When it comes to investing in semiconductor stocks, most growth investors don't look much further than Nvidia, Advanced Micro Devices, or Broadcom. With gains that consistently outperform the S&P 500 and Nasdaq Composite, the big three chip designers have been some of the most lucrative stocks to own throughout the AI revolution.

In the background, however, smart investors aren't ignoring another budding name in the chip realm -- Taiwan Semiconductor Manufacturing (TSM 1.73%). While Nvidia's $500 billion order book and Broadcom's latest $10 billion customer make the headlines, TSMC is strategically positioned to benefit from such hefty investments in AI infrastructure, too.

Let's break down what makes TSMC such a lucrative investment opportunity and explore why growth investors should not overlook the chip powerhouse.

NYSE: TSM

Key Data Points

Taiwan Semiconductor is the backbone of the AI infrastructure boom

As mentioned, Nvidia, AMD, and Broadcom are constantly featured in the financial news. The reason is simple: Hyperscalers like Microsoft, Alphabet, Amazon, Meta Platforms, Oracle, and OpenAI are collectively committing to trillions of dollars in infrastructure spending over the next several years.

Much of this capital expenditure (capex) outlay is going to be allocated toward ongoing data center construction, chip procurement, and buying the necessary networking gear to keep these AI systems running at maximum capacity.

While this level of spending obviously benefits the core chip designers, it's arguably even more positive for TSMC because it is the world's largest chip manufacturer. Companies like Nvidia, AMD, and many others designing custom chips and integrated systems rely on TSMC'S fabrication services.

So while Nvidia and its peers may garner the most hype, TSMC is uniquely positioned to benefit from the AI infrastructure gold rush no matter which company's chips are in demand. This dynamic makes TSMC a hidden pick-and-shovel play in the broader AI realm.

Image source: Taiwan Semiconductor Manufacturing.

Why might investors be overlooking Taiwan Semi?

In my eyes, there are two primary reasons why some investors might be discounting TSMC.

First, geopolitical tensions with China are playing a role in the perception around TSMC. In other words, given a good deal of the company's facilities and expertise remain abroad, some investors may equate diplomatic friction with unpredictability. And there's nothing growth investors loath more than a lack of visibility in a company's outlook.

In addition, President Donald Trump has made it a major part of his administration to entice companies to bring back manufacturing domestically. This reshoring effort may also be thought of as a headwind for TSMC's trajectory. But in my eyes, both of these potential conflicts are already being mitigated.

First, TSMC is investing significantly in expanding its geographic footprint. More recently, the company has invested in building additional capacity in locations including Arizona, Germany, and Japan.

Against this backdrop, Nvidia CEO Jensen Huang recently told investors that the first wafer of the company's most advanced chip architecture -- dubbed Blackwell -- was manufactured here in the United States. Nvidia's partner in the process? TSMC, of course.

Given these dynamics, I do not see any potential international strife or further reshoring to the U.S. as a problem for TSMC.

Is TSMC stock a buy right now?

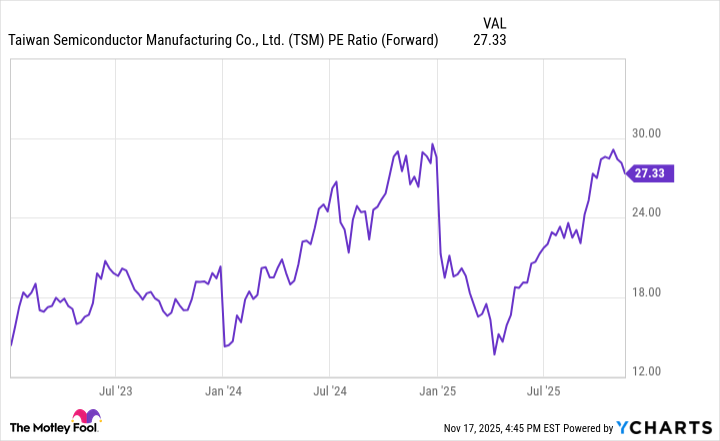

As of this writing (Nov. 17), TSMC's forward price-to-earnings (P/E) multiple of 27 is within shouting distance of its peak levels previously seen during the AI revolution. The nuance to point out here is that the stock had actually gotten crushed earlier this year, and was trading at a more modest forward earnings multiple just a few months ago.

TSM PE Ratio (Forward) data by YCharts

Moreover, I do not necessarily see the recent buying activity as a sign that TSMC is now overvalued. Rather, I think some investors have been rotating capital out of the usual AI suspects and are beginning to position themselves more strategically for the AI infrastructure boom -- leading to a normalization in TSMC's valuation as a growth stock.

Considering sophisticated applications across robotics, autonomous systems, and more are set to enter the market during the AI infrastructure era, it's highly likely that TSMC will be doubling down on its innovation roadmap and introducing new chip nodes with cutting-edge capabilities.

In addition, with the secular tailwinds of ongoing capex spend from the hyperscalers in combination with designers introducing next-generation chip architectures every couple of years, TSMC appears well positioned at the intersection of hardware, manufacturing, and infrastructure.

While the recent valuation expansion has made TSMC appear frothy, I think the stock is still quite reasonable given the company's long-term potential. For these reasons, investors should not overlook the chance for TSMC stock to continue delivering strong, durable gains for years to come.