Broadcom (AVGO +3.79%) has been a sneaky winner of the artificial intelligence (AI) boom. Share are up nearly 1,000% in the last five years, and the semiconductor and enterprise software company now has a market cap of $1.6 trillion, making it the seventh-largest business in the world according to that metric. It just signed a momentous deal with OpenAI, and its revenue is up 761% in the last 10 years.

But that doesn't mean it is automatically a great stock to buy for your portfolio right now. Here's why Broadcom stock is likely overvalued today and why Berkshire Hathaway (BRK.B +0.00%), through steady growth, will supplant it in market cap by 2030.

NYSE: BRK.B

Key Data Points

Berkshire Hathaway's diversified assets

Betting on the AI sector has been fruitful in the last few years, which has caused Broadcom's share price to shoot up. This is not guaranteed to continue. There are a lot of reasons to be skeptical about the hundreds of billions in annual spending on AI infrastructure that is currently generating a much smaller percentage in AI software revenue, and what it means for future spending on semiconductor and datacenter stocks such as Broadcom. Eventually, all this spending on computer chips needs to lead to a financial return, or else it will fall to a much lower equilibrium.

On the other hand, Berkshire Hathaway has a diversified set of businesses and investments that should do well through most market environments. It owns insurance companies that do over $20 billion in earnings combined from underwriting and investing income, the BNSF railway, and Berkshire Hathaway Energy (which, it should be noted, benefits greatly from the growing demand for electricity due to AI). Plus, it has a collection of other businesses that collectively generated $13 billion in earnings last year.

Combined, Berkshire Hathaway's operating earnings were $47 billion in 2024, or around twice the size of Broadcom's $23.6 billion in revenue over the last 12 months. Sure, Broadcom is growing faster, but Berkshire Hathaway is no slouch and is not reliant on growth solely from the AI spending boom.

Image source: Getty Images.

Large cash pile and cheap valuation

Berkshire Hathaway is not just its operating businesses. Far from it. The conglomerate built by Warren Buffett also has a portfolio of minority investments and a huge pile of cash on its balance sheet, giving it flexibility to invest through all market environments. At the end of last quarter, it had $381 billion in cash and equivalents, which grows to close to $400 billion if you include its fixed income portfolio.

Its stock positions -- which include the likes of Apple, American Express, and Coca-Cola -- were worth over $300 billion at the end of last quarter, including its equity-method investments. Add its cash position, and that is $700 billion in enterprise value, not including its operating businesses.

Broadcom had just $10 billion in cash and $60 billion in debt at the end of last quarter, giving it a large net debt position, or a negative drag on its enterprise value vs. Berkshire Hathaway.

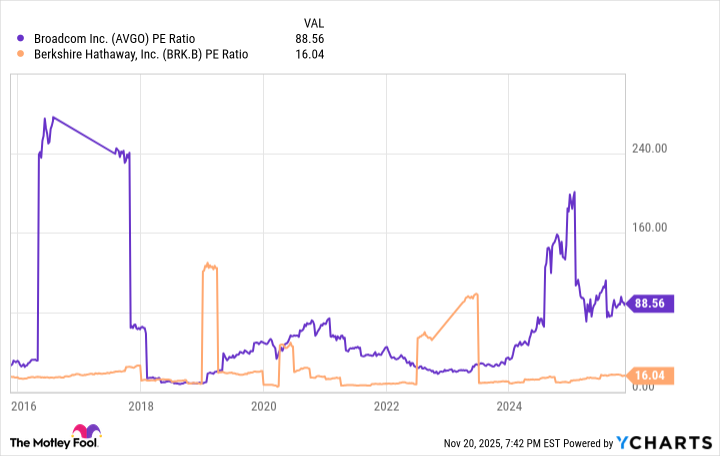

Even if we look at standard metrics like the price-to-earnings ratio (P/E), Berkshire Hathaway is much cheaper than Broadcom. Broadcom has a P/E of 88.5 compared to Berkshire's 16. And we aren't in a situation where Broadcom is blowing the doors off with growth, either. Q4 guidance calls for 24% year-over-year revenue growth. Growth may accelerate because of the massive deal to help OpenAI make computer chips for AI data centers, but it is going to take years for this P/E to reach a reasonable level.

AVGO PE Ratio data by YCharts

Why Berkshire Hathaway will pull ahead of Broadcom by 2030

Berkshire Hathaway will have a larger market cap than Broadcom in 2030 for a simple reason: It is undervalued while Broadcom is overvalued. Berkshire Hathaway's current market cap is $1.08 trillion. If you strip out its investments and cash, the operating business trades at well under 10 times its 2024 earnings -- earnings that the company has shown time and time again it can steadily grow.

Broadcom, on the other hand, is trading at a P/E ratio pushing 90 with a lot of debt on the balance sheet. I think it is likely that Broadcom's stock underperforms for the rest of the decade, falling behind Berkshire Hathaway as the latter gets larger and larger every year.