There are currently 11 public companies that boast market capitalizations of at least $1 trillion. In order from largest to smallest, they are:

- Nvidia: $4.6 trillion

- Apple: $4 trillion

- Microsoft: $3.8 trillion

- Alphabet: $3.3 trillion

- Amazon: $2.5 trillion

- Saudi Aramco: $1.7 trillion

- Broadcom: $1.6 trillion

- Meta Platforms: $1.5 trillion

- Taiwan Semiconductor Manufacturing (TSM +1.52%): $1.5 trillion

- Tesla: $1.3 trillion

- Berkshire Hathaway: $1.1 trillion

You might notice that with the exceptions of conglomerate Berkshire Hathaway and the Saudi oil powerhouse, all of the market's trillion-dollar stocks share a common thread: artificial intelligence (AI).

Prior to the dawn of the AI revolution, Apple, Microsoft, and Alphabet were the only companies that featured trillion-dollar valuations consistently. This is important to point out, as Nvidia -- which is now the world's most valuable company -- witnessed historic levels of market-cap expansion over the last three years thanks entirely to the AI boom.

While Nvidia remains king of the parallel processing chip realm, the technology behemoth has to give a lot of credit to its manufacturing partners -- particularly Taiwan Semi.

TSM Market Cap data by YCharts.

While TSMC's market value has already risen nearly fourfold during the AI revolution, I think its rally could continue as investment in AI infrastructure begins to kick into a new gear.

Let's explore what makes Taiwan Semi such an important variable within the broader AI equation, and assess what supports my view that the stock could double over the next couple of years, lifting the company into the $3 trillion club.

TSMC: The unsung hero of AI development

When new mega-deals get announced in the AI industry, chances are, the headlines of the stories relate to which hyperscaler has decided to procure billions of dollars' worth of Nvidia's graphics processing units (GPUs). Big tech's capital expenditures continue to accelerate, and I think it's reasonable to say that demand for data center chips won't diminish anytime soon. While this is good news for Nvidia investors, it's even better for Taiwan Semiconductor.

The reason is simple: TSMC is already the world's largest third-party chip foundry by revenue -- holding an estimated 68% market share. In essence, chip designers like Nvidia, Advanced Micro Devices, Apple, Broadcom, Qualcomm, and many others outsource much of their manufacturing to Taiwan Semi's best-in-class fabrication facilities.

These dynamics are what make Taiwan Semi such a lucrative opportunity. Given the company's broad customer base, in combination with the tailwinds of rising chip demand, TSMC represents the ultimate pick-and-shovel semiconductor stock in the AI infrastructure era.

Image source: Taiwan Semiconductor Manufacturing.

Fuel for Taiwan Semi's next growth phase

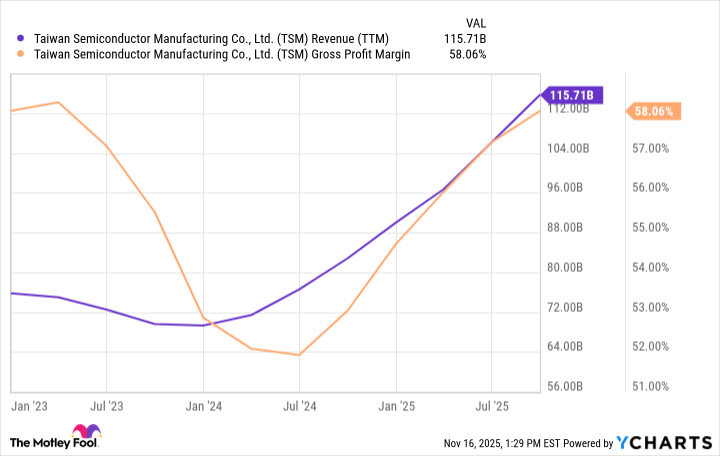

The chart below shows Taiwan Semi's revenue and gross margin trends over the last three years. The combination of accelerating sales and improving margins speaks volumes about the level of pricing power TSMC is able to command for its foundry services.

TSM Revenue (TTM) data by YCharts.

With this type of momentum, smart investors are asking how TSMC can keep its growth train chugging along.

From a macro standpoint, AI infrastructure is expected to be a $7 trillion opportunity over the next five years -- according to a forecast from McKinsey & Company.

In addition, AI workloads continue to become more sophisticated. As applications across robotics and autonomous systems move closer to commercialization, more advanced chipsets will be required. Anecdotally, TSMC is already working closely with Tesla to bring its custom AI5 chip to life.

Furthermore, Nvidia CEO Jensen Huang recently told investors that demand is so high for the company's various data center hardware -- particularly its new Blackwell and Blackwell Ultra chips and its next-generation Vera Rubin architecture -- that an estimated $300 billion in incremental revenue could be recognized over the next year alone.

NYSE: TSM

Key Data Points

With trillions of dollars expected to be poured into additional data center capacity, and with new chip designs coming to market, demand for Taiwan Semi's robust manufacturing expertise appears likely to be sustained for the foreseeable future.

Is Taiwan Semi stock a good buy right now?

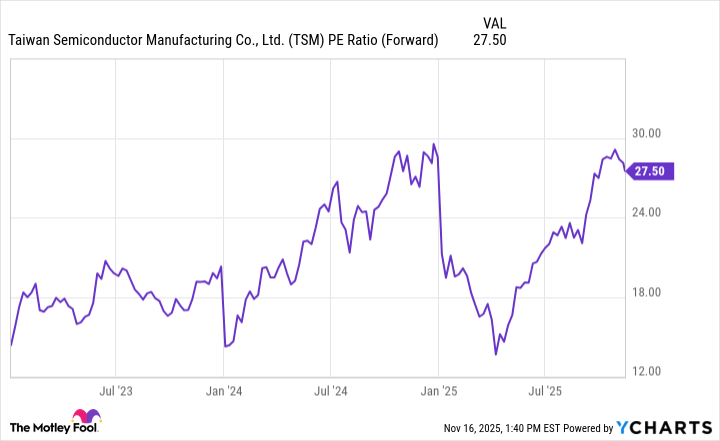

At the moment, Taiwan Semi trades at a forward price-to-earnings (P/E) ratio of 27. While this is close to its peak levels during the AI revolution, I think it deserves that premium.

TSM PE Ratio (Forward) data by YCharts.

Over the last several months, sentiment appears to have shifted more positively toward TSMC. I think the reason is twofold. First, the geographic expansion of its foundry footprint beyond Taiwan is helping mitigate investors' fears related to geopolitical tensions with China.

Moreover, I think growth investors are beginning to better understand TSMC's critical role in the AI narrative and are bullish on the company's prospects as big tech doubles down on AI infrastructure.

While the stock isn't cheap, TSMC's upside potential is compelling. Against this backdrop, I see TSMC stock as a no-brainer pick to buy and hold over the next several years.