As of the end of trading on Tuesday, Nvidia (NVDA 0.69%) boasted a market capitalization of about $4.3 trillion.

While shares of the semiconductor giant have soared by 1,000% throughout the artificial intelligence (AI) revolution, Beth Kindig of the I/O Fund thinks Nvidia's rally is just getting started. In a recent investor note, Kindig outlined a path by which she believes Nvidia could reach a market cap of $20 trillion by 2030 -- implying an upside of about 360% from current levels.

Below, I'll explain what it will take for Nvidia to reach such a historic milestone and detail the catalysts that support even greater gains for the chip leader.

NASDAQ: NVDA

Key Data Points

What would it take for Nvidia to reach a $20 trillion valuation?

Nvidia's largest source of revenue is sales of its products to data centers, which make heavy use of its GPUs and complementary networking services.

In its fiscal 2026 third quarter, which ended Oct. 26, the company's data center business generated $51.2 billion in revenue -- implying an annual run rate of about $200 billion.

Kindig is modeling for Nvidia's data center business to grow at a compound annual rate of 36% between 2025 and 2030. If that assumption proves accurate, that data center business would reach a $931 billion run rate by the end of that period.

From there, Kindig simply applies Nvidia's five-year median price-to-sales (P/S) ratio of 25 to her figure for its expected data center revenue -- which yields a market cap well north of $20 trillion.

The math is pretty straightforward. The more important details relate to why Kindig is so bullish on Nvidia's prospects through the rest of the decade.

Image source: Getty Images.

How can Nvidia realistically become a $20 trillion company?

If you follow the AI narrative, you've probably heard quite a bit about the accelerating investments into data center infrastructure.

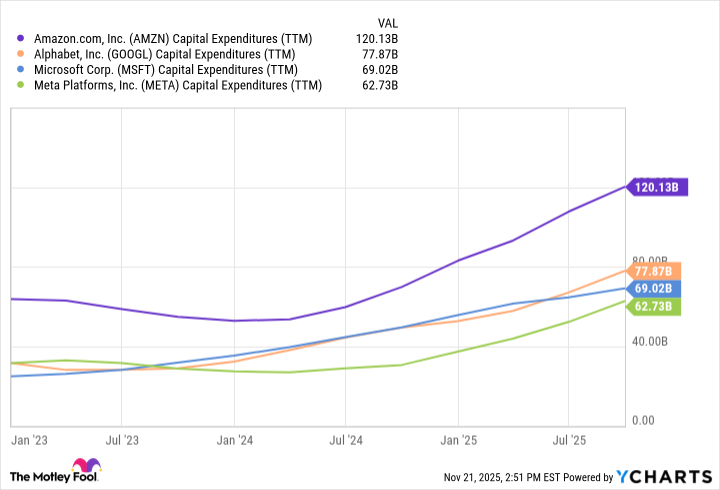

Research from Goldman Sachs suggests that by next year, hyperscalers including Microsoft, Alphabet, Amazon, and Meta Platforms will spend nearly $500 billion on AI infrastructure. To underscore the level of demand these companies are experiencing for AI-capable data center capacity, this expected acceleration in infrastructure spend represents more than a 50% increase in capital expenditures (capex) in just one year.

AMZN Capital Expenditures (TTM) data by YCharts.

Taking this one step further, McKinsey & Company is forecasting AI infrastructure to be a $7 trillion market opportunity over the next five years. More importantly, McKinsey is modeling for about $5 trillion of this spending will be allocated toward supporting AI workloads. Translation: Demand for Nvidia's GPUs should remain incredibly robust for the foreseeable future.

This helps explain the scope of the broader AI infrastructure opportunity. But we can also look at a host of individual deals that benefit Nvidia directly, among them:

- In September, OpenAI announced its intention to deploy 10 gigawatts of Nvidia's systems to help train its next-generation models. As part of the deal, Nvidia plans to invest up to $100 billion into OpenAI.

- In early November, OpenAI signed a $38 billion chip deal with Amazon Web Services (AWS). Per the terms of the partnership, Amazon will be renting clusters of Nvidia GPUs to OpenAI.

- A budding segment of the data center market called "neocloud" is rapidly gaining popularity with big tech players. Neocloud companies such as Nebius Group and Iren build their own data centers outfitted with Nvidia's high-end hardware, and rent direct access to their servers under a model described as "bare metal as a service."

- Following President Donald Trump's inauguration in January, OpenAI, Oracle, and SoftBank announced a joint venture called Project Stargate -- an ambitious plan to invest $500 billion into AI infrastructure in the U.S. over the next four years.

Nvidia looks poised to dominate the AI infrastructure revolution

The biggest risk I see to Kindig's forecast is that it is based in part on the premise that Nvidia will not only maintain its current market share, but actually increase it. For Nvidia to meet her estimated growth rates, Kindig believes that it will need to capture about 60% of the AI capex spending over the rest of the decade. Today, Nvidia is drawing about 50% of AI infrastructure spending.

Admittedly, expanding its market share by another 10 percentage points would be a tall order. However, I think there are some factors here that mitigate the downside risk.

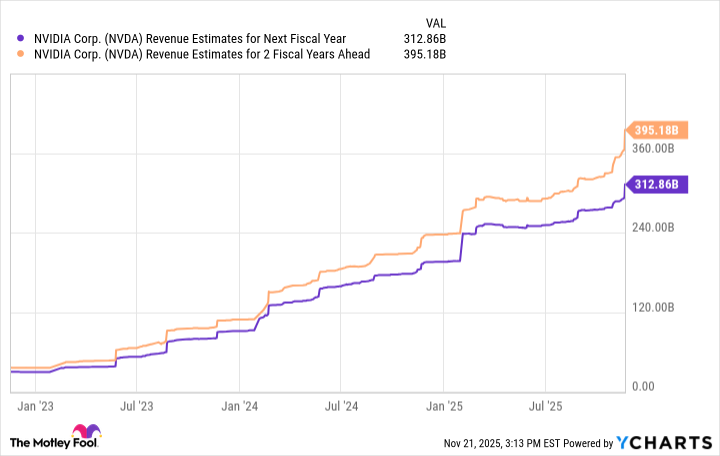

First, Nvidia's current order backlog of $307 billion primarily revolves around the following product lines: its current Blackwell chips, its upcoming Rubin GPUs, as well data center services NVLink and InfiniBand. In the chart below, investors can see that Wall Street's consensus calls for $312 billion of revenue for Nvidia's entire business next year. In my view, analysts could be underestimating the incremental demand for Nvidia's CUDA software platform, adjacent networking equipment, and other products within the company's broader suite.

NVDA Revenue Estimates for Next Fiscal Year data by YCharts.

In addition, Nvidia is entering new markets, most notably AI telecommunications through a strategic investment in Nokia. It's also entering into a collaboration under which Intel will design custom CPUs for Nvidia to integrate into its AI infrastructure platforms and GPU products.

Moreover, Kindig's forecast doesn't even account for the potential demand for GPUs from emerging applications in robotics, agentic AI, or autonomous systems.

Taken together, these investments and new markets represent additional trillions of dollars in incremental addressable market opportunities for Nvidia.

I expect Nvidia's biggest challenge will be consistently balancing the dynamics of supply and demand. Thankfully, Nvidia's fabrication partner, Taiwan Semiconductor Manufacturing, has been expanding its foundry footprint and building out additional production capacity, which should help mitigate supply chain bottlenecks.

With this in mind, I think Nvidia is more than well positioned to dominate the AI infrastructure era, and could be the first company to achieve a $20 trillion market value.