With Bitcoin (BTC +1.66%) showing significant weakness relative to the stock market and commodities, business news outlets are starting to mention the "Great Bitcoin Crash of 2025" as if the floor had fallen out from under the market. In reality, the coin is down just 6% for the year so far, even after falling by 24% over the last three months.

The tension here is the gap between sentiment and facts. There's a growing sense that something is wrong with the cryptocurrency itself, or at least the market in which it resides. So, are we watching a genuine collapse, or is this a routine Bitcoin correction that looks dramatic only because everyone had assumed it'd never go down again?

Image source: Getty Images.

This barely even counts as a crash

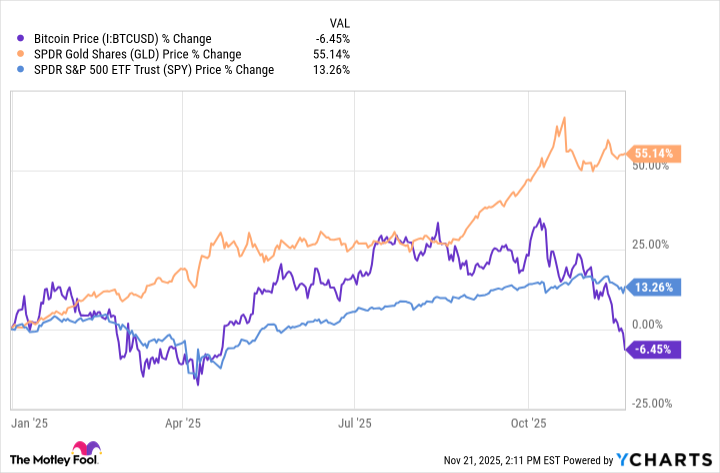

First, let's establish some basic facts about Bitcoin's performance by looking at this chart:

Bitcoin Price data by YCharts

As you can see, this year has indeed been weak for Bitcoin, and investors who prioritized allocating their capital to it over safer alternatives, such as gold or index funds, missed out on significant growth as a result of that decision. Holders, staring at a 24% three-month drawdown and persistent relative underperformance, feel a bit foolish -- including yours truly. And it's that emotional gap which makes the "crash" narrative so salient right now.

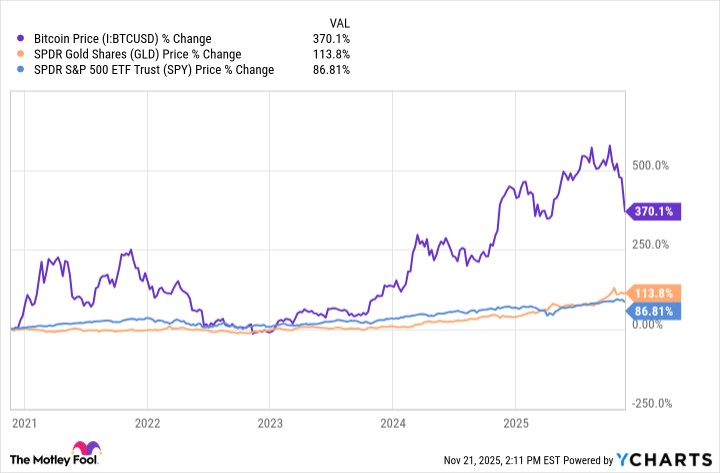

But let's zoom out and look at a second chart:

Bitcoin Price data by YCharts

Here, the picture is clearer. Bitcoin is a volatile asset, and its downturns are steep, but its uptrends tend to reward those who buy the dip.

Historically, Bitcoin's bear markets have involved much deeper damage than anything we are seeing today. Peak-to-trough declines are commonly in the ballpark of 80%, as seen in 2011, 2015, and 2018, with the most recent 2022 bear market bottoming out after a drawdown of approximately 77%.

In that light, a fairly slow 24% decline from recent highs appears more like a typical correction than a once-in-a-decade catastrophe worthy of being called a crash, even though the decline coincided with the Oct. 10 crypto flash crash, which was quite destructive to the sector. Regardless, swings of 20% to 30% inside otherwise healthy bull markets have been common in Bitcoin's history.

The fear is understandable

But why does this recent episode in particular feel so ominous anyway? The flash crash essentially had nothing to do with Bitcoin -- the blame for that lies in the widespread excessive use of leverage to trade altcoin derivatives, such as perpetual futures contracts.

In short, the macro backdrop is very uncertain, with some aspects of it starting to look outright hostile.

CRYPTO: BTC

Key Data Points

The Trump administration's chaotic trade policies are weighing on economic growth expectations, keeping investors skittish, and increasing the likelihood of a policy mistake that could tip the U.S. into recession. Higher-than-desired inflation squeezes disposable income and makes investors less willing to own volatile assets. A government shutdown may have also led to some market distortions. The government's delay in releasing critical economic data is only exacerbating the uncertainty.

In other words, the short-term bear case for Bitcoin is real. If the macro picture worsens and outflows from Bitcoin exchange-traded funds (ETFs) accelerate, Bitcoin could easily fall much further, especially if investors start to panic. Calling this move a "crash," however, ignores just how extreme an actual Bitcoin collapse looks historically; if it were actually crashing, there wouldn't be a debate.

The thesis still looks strong

The next step is to ask whether anything has fundamentally broken in Bitcoin's investment thesis. The answer to that question is no, and it isn't likely to change because Bitcoin isn't likely to change either.

It still has a fixed supply, and the halving will still make future production of the supply harder. On the demand side, structural adoption is still moving in the right direction. The ETFs, though currently reporting outflows, still make it easier than ever for investors to get exposure to the asset. And digital asset treasury (DAT) companies are still accumulating it with the intention to hold it forever.

There is, of course, still a real chance that, from the last peak, the next major bear phase could involve a 60% to 70% decline if global liquidity tightens sharply or if other macroeconomic factors deteriorate further. However, for investors willing to hold through a few stormy quarters in exchange for the possibility of outsized long-term gains, steadily buying Bitcoin on its current weakness still makes sense, and it's what I'll be doing.