GLP-1 medicines are all the rage in the pharmaceutical industry these days. Recent breakthroughs in the field -- especially in helping patients manage their weight -- have helped catapult sales of the leaders in this market over the past few years.

It's no secret which companies currently dominate the space. Eli Lilly (LLY +0.03%) and Novo Nordisk (NVO 1.67%) are the clear front-runners, but which one has the edge heading into next year?

Eli Lilly looks unstoppable

Eli Lilly's Trulicity, a GLP-1 medicine indicated for the treatment of Type 2 diabetes, was its best-selling product for a while. However, in recent years, Trulicity has been cannibalized by a newer clinical compound called tirzepatide, marketed under the brand names Mounjaro for diabetes and Zepbound for obesity. It has proven effective not only in those two indications, but also in treating sleep apnea.

Image source: Getty Images.

Tirzepatide's sales are growing at an incredibly rapid rate. Through the first nine months of 2025, the therapy has generated $24.8 billion in revenue, making it the new world's best-selling drug despite its relatively recent approval.

Why is tirzepatide in such high demand? The drug mimics the action of not just the GLP-1 hormone, but also GIP, which plays a role in insulin secretion. Activating two different pathways has proved to be a winning strategy. Tirzepatide has outperformed its main competitor in a head-to-head study in weight management.

NYSE: LLY

Key Data Points

Here's the best part for Eli Lilly: The company has other candidates that could strengthen its lead in the GLP-1 field. The drugmaker completed phase 3 studies for orforglipron, an oral GLP-1 medicine, this year. There is still no oral GLP-1 approved for weight management, and orforglipron could be one of the first.

Eli Lilly's retatrutide goes one step further than tirzepatide. It mimics the action of three hormones: GLP-1, GIP, and glucagon, which could further improve efficacy. Retatrutide is currently in phase 3 studies.

Given Eli Lilly's lineup and pipeline, it is clearly winning the GLP-1 race, for now. Can any company stop Eli Lilly?

Novo Nordisk is making moves

Novo Nordisk was the leader in the space until Eli Lilly launched tirzepatide. The Denmark-based pharmaceutical giant markets semaglutide, sold under famous brand names such as Ozempic and Wegovy. But it has been losing market share. As of August, it had a 49.3% share of the global GLP-1 space, down from 55.7% the previous year.

Novo Nordisk has revised its guidance several times this year, as it is experiencing slower-than-expected sales for its GLP-1 products, presumably due to Eli Lilly capturing a larger share of the market. Novo Nordisk has also encountered competition from compounding pharmacies that sell copies of its well-known medicines.

The company is trying to turn things around, though. Novo Nordisk has earned label expansions for semaglutide in recent months, including in treating metabolic dysfunction-associated steatohepatitis, a disease linked to obesity that affects millions of people and for which there are few treatment options. An oral version of semaglutide could also be approved for weight management in the near future.

NYSE: NVO

Key Data Points

Furthermore, Novo Nordisk has a robust pipeline, which it has expanded through strategic acquisitions. It now has its own triple agonist in development and has a dual agonist of the GLP-1 and amylin hormones in phase 3 studies called amycretin.

Novo Nordisk just made yet another move that could help it restore its competitive position. It is now offering Wegovy and Ozempic at $349 per month for cash-paying patients. These were, at one point, over $1,000 per month. Novo Nordisk is looking to increase access to these drugs for people without insurance coverage -- and perhaps dominate that market over the more expensive tirzepatide -- while undercutting the efforts of compounding pharmacies.

What does this mean for investors?

Despite Novo Nordisk's recent efforts, Eli Lilly's momentum with tirzepatide is too much for the Danish company to handle right now. Eli Lilly should remain the leader in the GLP-1 market for the foreseeable future. It is also a much better buy than Novo Nordisk.

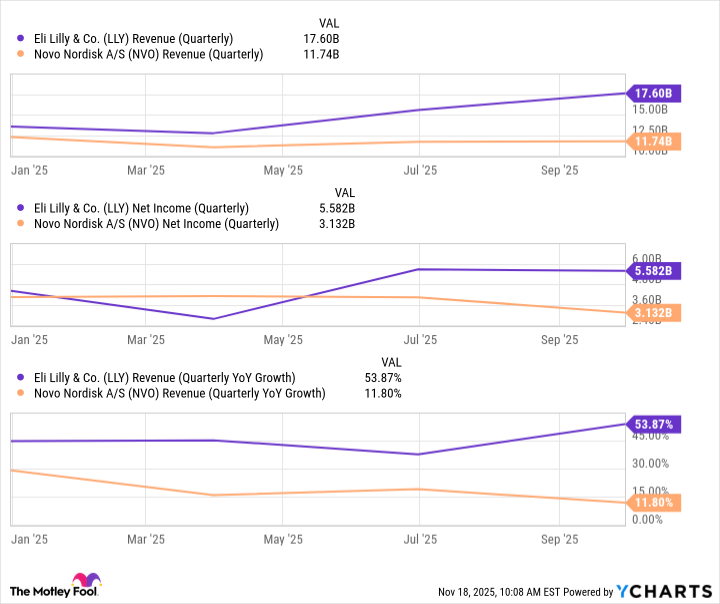

LLY Revenue (Quarterly) data by YCharts

Eli Lilly generates higher, faster-growing revenue. It is beating Novo Nordisk at its own core therapeutic area, while it also has blockbusters in others -- such as Verzenio, a cancer medicine -- whereas Novo Nordisk doesn't.

The one area where Novo Nordisk appears more favorable is valuation. Its stock trades at 12 times forward earnings versus Eli Lilly's 32 and the healthcare industry's average of 18.1.

Even so, Eli Lilly has earned its valuation, considering it is growing its revenue and earnings significantly faster than comparable peers. Novo Nordisk is also worth considering at current levels, as its GLP-1 portfolio and pipeline should continue, enabling it to generate solid financial results in a weight loss market that is anticipated to grow substantially in the coming years.