Annaly Capital (NLY +2.42%) is a complicated investment. It appears to be a dividend stock because it has a huge 12.9% dividend yield. For comparison, the yield on the S&P 500 (^GSPC +0.19%) is only 1.2% or so. Yet, if you examine the stock's dividend history, you would definitely not want to own it believing you will collect a reliable income stream. Whether or not Annaly is a millionaire-maker stock really depends on what you do with the dividends it pays. Here's what you need to know.

What does Annaly Capital do?

Annaly Capital is a real estate investment trust (REIT), which is a business structure specifically designed to pass income on to investors in a tax-efficient manner. Essentially, REITs avoid corporate-level taxation by distributing at least 90% of taxable earnings to shareholders as dividends. So most REITs have fairly high yields, with the average for the sector sitting at nearly 3.9%.

Image source: Getty Images.

While 3.9% is an attractive dividend yield, Annaly's yield is nine percentage points higher than that. That's not actually unusual for the mortgage REIT (mREIT) niche in which Annaly operates. Unlike a traditional REIT, which buys physical properties, Annaly buys mortgages that have been pooled together into bond-like securities. It is a fairly complicated business that requires a bit more legwork from investors to ensure they fully understand the business dynamics to which an mREIT exposes them.

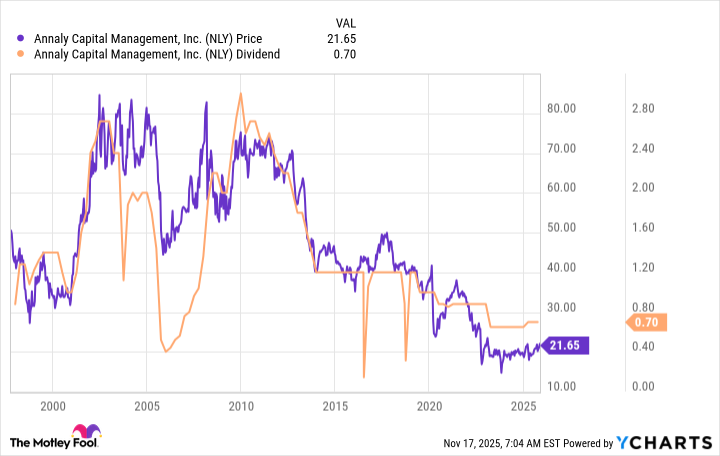

However, there's one simple dynamic that every dividend investor will easily recognize. As the chart below illustrates, Annaly's dividend is highly variable over time and is clearly prone to prolonged periods of decline. The stock price, meanwhile, tends to follow the dividend higher and, more to the point here, lower.

Annaly isn't a great pick for dividend investors

Annaly will be a terrible investment for you if you are trying to live off the income your portfolio generates. If you'd bought this stock in 2010, you would have less income and less capital today if you spent the dividends on living expenses. That's pretty much the exact opposite of what most dividend investors would be hoping to achieve.

However, Annaly Capital isn't primarily trying to generate income as its ultimate goal. It is actually attempting to provide investors with "superior risk-adjusted returns." The huge dividend is merely incidental to the REIT structure and the company's focus on investing in interest-paying mortgage securities.

In fact, in the section of its investor website labeled "Working for Our Shareholders," the dividend doesn't even get a mention. Essentially, Annaly aims to generate a strong total return. Total return requires the reinvestment of dividends over time. Obviously, if you are reinvesting dividends, you can't use them to pay your day-to-day bills.

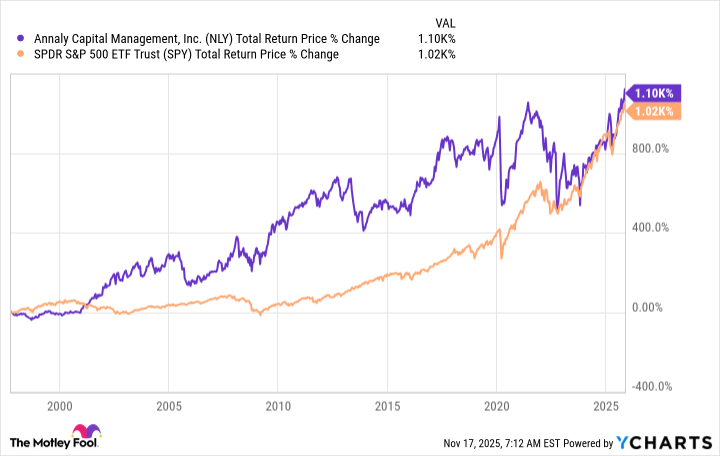

NLY Total Return Price data by YCharts.

What's interesting here is that Annaly's total return is pretty strong. It is slightly lower than the total return of the S&P 500 index over time, but not by much. And the performance profile has been notably different, which means that adding Annaly to a portfolio could be a net benefit from a diversification perspective.

Yes, Annaly can help you build wealth

There are really two takes on Annaly. It will likely be a poor choice if you are a dividend investor seeking to live off the income your portfolio generates. However, it could help you build a million-dollar nest egg if you are focused on total return and use an asset allocation approach. At the end of the day, whether or not Annaly is a millionaire-maker stock really depends on how you use it in your portfolio.