Warren Buffett's Berkshire Hathaway rarely invests in technology stocks, which is why the company's latest move is likely to come as a big surprise for market watchers. Berkshire's latest 13-F filing shows that it now holds $4.3 billion worth of shares of Alphabet (GOOG 1.22%) (GOOGL 1.12%). The technology giant has been investing heavily in artificial intelligence (AI), and that makes the Buffett-led conglomerate's move a tad surprising since the Oracle of Omaha has shied away from investing in tech stocks and is not known for chasing trends such as AI.

Now, there is no information on whether Buffett himself made the decision to invest in Alphabet, or if it was one of his portfolio managers. However, he would have likely overseen this investment considering its size, and it could be one of his most notable moves before he steps down as CEO of Berkshire Hathaway at the end of the year.

In fact, it won't be surprising to see this investment in Alphabet act as a vote of confidence for tech giants who have been spending huge amounts of money on shoring up their AI infrastructure. And that seems to be great news for Nvidia (NVDA 2.82%) investors.

Image source: Nvidia.

Berkshire's Alphabet stake suggests that the tech giant is moving in the right direction

Tech giants such as Alphabet have ramped up their spending on AI infrastructure. That's not surprising as these companies report improvements in their businesses when they include AI-powered features. Alphabet CEO Sundar Pichai remarked on the latest earnings conference call that the company is "seeing AI now driving real business results."

NASDAQ: GOOG

Key Data Points

For instance, the company's Gemini application now boasts more than 650 million monthly active users. Additionally, the AI Overviews feature on Google Search is driving a substantial improvement in query growth. That points toward an improvement in user engagement as people using this feature now see that Google is answering more of their questions.

What's worth noting is that the new AI features Alphabet launched are seeing quick adoption. For instance, its AI Mode search feature is now being used by more than 75 million active users daily, and it was launched just last quarter.

Meanwhile, the Google Cloud business is also reaping the benefits of AI adoption. Google Cloud offers a range of chips that include graphics processing units (GPUs) from Nvidia, along with Alphabet's in-house custom processors. Customers are flocking toward the Google Cloud platform to run their AI workloads, which is evident from the 34% year-over-year growth in the number of Google Cloud customers last quarter.

Throw in the bigger deals that Google is landing with its cloud customers, and it is easy to see why the company's Google Cloud backlog jumped by 46% last quarter to $155 billion. That's well above the $15 billion Google Cloud revenue the company generated last quarter. As such, it is easy to see why Alphabet has increased its 2025 capital expenditure (capex) estimate to $92 billion from the earlier expectation of $85 billion. That's going to be a big jump over its 2024 capex of $52 billion.

What's more, it forecasts a "significant increase" in its 2026 capex as well. However, Alphabet isn't the only company that's taking this route. So, Berkshire's investment in Alphabet seems like an endorsement of the large amounts of money that tech giants are pouring into AI, and that looks like a positive for Nvidia investors.

Higher capex points toward better times for Nvidia

The combined capital spending by big tech companies in the U.S. is expected to hit $405 billion, which would be a substantial improvement over the initial forecast of $250 billion. The higher spending that the likes of Meta Platforms, Alphabet, and Microsoft are suggesting for next year indicates that this figure is likely to head higher.

Not surprisingly, Goldman Sachs is forecasting a whopping $1.15 trillion in capital spending by hyperscalers from 2025 to 2027. That's going to be a big jump over the $477 billion these companies spent between 2022 and 2024. There have been concerns about Nvidia's ability to keep growing at elevated levels owing to a potential slowdown in capital spending.

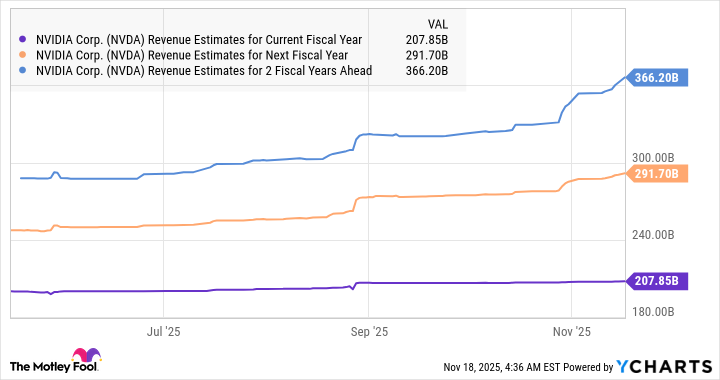

But that's unlikely to be the case. Major tech companies are sitting on huge contractual backlogs that they need to fulfill. As a result, they need to continue buying Nvidia's GPUs, along with other AI infrastructure, to build more data centers and satisfy the massive backlogs they are sitting on. This explains why analysts have become bullish about Nvidia's growth prospects.

Data by YCharts.

It won't be surprising to see Nvidia stock come out of its recent rut and deliver more upside in the long run, especially after Berkshire's probable vote of confidence in AI infrastructure spending.