution (creating and selling more units of stock) to fund its operations.

A best-case scenario may already be baked into the stock price

It's hard not to get excited about D-Wave from a business perspective, especially knowing that its technology is attracting early private-sector interest. However, with just $3.7 million in third-quarter sales, the company's operations are far from justifying its $10 billion market cap. At this valuation, decades of hoped-for growth are already priced into the stock. Long-term investors should wait for a substantial pullback in the stock price before they consider buying shares.