When it comes to stocks critical to the artificial intelligence (AI) boom, perhaps none have a more direct impact on the industry than Taiwan Semiconductor Manufacturing (TSM 1.64%). The company -- also known as TSMC -- controls 70% of the chip manufacturing market according to TrendForce, and its dominance has continued to rise as the demand for its production capabilities grows.

Not surprisingly, that has helped its stock increase in recent months, and it is likely not too late for investors to capitalize on this opportunity. Three reasons explain why.

Image source: Taiwan Semiconductor.

1. The total addressable market

Grand View Research predicts the AI chip market will expand at a compound annual growth rate (CAGR) of 29% through 2030, reaching an estimated $323 billion size by that year. Looking at the entire semiconductor industry, Statista estimates it will grow to nearly $1.3 trillion by 2030, implying significant growth potential even from the current $789 billion size of the chip market.

That situation strongly positions TSMC, as it claims an aforementioned 70% market share and the most prominent chip companies as customers. Apple has long served as TSMC's No. 1 client, which is not surprising given the popularity of its iPhone, Mac computers, and other products.

However, Nvidia's dominance has also made it one of TSMC's more critical clients. Also important is Qualcomm, which depends on TSMC to manufacture smartphone chipsets and other products. Advanced Micro Devices, Broadcom, MediaTek, and other top chip companies also contract with TSMC.

2. Rapid growth

Moreover, given the aforementioned growth in the industry, investors should probably expect TSMC to continue benefiting from the increased interest in the chips designed by these companies. Judging by its financials, it has profited tremendously.

In the first nine months of 2025, TSMC earned almost $89 billion in revenue, a 36% increase from the same period in 2024. This is likely a measure of the rapid growth reported by clients such as Nvidia, AMD, and Broadcom. Also, the 24% rise in the cost of revenue over the same period may indicate that the costs of keeping up with demand are manageable.

Still, TSMC suffered over $4 billion in other comprehensive losses. Thus, even though the company reported almost $35 billion in comprehensive income for the first three quarters of 2025, the 30% profit increase lagged the revenue growth rate.

3. Valuation

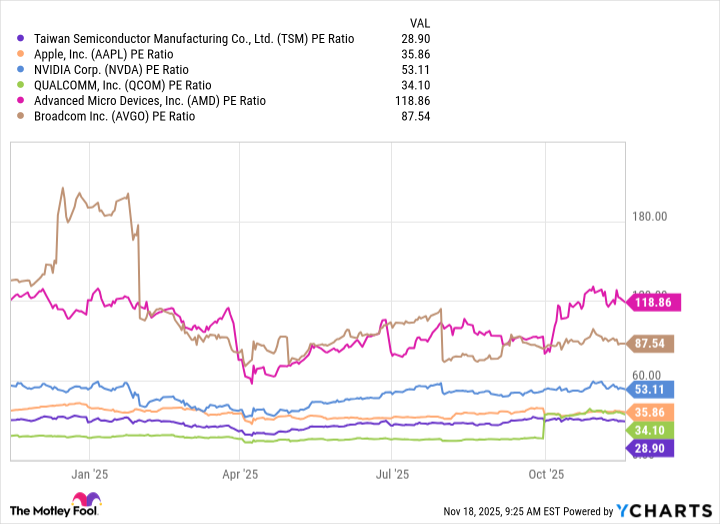

Nonetheless, despite that disappointment, TSMC's stock is up by more than 50% over the previous year. Additionally, that rise may not be as worrisome to the company's valuation as some might fear. Indeed, TSMC stock trades at a price-to-earnings (P/E) ratio of 29, and that is above its five-year average earnings multiple of 25.

NYSE: TSM

Key Data Points

Also, that P/E ratio may reflect the geopolitical dangers it faces by building most of its chips in Taiwan. Investors might recall when Berkshire Hathaway briefly owned the stock only to have the decision reversed by Warren Buffett, who expressed concern over the geopolitical dangers faced by locating its manufacturing in Taiwan.

Still, China's need for TSMC's chips may reduce that danger. Moreover, one should not ignore the fact that its stock sells at a significant discount to its largest clients. Hence, the risk is likely priced into the stock.

TSM PE Ratio data by YCharts.

Buy TSMC stock

When considering its attributes, TSMC stock looks like an underrated buy. TSMC benefits from a secular AI growth trend, and it is currently the only company that can build the most advanced chips in the numbers demanded. That has stoked rapid revenue and earnings growth.

Additionally, its valuation compared to its peers should not be ignored. Indeed, some of that lower multiple likely stems from a remote but real geopolitical risk. Nonetheless, all parties depend on TSMC's manufacturing to continue the advancement of AI.

Hence, if one wants to win in the AI hardware boom, investors likely have a lucrative opportunity in TSMC stock.