The artificial intelligence (AI) market is hot, but a lot of computing power is needed to drive AI's evolution further. Here, quantum computers may be the solution thanks to the potent properties of quantum mechanics.

For example, D-Wave Quantum (QBTS +0.94%), a pure-play quantum computing company, showcased its technology's power by solving a complex calculation in minutes that would take a million years and the world's annual electrical consumption for today's classical supercomputers to solve.

D-Wave isn't the sole contender vying for quantum supremacy. Rival IonQ (IONQ +3.92%) claims it's the world's only quantum platform company.

But between these two businesses, one may prove a better investment to capture AI's market growth over the long term. Here's a deeper look into IonQ and D-Wave.

Image source: Getty Images.

IonQ's AI tech

Artificial intelligence must process mountains of data to effectively execute tasks. In experiments, IonQ's quantum machines demonstrated the ability to accelerate such processing with greater accuracy compared to current classical computers and with substantial energy savings.

Another advantage to IonQ's tech is that it can work in scenarios where data is sparse. In one situation, the company's quantum system was able to expand a limited dataset to train AI on the identification of reliable engine components for a major automotive business. IonQ is also building a quantum-based internet. It's taken steps in this direction by deploying a citywide quantum network in Geneva, Switzerland this year.

A network of quantum computers can deliver the kind of computational scale desirable for AI. However, widespread adoption of the tech still faces significant hurdles. For instance, quantum machines are prone to high rates of calculation errors, requiring continuous error correction. IonQ has made a number of acquisitions to help it overcome these challenges, such as Oxford Ionics, the company that held the world record for the accuracy of its quantum machines.

NYSE: IONQ

Key Data Points

D-Wave's AI approach

IonQ's competitor D-Wave may have an advantage in bringing quantum computers to AI due to its focus on technology called annealing quantum computing. This approach is well-suited for optimization tasks, such as creating AI models, since it can pinpoint the optimal solution among many possible choices.

D-Wave is addressing the current limitations of quantum computers by taking a hybrid approach to AI. It's integrating classical computers with quantum devices, so they can capitalize on each other's strengths while addressing the weaknesses.

According to D-Wave Vice President Irwan Owen, the company is "paving the way for scalable, hybrid quantum-classical solutions that may redefine what's possible in science and business." The company's hybrid technique was applied to a Japanese pharmaceutical company's AI-based drug discovery process, which showed results outperformed AI run on classical computers alone.

D-Wave also released a quantum toolset for building AI software earlier this year. These tools combine D-Wave's quantum computers with a popular software framework for constructing and training AI.

NYSE: QBTS

Key Data Points

Choosing between IonQ and D-Wave stocks

Quantum computers possess the potential to elevate AI, yet the technology is still in its infancy. To date, the AI successes are encouraging, but it's too early to tell whether IonQ or D-Wave's tech will win out over the long run.

Therefore, to decide which is the better AI investment, one factor to weigh is financial performance. In the third quarter, IonQ pulled in sales of $39.9 million, while D-Wave generated just $3.7 million. Although IonQ's revenue is more than 10 times higher than D-Wave's, neither company is profitable. IonQ's Q3 operating loss was $168.8 million. D-Wave's Q3 loss from operations was $27.7 million.

To help sustain its business, IonQ performed a $1 billion equity offering in July, then another for $2 billion in October. D-Wave executed a $400 million equity program over the summer. These funds should keep their operations going in the short term, but given their slim sales, combined with nascent technology that may take years to achieve widespread adoption, investing in either company entails high risk.

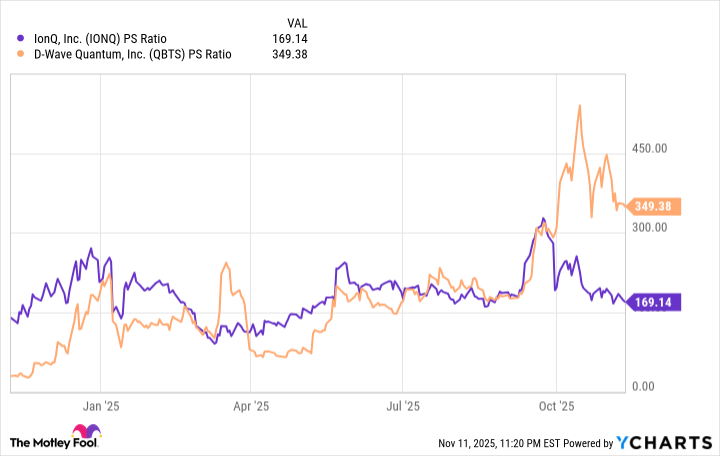

Adding to that risk is stock valuation. This can be seen by comparing IonQ and D-Wave's price-to-sales (P/S) ratio, which measures how much investors are paying for every dollar of revenue generated over the trailing 12 months.

The chart above reveals that IonQ's P/S ratio was higher than D-Wave's at the start of 2025 but is now significantly lower, indicating that its stock is a better value. Even so, with a sales multiple over 100, shares are not cheap.

However, considering IonQ's accomplishments, such as implementing a quantum network in Geneva, coupled with its substantially greater revenue generation and lower share price valuation compared to D-Wave, these factors add up to make IonQ the better overall AI investment between these two quantum companies.