We're nearing the end of 2025, and it looks set to be another winning year for the stock market, continuing the artificial-intelligence-driven bull market that began with the launch of ChatGPT.

However, more recently, stocks are showing signs of weakness as murmurs about an AI bubble are growing louder.

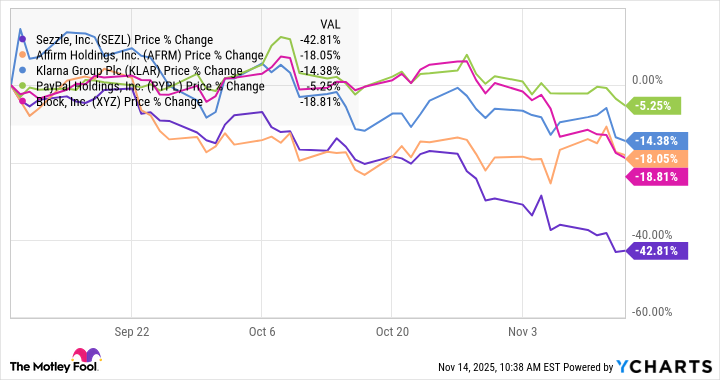

One of the most vulnerable sectors has been fintech, as a number of fintech stocks have fallen sharply in recent weeks on concerns about a weakening credit environment, declining consumer confidence, and a labor market that has soured.

One stock that has tumbled sharply in recent weeks is Sezzle (SEZL 2.39%), the buy now, pay later (BNPL) specialist that has delivered exceptional growth in recent quarters. As you can see from the chart below, however, Sezzle has fallen 43% since Sept. 9, the day before Klarna's IPO, underperforming other declining fintech peers.

Is the sell-off in Sezzle an opportunity? Here's what you need to know about the hot BNPL stock.

Image source: Getty Images.

Sezzle is still sizzling

Sezzle stock skyrocketed on soaring growth earlier this year, but the stock plunged in August on its second-quarter earnings report. While the company beat analyst estimates, management did not raise its full-year guidance, indicating an expected moderation in its growth rate in the second half of the year.

Sezzle stock fell again on Nov. 6 on its third-quarter earnings report as it easily beat analyst estimates and raised its EPS guidance for the year. However, CFO Karen Hartje, who built the company's finance team, said she intended to resign for personal reasons, leaving a significant gap in the company's leadership. Hartje will serve as CFO while the company searches for her replacement.

Despite the market's reaction to Sezzle's results, its numbers have been strong. In the third quarter, gross merchandise volume -- the total spend on the platform -- jumped 58.7% to $1 billion, and revenue jumped 67% to $116.8 million as the company's monthly on-demand users and subscribers, which it calls MODS, rose 36,000 in the quarter to 784,000.

On the bottom line, its performance was also strong, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rising 75% to $39.6 million, and adjusted earnings per share from $0.47 to $0.71.

Sezzle was a late entrant in the BNPL arena and has had to be scrappy to gain market share. Its business model is similar to that of other BNPL operators. It offers a "pay in four" feature and makes most of its money from merchants, who pay a 6% processing fee plus $0.30 on transactions.

The company also presents itself as more user-friendly and less predatory than its peers. For example, it cuts off users if they miss payments, which limits its own credit risk and gives users an incentive to pay their bills.

Its subscription products have been popular and include Sezzle Anywhere, which allows users to use Sezzle virtually anywhere Visa is accepted.

NASDAQ: SEZL

Key Data Points

Could Sezzle 10x?

While Sezzle is under pressure like other fintech stocks, this could be an attractive buying opportunity. Based on its updated adjusted EPS of $3.38 for the year, the stock now trades at a forward P/E of just 16, which is incredibly cheap for a company growing this fast.

That seems to reflect investor skepticism about the growth potential of the business as well as its rising credit risk in the current macro environment. However, while credit risk may be going up, the pressure on the consumer also creates more opportunity for Sezzle, as it's likely to drive more people to use its product. In the third quarter, its provision for credit losses doubled to $32.2 million, a potential warning sign.

However, if Sezzle can get through the current volatile market environment unscathed, the stock could move a lot higher from here, considering its valuation, its growth rate, and the large market opportunity in BNPL. Given its current market cap of $1.8 billion, a 10x gain isn't out of the question if Sezzle can maintain a strong growth rate.