Quantum computing stocks have proven popular over the past year. Quantum Computing Inc. (QUBT +7.31%), which also refers to itself as QCi, is among the pure-play quantum companies to have seen share price appreciation.

Its stock experienced a considerable jump up from the 52-week low of $2.22 reached last November. But is its share price increase due to QCi's business success, or because investors are excited about the quantum computing industry's potential to impact sectors such as artificial intelligence (AI)?

The answer determines whether the company is a good long-term investment, or simply benefiting from a fad. Let's take a deeper look into Quantum Computing Inc. to find out.

Image source: Getty Images.

The technology behind Quantum Computing Inc.

A quantum computing company's success comes down to its technology. Many methods exist to harness the quantum mechanics that power these devices. Quantum Computing Inc. decided to pursue light particles called photons.

QCi selected photons because they hold a number of advantages over other quantum technologies. One is that photons can carry quantum data over long distances at the speed of light. This is useful for networking quantum computers without the need for additional equipment and costs, which other approaches require.

In addition, photonic quantum computers can operate at room temperature. This is in stark contrast to the tech used by larger competitors, such as International Business Machines, which employs a different quantum computing method that requires special cryogenic equipment to operate.

Consequently, QCi's products could eventually be incorporated into laptops and other devices commonly used today, especially since photons allow for the miniaturization of quantum components.

Photons are also good for use in sensor equipment. This feature combined with miniaturization and the ability to operate at room temperature makes QCi's tech usable in self-driving vehicles.

Its quantum computers can process real-time driving conditions at the speed of light, an essential feature given the dynamic nature of driving. The company sold one of its quantum computers to a major automotive manufacturer this year.

NASDAQ: QUBT

Key Data Points

The challenges facing Quantum Computing Inc.

Although its focus on photons holds promise, like all quantum computers, QCi's machines face many challenges to widespread adoption. Controlling photons is difficult, resulting in calculation errors that require costly and time-consuming corrections. Also, the tech is still in its infancy, so it's still prohibitively expensive to implement compared to a conventional computer.

As a result, the company's sales totaled a mere $384,000 in the third quarter. At the same time, its operating costs nearly doubled from the previous year to $10.5 million.

The difference between its massive expenses and meager revenue could have led to QCi's eventual collapse, but it raised funds in October through an equity offering, which resulted in gross proceeds of $750 million. This, combined with cash and investments of $813 million, gives the company over $1.5 billion to maintain operations while it builds up sales.

QCi's Q3 revenue of $384,000 is a significant improvement over last year's $101,000, which suggests its products may be starting to gain traction. Its large cash balance gives it the funds to grow its business and continue to strengthen its technology.

To buy or not to buy Quantum Computing Inc. stock

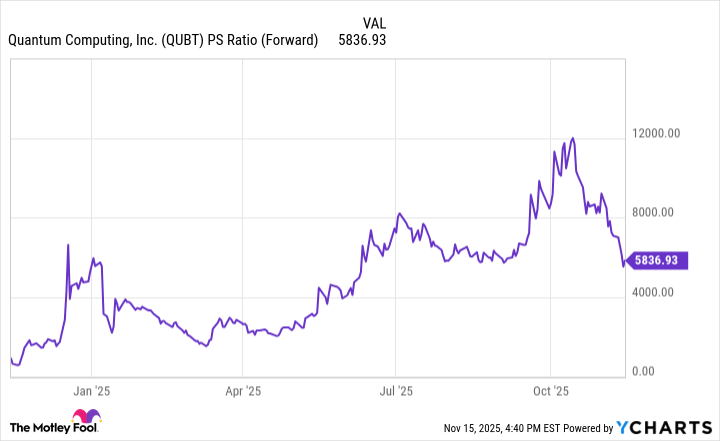

In weighing an investment in QCi, one factor to consider is whether the stock is fairly valued. The company's sales show signs of growth, but the amount remains so small, its current share price valuation is outrageously high based on the stock's forward price-to-sales (P/S) ratio. This metric measures how much investors are paying for every dollar of projected revenue over the next 12 months.

Data by YCharts.

The chart shows QCi's forward sales multiple is down from its peak over the past year, but is still elevated. Consider that IBM has a P/S ratio of 4. This suggests the rise in QCi's share price over the last year is likely due to investor excitement over the quantum computing industry's potential rather than the company's performance.

At this point, QCi's exorbitant stock price, low sales, and rising costs make it a high-risk investment. Buying shares now does not make sense. That said, thanks to the potential of photonic quantum computers, QCi is worth putting on a watch list as you see how its business evolves over the coming quarters.