Quantum computing stocks have been popular over the past year, but among the pure-play quantum companies, one of the most compelling to invest in is IonQ (IONQ +4.21%). It has made tremendous strides in its quest to become the Nvidia of quantum computing. IonQ seeks to produce quantum processors that are as indispensable as Nvidia's artificial intelligence (AI) semiconductor chips.

If IonQ's technological success can match its lofty ambitions, it could be a good long-term investment. Here's a deeper dive into the company to evaluate whether now is the time to invest in IonQ.

Image source: Getty Images.

IonQ's potent technology

In order to become a leader in the nascent field of quantum computing, IonQ pursued several acquisitions, which helped to quickly expand its offerings. As a result, the company claims to be "the world's most complete quantum platform."

One of its most recent acquisitions is Oxford Ionics, which holds the world record for fidelity (a measure of accuracy of quantum operations). A big challenge to the progress of quantum devices is reducing currently high error rates. Purchasing Oxford Ionics is intended to help IonQ improve its error rates.

The company also acquired businesses to build a quantum computing network and to develop quantum capabilities to deploy in outer space. The latter may seem a bit extreme, considering IonQ's fidelity problems, but its space features helped it win a contract with the U.S. Department of Energy to demonstrate quantum-based secure satellite communications.

These kinds of customer wins allowed IonQ to grow revenue in the third quarter by 222% year over year to $39.9 million. The strong sales growth prompted the company to raise its 2025 full-year revenue forecast to a range of $106 million to $110 million.

Even the low end of that range represents a massive increase over 2024's $43.1 million and made the company the first public pure-play quantum business to project triple-digit sales, according to IonQ.

NYSE: IONQ

Key Data Points

IonQ's downsides

While its acquisitions helped IonQ quickly build up its quantum capabilities, this progress came at a cost. The company exited the third quarter with an operating loss of $168.8 million, a substantial increase from the prior year's loss of $53.1 million.

IonQ's revenue growth isn't keeping pace with its large and growing operating losses. So to help fund its acquisition appetite, the company executed a $1 billion equity offering in July, then another for $2 billion in October.

These actions brought IonQ's cash hoard to a robust $3.5 billion on a pro forma basis as of Sept. 30. While the funds from the equity offerings will sustain IonQ's operations for a time, they cause share dilution.

Moreover, the company's downsides contributed to shares dropping from the 52-week high of $84.64 reached on Oct. 13, despite strong Q3 sales growth and a rise in the full-year outlook.

Deciding whether to buy IonQ stock

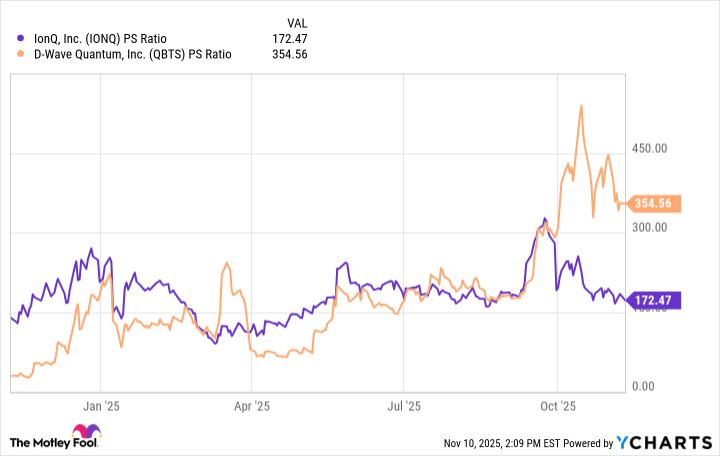

With the stock price drop, perhaps now is a good time to pick up IonQ shares. Consider the stock's price-to-sales (P/S) ratio, which measures how much investors pay for every dollar of revenue generated over the trailing 12 months, and compare it to that of fellow pure-play quantum computing company D-Wave Quantum.

Data by YCharts.

The chart reveals IonQ's P/S ratio is far lower than D-Wave's, which indicates it is a better value than its rival. Still, at a sales multiple over 100, IonQ stock is not cheap. For example, Nvidia is a leader in the hot artificial intelligence sector, yet its P/S ratio is about 30.

That said, given the technological platform IonQ is rapidly building, the promise of potent computational power through its ion-based quantum computers, and the sales growth validating customer interest in its solutions, IonQ may well be worth an elevated share price.

At this point, a good strategy is to wait for the stock price to drop further before deciding to buy. Even then, because IonQ's operating loss is high and rising, and many competitors are vying for quantum computing supremacy, only investors with a high risk tolerance should consider investing.