Opendoor Technologies (OPEN +5.87%) stock hit an all-time low of $0.51 in June, but it has since rocketed higher by 1,700% to trade at around $9 as I write this. Unfortunately, the powerful rally has very little fundamental basis. Instead, retail investors have whipped up a frenzy in the stock using social media platforms like Reddit and X (formerly Twitter).

In fact, Opendoor's business continues to face significant challenges, which could pressure its stock price over the long term. Is it too late for investors to buy?

Image source: Getty Images.

Opendoor's business model is simple, but very risky

Most homeowners use a professional agent when it's time to sell, because the process can be stressful and complex. But it can still take weeks or even months to find a buyer, and sometimes even the best agents can't eliminate that uncertainty.

However, Opendoor gives sellers a faster option. They can enter some basic details about their property on the company's website, and they will instantly receive a cash offer, which they can accept or reject. If they choose to proceed, Opendoor can close the deal in as little as two weeks.

Opendoor makes money by selling the property for more than it paid, which is relatively easy when the real estate market is strong because prices are constantly rising. However, the reverse is true when the housing market is weak, leaving the company exposed to steep losses on its inventory.

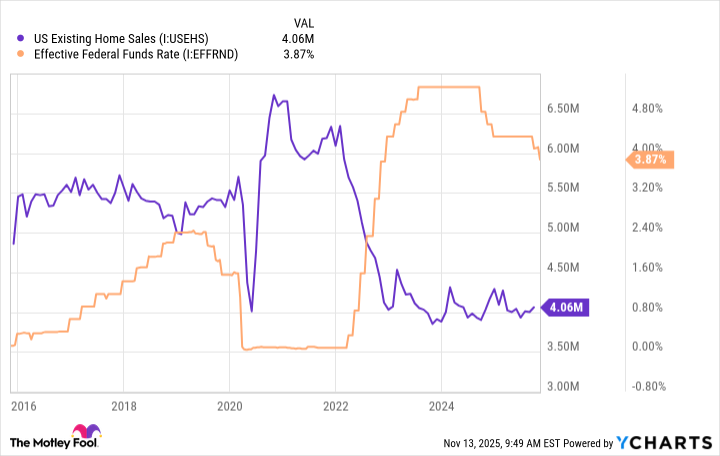

U.S. existing home sales are currently near a five-year low as elevated interest rates and rising economic uncertainty are sidelining would-be buyers. In fact, according to Redfin, there were 506,000 more sellers than buyers in the U.S. housing market back in August, which was a record spread. It's very difficult for Opendoor to get the price it wants for each home in this environment.

US Existing Home Sales data by YCharts

In September, Opendoor appointed Kaz Nejatian as its CEO, who previously held leadership roles at tech companies like PayPal, LinkedIn, and Shopify. He is introducing technologies like artificial intelligence (AI) to accelerate the pace with which Opendoor acquires and flips homes, in the hope that this will make the company less vulnerable to housing market swings.

Nejatian believes boosting volume is the key to achieving profitability. A higher market share will generally give Opendoor more control over prices and also increase demand for the company's other services. Eventually, he also wants to create a marketplace where buyers and sellers can transact with one another directly, which will materially de-risk the company's business model.

Opendoor's losses are piling up

Opendoor sold 2,568 homes during the third quarter of 2025 (ended Sept. 30), generating $915 million in revenue, which was down 33% from the year-ago period. The company had just 3,139 homes in its inventory at the end of the quarter, which was down by half from the year-ago period, reflecting its cautious approach in this challenging real estate market.

But Opendoor's biggest problem is at the bottom line. The company generated a net loss of $204 million on a generally accepted accounting principles (GAAP) basis through the first three quarters of 2025, and even after stripping out one-off and non-cash expenses, its adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) was negative to the tune of $40 million.

Those losses actually improved compared to the year-ago period, but remember, Opendoor's sales and inventory are down sharply. In other words, under its previous leadership, the company was shrinking to reduce risk, which Nejatian believes is the wrong strategy. Only time will tell if his decision to acquire homes more aggressively and adopt AI will bear fruit.

Opendoor had $962 million in cash and cash equivalents on its balance sheet at the end of the third quarter, so Nejatian has a few years to implement his strategy, as long as the company's losses don't materially increase from here.

NASDAQ: OPEN

Key Data Points

Is it too late to buy Opendoor stock?

The U.S. Federal Reserve cut interest rates three times at the end of 2024, and it has cut two more times in 2025 so far, with another expected in December. It takes time for the positive effects of lower interest rates to work their way through the economy, but this will almost certainly be a tailwind for the real estate market.

However, I think Opendoor will struggle to make its direct-buying business model work in the long run, even with Nejatian's planned tweaks. Two of the most dominant players in this space, Zillow and Redfin, both closed their direct-buying businesses after the 2021 housing boom ended, as they couldn't make the numbers work. In fact, Zillow's direct-buying segment was losing so much money that it threatened the financial stability of the entire company.

So far, Opendoor hasn't presented any evidence that can produce a different outcome than Zillow and Redfin, but even if investors believe in the company's new strategy, this probably isn't the right time to buy its stock. In my opinion, the 1,700% rally in the stock over the last few months has priced in a lot of future success, so if Nejatian fails to produce results, investors could face steep losses.

This isn't the first time retail investors have used social media to whip up a frenzy in a particular stock without consideration for its fundamentals. We saw this with GameStop and AMC in 2021, and both of those stocks crashed once the speculative fever wore off. I don't think Opendoor will hold onto its recent gains, so it might be too late for investors to board this train.