Advanced Micro Devices (AMD +1.93%) has been a successful investment since the artificial intelligence (AI) arms race began in 2023, with its stock rising from about $60 to around $250 today. That's about a 213% rise, which is an impressive return in three years. But several companies have delivered far better returns over that time, including AMD's chief rival, Nvidia.

However, the tables may have turned, as AMD is becoming more competitive and may be able to steal some of the data center money that Nvidia is capturing. All of this was revealed during AMD's Financial Analyst Day, and it included some monster projections that have investors like me considering buying the stock.

AMD's stock price could be significantly higher by 2030 if the company achieves these targets, making the stock a worthy investment today.

Image source: Getty Images.

AMD's data center growth will rapidly accelerate

AMD hasn't seen nearly the success that Nvidia has during the AI arms race. While Nvidia's data center division grew revenue at a 66% pace during Q2 FY 2026 (ending October 26), AMD's data center revenue rose only 22% year over year in Q3. This growth disparity is odd, especially considering that AMD's data center revenue totaled only $4.3 billion versus Nvidia's $51.2 billion. Normally, smaller companies can grow faster because a big sale can deliver outsize growth, but that isn't the case here.

The primary difference between AMD's and Nvidia's artificial intelligence computing units lies in the software that controls them. While each produces graphics processing units (GPUs) with incredible capabilities, Nvidia's CUDA software was light-years ahead of AMD's ROCm software. However, AMD is making headway in this realm, and has rapidly improved the software so that it's at least competitive with CUDA. Once it can prove that this software is a viable alternative, AMD will be able to capture a much larger part of the data center spending pie.

NASDAQ: AMD

Key Data Points

This is huge news for AMD investors, as AI data center capital expenditures aren't expected to slow down for many years. But what will that do to AMD's stock five years from now?

AMD will be a nearly a trillion-dollar company if its projections pan out

Over the next five years, AMD expects unbelievable growth to emerge from its data center division. It expects a 60% compounded annual growth rate (CAGR) for its data center business. That's a huge acceleration from today's growth levels, but AMD is more than just a data center business.

AMD also has a large Client and Gaming division that sells OEM hardware as well as aftermarket upgrades for the consumer PC market. During Q3, AMD's data center division delivered $4.3 billion in revenue, while Client & Gaming produced $4 billion, so the difference is not significant. It also has an embedded processor division that contributed $857 million to the total.

AMD doesn't expect either of these divisions to grow fast over the next five years, as it projects a 10% CAGR through 2030. That significantly drags down the overall growth rate, but AMD still expects a CAGR of 35% overall.

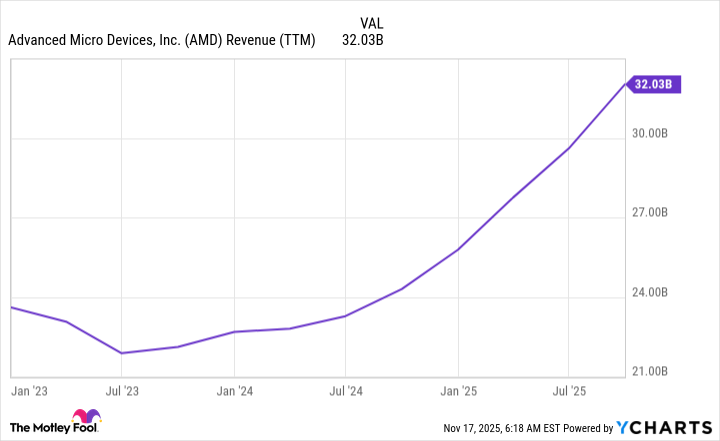

With AMD's revenue over the past 12 months totaling $32 billion, that's $155 billion in revenue by the end of 2030.

AMD Revenue (TTM) data by YCharts

That's monster growth, but what kind of stock price can investors expect to come with it? If AMD also delivers the $20 in earnings per share that it projects, and the stock is valued at 30 times earnings (which is less than its forward P/E of 50 at this writing), that indicates a stock price of $600. With AMD's current stock price hovering around $200 with a market cap of $330 billion, AMD's stock could grow at a 140% pace and nearly become a $1 trillion company.

That is an impressive return in five years, and few stocks will achieve it. If AMD's management team is right about its trajectory, then AMD stock is a must-buy here.