MP Materials (MP +0.16%) has had a wild year. After two huge strategic partnerships were unveiled in July -- one with the Department of Defense, the other with Apple -- the stock was set on a steep, steep path that saw it climb to its highest share price, reached in mid-October.

NYSE: MP

Key Data Points

Since then, the mining stock has pulled back about 27% yet still has a 256% gain on the year. That boost in valuation has made it pretty expensive for most investors, with shares trading over 40 times sales.

For investors who have waited this one out, it might seem like the ship has already left the port. But there's plenty of reason to expect more growth from MP, and the U.S. government is at the center of it.

A policy shield most mining companies never get

MP Materials is a mining company at the heart of the U.S. push to secure a domestic supply chain of rare-earth metals.

The company operates the Mountain Pass mine in California, which is one of the few rare-earth mining and processing centers in the U.S.

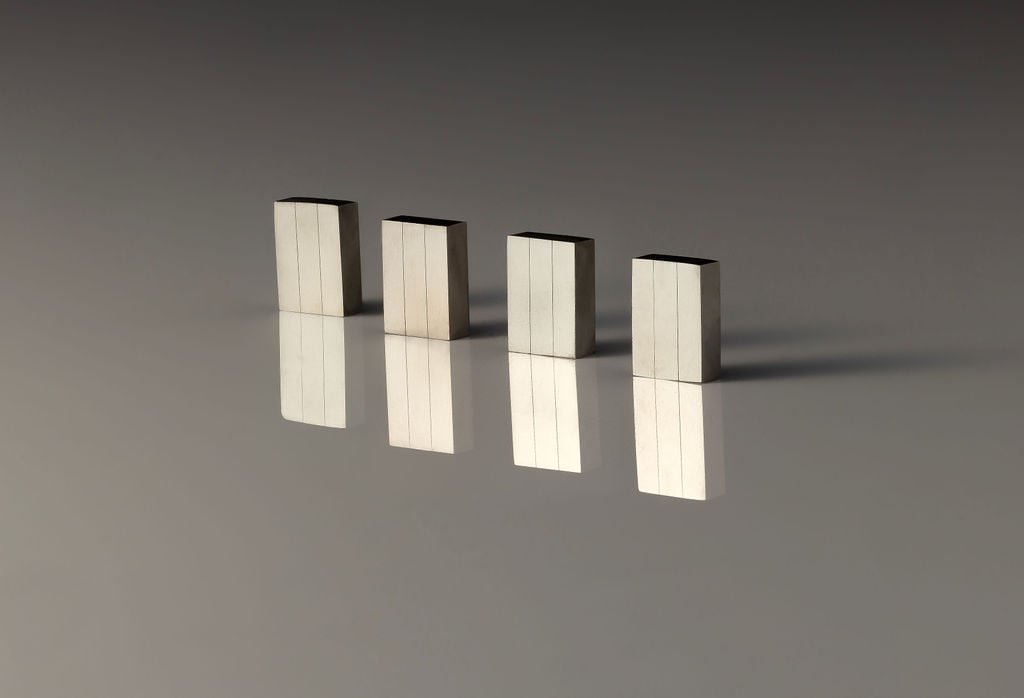

An overhead view of the Mountain Pass processing operation. Photo Source: MP Materials.

The company focuses on making the kinds of super-strong magnets found in electric vehicle (EV) motors, wind turbines, smartphones, and robots, among other uses.

China has dominated rare-earth magnet manufacturing, which is one reason the White House became MP's largest shareholder.

In July, the Department of Defense agreed to a 10-year price floor of $110 per kilogram of one such magnet material, neodymium-praseodymium (NrPr). That offers MP predictability while it continues to expand, something few mining companies have.

The U.S. trade tension with China has also helped MP's investment thesis. An analyst at J.P. Morgan recently set a December price target about 29% higher than today's price largely because of its underappreciated national security importance.

MP Materials still faces execution risk. It needs to build its 10X Facility to ramp up magnet production. Until then, this company will likely remain unprofitable, and its stock will be volatile.