Artificial intelligence (AI) stocks have fueled the S&P 500's gains over the past two years, and this movement has continued into 2025, with the index heading for yet another double-digit increase. But, in recent weeks, investors have started to hesitate before buying AI stocks -- and have even shied away from them after excellent earnings reports. For example, Palantir Technologies announced surging revenue and demand, yet the stock tumbled after the report.

And other big tech names, from Oracle to Nvidia, have seen their shares flounder or even drop since the start of the month. The problem? Some investors, seeing companies aggressively invest in ramping up cloud infrastructure, worry they're spending too heavily -- and won't benefit as much as expected down the road. On top of this, investors also have been looking at soaring valuations with a critical eye -- and wondering if an AI bubble may be developing.

Still, earnings reports have painted a much brighter picture, with the world's biggest tech companies and AI leaders reporting solid revenue growth as well as high demand. So, should you buy the dip in AI stocks? Top tech analyst Dan Ives thinks so. Let's find out more.

Image source: Getty Images.

Bullish on tech

You may have seen or heard Dan Ives, global head of tech research at Wedbush, at some point in recent quarters, as he regularly shares his views on X as well as in interviews with the media. He's bullish on tech and isn't easily shaken during moments of market turmoil -- for example, this spring, even as he warned about the impact of potential import tariffs on the industry, Ives remained positive on the long-term tech story.

And now, as a fresh batch of concerns -- the ones I mentioned above -- surface, Ives maintains his confidence in the AI revolution. In an interview with CNBC on Friday, he called the market dip a "golden buying opportunity" for many tech players as he sees the tech bull market continuing for another two years.

"To be bearish or nervous here, I just view it as short-sighted," he said during the interview. Ives predicts that every dollar a tech giant adds to capital spending as part of the AI buildout could result in $8 to $10 made in the coming years. And for that reason, he's encouraged by the current spending trends. Ives also predicts a "massive tech rally into year-end."

Messages from Amazon and Alphabet

Now, the question is: Should you follow Ives' lead and favor AI stocks right now? I agree with Ives and think there's a lot more growth ahead for quality tech players. As I mentioned above, companies in the AI field have delivered encouraging messages in their recent earnings reports. Amazon (AMZN +2.12%) and Alphabet (GOOG 0.68%) (GOOGL 0.79%), for example, each have spoken of high demand from cloud customers for their AI products and services.

NASDAQ: GOOGL

Key Data Points

So, I think it's a great idea to buy AI stocks on the dip, but the way you go about it should depend on your investment strategy. After all, current concerns in the market could persist or even resurface months down the road -- this might weigh on AI stocks at certain points in time.

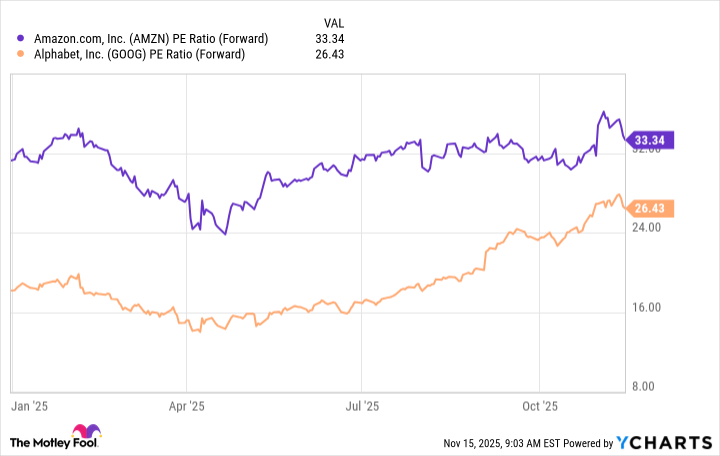

What this means is if you're a cautious investor, you should stick with well-established players that don't depend entirely on AI for growth -- for example, companies such as Amazon, which has a leading e-commerce business, or Alphabet, which makes most of its revenue thanks to advertising across its Google platform. Another plus: These players don't trade at extremely high valuations right now.

AMZN PE Ratio (Forward) data by YCharts

If you're an aggressive investor, you might scoop up shares of a younger company that's more reliant on AI, for example, CoreWeave. The company rents out AI chips to customers and focuses specifically on AI workloads. This sort of player represents more risk, but it could deliver enormous gains over time if the AI story unfolds as expected.

In either case, though, two crucial points to keep in mind when investing are to be sure that you maintain a well-diversified portfolio -- it's always risky to invest in only one industry or just a few stocks -- and you hold on for the long term. By investing in a variety of quality companies over time, you'll boost your chances of scoring an investing win.