Over the past several years, GLP-1 agonist weight-loss drugs have evolved from a celebrity trend to arguably the hottest growth opportunity in the pharmaceutical industry.

Novo Nordisk (NVO +0.06%) jumped out to an early lead with the immense popularity of its Ozempic and Wegovy (semaglutide), used to treat type 2 diabetes and obesity. However, a shortage in 2022 spurred competition from compounding pharmacies, and arch-rival Eli Lilly's (LLY +1.57%) Mounjaro and Zepbound (tirzepatide) have come on strong.

Share prices of the Danish healthcare company have tumbled over the past 18 months, shedding two-thirds of their value. But after replacing its CEO earlier this year, Novo Nordisk is beginning to punch back in a big way.

The company is slashing prices to recapture market share in what could be a $150 billion industry by 2035. Here is what you need to know.

Image source: Getty Images.

Slashing prices is bold, but it has become necessary

Novo Nordisk didn't have much choice but to face the music and get more aggressive in its pricing strategy.

The Trump administration has pushed for lower drug prices, announcing TrumpRx, a website that sells drug treatments, including Ozempic and Wegovy, at negotiated prices. It follows the surging popularity of telehealth companies like Hims & Hers Health, which began selling compounded semaglutide directly to patients at low prices under Food and Drug Administration (FDA) loopholes.

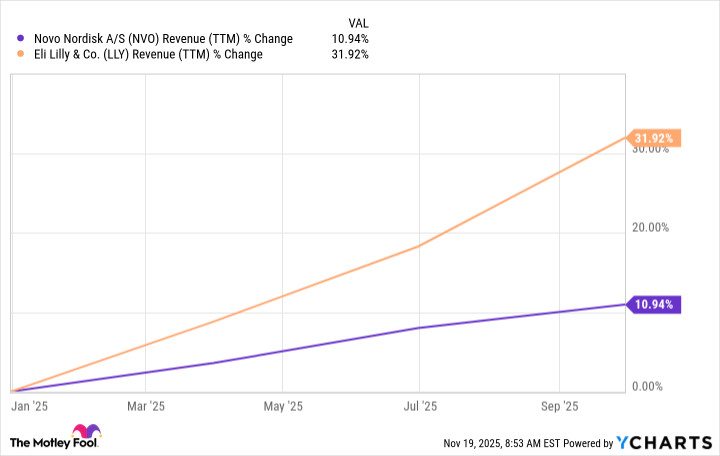

Eli Lilly's Mounjaro and Zepbound have come on strong over the past couple of years. That success has begun to be reflected in each company's growth: Lilly's revenue has increased significantly faster than Novo Nordisk's over the past year.

Data by YCharts; TTM = trailing 12 months.

But Novo Nordisk is finally going on the offensive. Under the new pricing plan, existing self-paying patients (those not using health insurance) will pay $349 per month for FDA-approved Ozempic and Wegovy, down from $499. That excludes the 2mg dose of Ozempic. First-time patients will pay $199 each for their first two doses.

It puts Ozempic and Wegovy on approximate price parity with Lilly's Zepbound, as well as with the pricing structure announced for TrumpRx.

Punching back against compounders

Novo Nordisk's struggles aren't due entirely to Lilly's success. Hims & Hers Health and other telehealth companies that began selling compounded semaglutide under FDA loopholes during the shortage have continued pushing them despite the shortage having ended earlier this year.

Regulators haven't yet taken drastic enough action to remove compounded semaglutide from the market, and it's no guarantee they will.

NYSE: NVO

Key Data Points

Novo Nordisk has clearly struggled with these telehealth competitors. It briefly tried to partner with Hims & Hers Health under the prior CEO, but it didn't prevent the telehealth provider from pushing compounded semaglutide, which quickly ended that relationship.

A more aggressive pricing strategy is probably the best tool to combat telehealth companies, given the lack of stronger regulatory support. Hims & Hers Health charges as little as $199 per month for its compounded semaglutide. While FDA-approved Ozempic and Wegovy will still cost more after the two-month promotion ends, there is less incentive for patients to use compounded semaglutide as the prices of the FDA-approved treatments drop.

Setting the stage for the Wegovy pill

A price war isn't ideal, but the timing of this is notable. Novo Nordisk expects to receive a decision from the FDA by the end of the year on its approval request for a tablet version of semaglutide. It could appeal to more people since many patients may prefer taking a pill to an injection.

It's the same drug in pill form, so anyone taking a semaglutide injection would theoretically have an easy time switching to the pill in an equivalent dose. That could help Novo Nordisk retake market share, especially from the telehealth companies. Its new CEO has emphasized that the company is investing heavily in the launch of the Wegovy pill, touting its supply ahead of the FDA's decision.

As competitive as the obesity drug market has become, Novo Nordisk's decision to slash the prices of its GLP-1 agonist drugs could put it back on the right track. While profit margins may slip due to the price cuts, the company could ultimately benefit more from making its drugs more accessible to patients.