Oklo (OKLO 3.68%) is a nuclear energy start-up with a reactor design that purports to solve one of the tech's biggest problems: how to meet the exorbitant demand for energy from increased artificial intelligence (AI) usage.

The reactor design is Oklo's Aurora powerhouse. Small, modular, and capable of running on specialized fuel, these reactors can be assembled quickly and in places where grid power would never go. That makes them ideal not only for AI data centers, but also for other remote sites, like military camps and research labs.

A rendering shows Oklo's Aurora powerhouse. Image source: Oklo.

Because the world of tomorrow will need more power than today's power facilities can provide, Oklo seems well-positioned to grow. But that isn't the only reason investors are so bullish in 2025 on this nuclear stock.

Oklo is making progress on regulatory approval

Oklo's reactors could unlock massive energy potential for AI. The only hang-up is that it needs to pass the regulatory process of the Nuclear Regulatory Commission (NRC) to operate its reactors commercially.

NYSE: OKLO

Key Data Points

In 2022, the NRC denied Oklo's first application. Since then, the company has reconnected with the agency and submitted its pre-application readiness review in July 2025. Normally, this process could drag on for several years. Yet a few nuclear-focused initiatives from the Trump administration have put Oklo on a faster track to deployment.

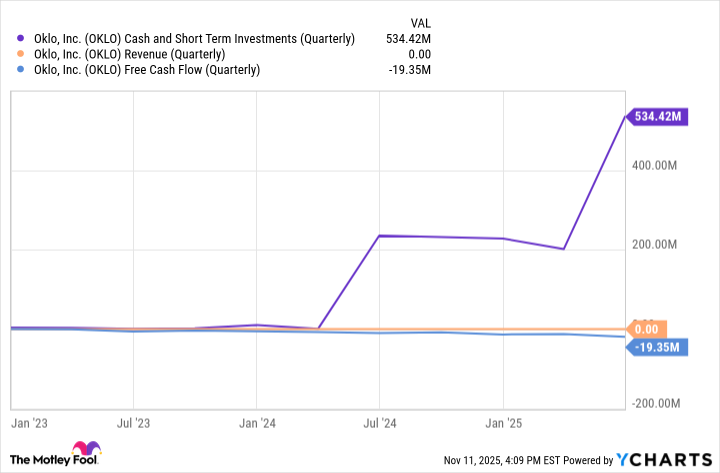

Over the summer, President Donald Trump signed several executive orders aimed at accelerating advanced nuclear technology in the U.S. In September 2025, Oklo began construction on its first Aurora powerhouse at Idaho National Laboratory (INL). Progress is encouraging, but it's not translating into revenue yet. Until Oklo reaches commercialization, its revenue is zero, and it's spending about $20 million a quarter on various projects.

Data by YCharts.

At its current cash burn rate, Oklo has enough to stay afloat for several years before it'll need a fresh cash injection.

Oklo stock has promise, but until the company has the license to operate commercially, it'll remain a highly volatile play on nuclear energy.